This topic contains 40 replies, has 17 voices, and was last updated by ![]() Y_ 1 year, 8 months ago.

Y_ 1 year, 8 months ago.

- AuthorPosts

The US Social Security Crisis is Worse than People Think [1]

Lance Roberts

RealInvestmentAdvice

April 26, 2018[Y: In keeping with my last post on “Who will buy US Treasuries when Social Security stops buying them?” [10], the conditions of pensions was briefly discussed. However this is an important topic and to do it justice we need to understand it a bit more and why it has failed. Y]

Lance Roberts has more than 25 years in private banking, investment management and private and venture capital. He is the Chief Editor of the Real Investment Report, a weekly subscriber based-newsletter that is distributed nationwide.

He writes the Real Investment Daily blog which is read by thousands nationwide from individuals to professionals, and his opinions are frequently sought after by major media sources.

His writings and research have also been featured on several of the nation’s biggest financial blog sites such as the Pragmatic Capitalist, Credit Writedowns, The Daily Beast, Zero Hedge and Seeking Alpha

Last year I penned an article discussing the “Unavoidable Pension Crisis:” [2]

- “Currently, many pension funds, like the one in Houston, are scrambling to slightly lower return rates, issue debt, raise taxes or increase contribution limits to fill some of the gaping holes of underfunded liabilities in their plans. The hope is such measures combined with an ongoing bull market, and increased participant contributions, will heal the plans in the future.

- This is not likely to be the case.

- This problem is not something born of the last ‘financial crisis,’ but rather the culmination of 20-plus years of financial mismanagement.

- An April 2016 Moody’s analysis [3] pegged the total 75-year unfunded liability for all state and local pension plans at $3.5 trillion. That’s the amount not covered by current fund assets, future expected contributions, and investment returns at assumed rates ranging from 3.7% to 4.1%. Another calculation [4] from the American Enterprise Institute comes up with $5.2 trillion, presuming that long-term bond yields average 2.6%.

- With employee contribution requirements extremely low, averaging about 15% of payroll, the need to stretch for higher rates of return have put pensions in a precarious position and increases the underfunded status of pensions.”

Larger Picture: http://realinvestmentadvice.com/wp-content/uploads/2017/04/pension-funding-contributions-040517.pngBut it is actually worse than we originally thought as Aaron Brown recently penned [5] :

- Today, the hard stop is five to 10 years away, within the career plans of current officials. In the next decade, and probably within five years, some large states are going to face insolvency due to pensions, absent major changes.

- If we extrapolate from the past, rather than use promises in the state budget, current employees plus the state will contribute about $25 billion over those seven years, which could provide another few years before the till is empty. But it will also add around $60 billion of future liabilities to current employees.

- The system probably breaks down before the pension fund gets to zero, for example if assets were to fall below $30 billion while projected future liabilities exceeded $300 billion. Even the most optimistic people would have to admit the situation is unsustainable. This could happen in three years in a bad stock market, or perhaps 10 with good stock returns. But fund assets are so low relative to payouts that good returns aren’t that helpful.

- The next phase of public pension reform will likely be touched off by a stock market decline that creates the real possibility of at least one state fund running out of cash within a couple of years. The math says that tax increases and spending cuts cannot do much.“

But the problem is not just in the United States, but the mismanagement of assets combined with irrational and flawed return expectations has spread globally. Visual Capitalist [6] recently took a look at the global pension problem stating:

- “According to an analysis by the World Economic Forum (WEF), there was a combined retirement savings gap in excess of $70 trillion in 2015, spread between eight major economies…

- The WEF says the deficit is growing by $28 billion every 24 hours – and if nothing is done to slow the growth rate, the deficit will reach $400 trillion by 2050, or about five times the size of the global economy today.”

Larger picture: https://realinvestmentadvice.com/wp-content/uploads/2018/04/VC-Pension-Crisis-042318-1024×955.png- “The graphic illuminates a growing problem attached to an aging population (and those that will be supporting it).

- Since social security programs were initially developed, the circumstances around work and retirement have shifted considerably. Life expectancy has risen by three years per decade since the 1940s, and older people are having increasingly long life spans. With the retirement age hardly changing in most economies, this longevity means that people are spending longer not working without the savings to justify it.

- This problem is amplified by the size of generations and fertility rates. The population of retirees globally is expected to grow from 1.5 billion to 2.1 billion between 2017-2050, while the number of workers for each retiree is expected to halve from eight to four over the same timeframe.

- The WEF has made clear that the situation is not trivial, likening the scenario to ‘financial climate change.’

- Like climate change, some of the early signs of this retirement savings gap can be ‘sandbagged for the time being – but if not handled properly in the medium and long-term, the adverse effects could be overwhelming”

While we all want to ignore the problem, it is isn’t going away. More importantly, there is nothing that can, or will, change the two primary problems fueling the crisis.

Problem #1: DemographicsWith pension funds already wrestling with largely underfunded liabilities, the shifting demographics are further complicating funding problems.

One of the primary problems continues to be the decline in the ratio of workers per retiree as retirees are living longer (increasing the relative number of retirees), and lower birth rates (decreasing the relative number of workers.)

However, this “support ratio” is not only declining in the U.S. but also in much of the developed world. This is due to two demographic factors: increased life expectancy coupled with a fixed retirement age, and a decrease in the fertility rate.

In 1950, there were 7.2 people aged 20–64 for every person of 65 or over in the OECD countries. By 1980, the support ratio dropped to 5.1 and by 2010 it was 4.1. It is projected to reach just 2.1 by 2050.

Of course, as I have discussed previously [7], the problem is that while the “baby boom” generation may be heading towards retirement years, there is little indication a large majority of them will be actually retiring. As Richard Eisenberg recently noted [8].

- “The dark, depressing and sometimes physically painful life of a tribe of men and women in their 50s and 60s who are surviving America in the twenty-first century. Not quite homeless, they are ‘houseless,’ living in secondhand RVs, trailers and vans and driving from one location to another to pick up seasonal low-wage jobs, if they can get them, with little or no benefits.

- The ‘workamper’ jobs range from helping harvest sugar beets to flipping burgers at baseball spring training games to Amazon’s “CamperForce,” seasonal employees who can walk the equivalent of 15 miles a day during Christmas season pulling items off warehouse shelves and then returning to frigid campgrounds at night. Living on less than $1,000 a month, in certain cases, some have no hot showers.

- Many saw their savings wiped out during the Great Recession or were foreclosure victims and, felt they’d spent too long losing a rigged game. Some were laid off from high-paying professional jobs. Few have chosen this life. Few think they can find a way out of it. They’re downwardly mobile older Americans in mobile homes.”

They, of course, are part of a large majority of individuals being dependent on the various pension systems in retirement, and the ultimate burden will fall on those next in line.

Problem #2: Markets Don’t Compound

The biggest problem, however, is the continually perpetrated “lie” that markets compound over time. Pension computations are performed by actuaries using assumptions regarding current and future demographics, life expectancy, investment returns, levels of contributions or taxation, and payouts to beneficiaries, among other variables. The biggest problem, following two major bear markets, and sub-par annualized returns since the turn of the century, is the expected investment return rate.

Using faulty assumptions is the linchpin to the inability to meet future obligations. By over-estimating returns, it has artificially inflated future pension values and reduced the required contribution amounts by individuals and governments paying into the pension system.

It is the same problem for the average American who plans on getting 6-8% return a year on their 401k plan, so why save money? Which explains why 8-out-of-10 American’s are woefully underfunded for retirement.

As shown in the long-term, total return, inflation-adjusted chart of the S&P 5oo below, the difference between actual and compounded (7% average annual rate) returns are two very different things. The market does NOT return an AVERAGE rate each year and one negative return compounds the future shortfall.

This is the problem that pension funds have run into and refuse to understand.

Pensions STILL have annual investment return assumptions ranging between 7–8% even after years of underperformance.

However, the reason assumptions remain high is simple. If these rates were lowered 1–2 percentage points, the required pension contributions from salaries, or via taxation, would increase dramatically. For each point reduction in the assumed rate of return would require roughly a 10% increase in contributions.

For example, if a pension program reduced its investment return rate assumption from 8% to 7%, a person contributing $100 per month to their pension would be required to contribute $110. Since, for many plan participants, particularly unionized workers, increases in contributions are a hard thing to obtain. Therefore, pension managers are pushed to sustain better-than-market return assumptions which requires them to take on more risk.

But therein lies the problem.

The chart below is the S&P 500 TOTAL return from 1995 to present. I have then projected for using variable rates of market returns with cycling bull and bear markets, out to 2060.

I have then run projections of 8%, 7%, 6%, 5% and 4% average rates of return from 1995 out to 2060. (I have made some estimates for slightly lower forward returns due to demographic issues.)

Larger Figure: http://realinvestmentadvice.com/wp-content/uploads/2017/04/Pension-Problems-Returns-040417-3.pngGiven real-world return assumptions, pension funds SHOULD lower their return estimates to roughly 3-4% in order to potentially meet future obligations and maintain some solvency.

They won’t make such reforms because “plan participants” won’t let them. Why? Because:

1. It would require a 40% increase in contributions by plan participants which they simply can not afford.

2. Given that many plan participants will retire LONG before 2060 there simply isn’t enough time to solve the issues, and;

3. The next bear market, as shown, will devastate the plans abilities to meet future obligations without massive reforms immediately.

In a recent note by my friend John Mauldin [9], he discussed an email Rob Arnott, of Research Affiliates, sent regarding this specific issue:

If our logic is sound, we earn 0.8% from our bonds (40% allocation x 2% return) and 2% to 3.2% from our stocks (60% x 3.3%, or 60% x 5.4%). Add up the return from stocks and the return from bonds, and we get 2.8% to 4% from our balanced portfolio.

Bottom line … US public service pensions are toast. One of three constituencies gets nailed:

1. The taxpayer (keeping in mind that the affluent are mobile!),

2. The current and/or future pensioners (keep in mind that private-sector pensions are now far less generous than public pensions … there’s an inequity here!), or

3. The public services that are on offer to our citizenry, net of sunk costs from servicing past generations.Most likely, it’ll be a blend of the three.”

Exactly right, and the chart above of projected stock market returns agrees with that assumption

We Are Out Of Time

Currently, 75.4 million Baby Boomers in America—about 26% of the U.S. population—have reached or will reach retirement age between 2011 and 2030. And many of them are public-sector employees. In a 2015 study of public-sector organizations, nearly half of the responding organizations stated that they could lose 20% or more of their employees to retirement within the next five years. Local governments are particularly vulnerable: a full 37% of local-government employees were at least 50 years of age in 2015.

It is no surprise that public pension funds are completely overwhelmed, but they still have not come to the realization that markets do not compound at an annual return of 8% annually. This has led to a continued degradation of funding levels as liabilities continue to pile up.

If the numbers above are right, the unfunded obligations of approximately $4-$5.6 trillion, depending on the estimates, would have to be set aside today such that the principal and interest would cover the program’s shortfall between tax revenues and payouts over the next 75 years.

That isn’t going to happen.With rates pushing higher, economic growth slowing and Central Banks extracting liquidity, we are already closer to the next major bear market than not.

The next crisis won’t be secluded to just sub-prime auto loans, student loans, and commercial real estate. It will be fueled by the “run on pensions” when “fear” prevails benefits will be lost entirely.

It’s an unsolvable problem. It will happen. And it will devastate many Americans. It is just a function of time.

Whatever amount you are saving for retirement is probably not enough

Lance Roberts

RealInvestmentBlog[Y: A few additional comments to this post.

The reasons for the real interest rate achieved rather than the expected have not been expanded on.

The expected interest figure usually quoted by hedge funds is a lie. Nominal interest achieved cannot be greater than the Fed Funds Rate for Treasuries. Real Interest is (Nominal Interest – Inflation).

Inflation in this case is not the standard CPI value used by consumers – but the rate needed to service outstanding public and non-public debt. This value can be checked at Shadowstats.com.

It is very unlikely the real interest rate exceeds 3%. During Paul Volker’s tenure as Fed Chairman during the 2008 debt crisis, real rates were negative since ZIRP was in effect. Only after 2014 did the nominal rates finally start to rise.

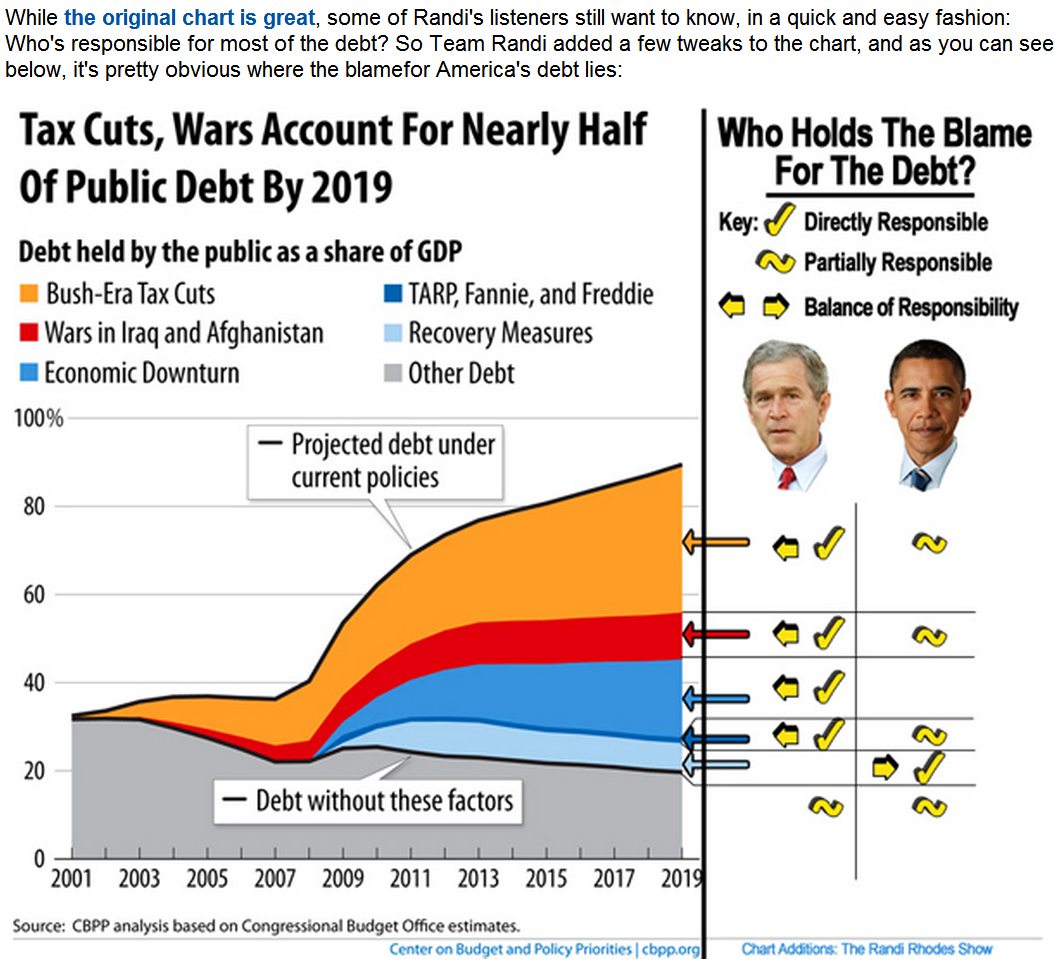

Take a look at this chart again on the servicing of debt needed before any interest is paid to hedge funds.

It is clear that Hedge Funds are therefore a Ponzi scheme, as alluded by Lance Roberts at the start of the article. The only (unfortunate) problem with Madoff is that he did not work for Wall Street. Y]

Citations

[1] https://realinvestmentadvice.com/the-pension-crisis-is-worse-than-you-think/

[2] https://realinvestmentadvice.com/the-unavoidable-pension-crisis/

[3] https://www.moodys.com/research/Moodys-US-government-pension-shortfall-overshadowed-by-Social-Security-Medicare–PR_346878

[4] https://www.aei.org/publication/are-state-and-local-government-pensions-underfunded-by-5-trillion/

[5] https://www.fa-mag.com/news/the-collapse-of-public-pension-funds-is-no-longer-a-distant-prospect-38190.html?section=40&utm_source=FA+Subscribers&utm_campaign=488478ed74-FAN_FA_News_Franklin_Temp_SecAmerica_041818&utm_medium=email&utm_term=0_6bebc79291-488478ed74-234730909

[6] http://www.visualcapitalist.com/pension-time-bomb-400-trillion-2050/

[7] http://realinvestmentadvice.com/dont-blame-baby-boomers-for-not-retiring/

[8] https://www.market~~~ch.com/story/many-older-americans-are-living-a-desperate-nomadic-life-2017-11-06?mod=mw_share_twitter

[9] http://www.mauldineconomics.com/frontlinethoughts/promises-promises-pension-promises

[10] /forums/topic/who-will-buy-treasuries-when-social-security-stops-buying-them/

Anonymous1Yes, the Titanic is sinking. Right now they are trying not to cause a panic, so they keep lying about it and cooking the statistics.

I feel bad for the suckers that believed in the system and paid into this system their whole life. Only to find out at the end that they have been had. Scammed by the greedy snickering 1% crowd.

How many Trillions got spent on the “Bail Outs” in 2007-2008?

There will be no “Bail Out” for the wage slaves. There will be no retirement. This is Serfdom 2.0. Welcome to the Dark Ages.

Anonymous42#METOO, I looked into it! Got legal advice, and yes, I got f~~~ed! So did my uncle and anyone that was laid off and discarded @50! The ship is sinking and men are thrown overboard first! but now we see the women too are getting wet too! #WETTOO

One big f~~~ing poncy scheme scam! I don’t care and I don’t give a f~~~! Just another nail in the coffin why I stopped paying taxes!

The cart has finally rolled backwards over the horse! And we’re that horse!

A link to the long article would have been sufficient. Social Security is hardly about to collapse and the sky isn’t falling, although there certainly are long-term funding issues and I’m not relying upon it in order to keep the wolf from the door when I retire. That said, they’re going to have to raise the retirement age gradually at some point for the millennials.

We just don't realize life's most significant events while they're happening. Back then, I thought, "Well, there'll be other days". I didn't realize that that was the only day. - "Moonlight" Graham

Anonymous42Social Security is hardly about to collapse and the sky isn’t falling

Tell that to my dead uncle that was denied and worked himself to death into his 70s!!!

F~~~ THE PROMISES OF GOVERNMENT!

ALL F~~~ING LIES!

A link to the long article would have been sufficient

The link has been provided should you wish to read the actual article. I would encourage you to do so.

Note however I add comments, references plus discussions should this be necessary to expand the topic to tie in with other posts and the overall intent of these articles over a period of time.

There is also no guarantee this article or anything of real interest will be available on the internet when the content becomes important. As it is now in the MGTOW servers regardless of what happens to the original article the information cannot be lost.

. Social Security is hardly about to collapse and the sky isn’t falling,

It is clear to many who are involved in this type of work that it is. This is not only my view but the industry professionals who are well known in their fields – some of the more important articles I have referred to in this and prior posts. The evidence for this is overwhelming.

I fail to see why retirement age has not risen with life expectancy.

All my life I've had doubts about who I am, where I belonged. Now I'm like the arrow that springs from the bow. No hesitation, no doubts. The path is clear. And what are you? Alive. Everything else is negotiable. Women have rights; men have responsibilities; MGTOW have freedom. Marriage is for chumps. If someone stands in the way of true justice, you simply walk up behind them and stab them in the heart-R'as al Ghul.

Anonymous43this country has been bankrupt since 1754.

I fail to see why retirement age has not risen with life expectancy.

My understanding is that there is no set full retirement age in the U.S. Retirement is not compulsory.

However for retirement purposes and benefit collection some ages are significant.

At 62 you can claim some Social Security retirement benefits

At 59.5, 65, 66, 67, and 70 there are other reasons to retire.Social Security’s full-benefit retirement age is increasing gradually because of legislation passed by Congress in 1983. Traditionally, the full benefit age was 65, and early retirement benefits were first available at age 62, with a permanent reduction to 80 percent of the full benefit amount. Currently, the full benefit age is 66 years and 2 months for people born in 1955, and it will gradually rise to 67 for those born in 1960 or later.

The premise would be that an individual would be best suited to decide on his expected retirement age based on what he believes would best serve his assumed life expectancy.

Anonymous42You can’t keep raiding the pockets of people that haven’t been born yet, then sell their futures to the GANGBANKSTERS like they’re god damned blue chips!

The overall picture is bleak and the time is coming when all men work for a bowl of rice a day!

JB Books wrote:

. Social Security is hardly about to collapse and the sky isn’t falling,

It is clear to many who are involved in this type of work that it is. This is not only my view but the industry professionals who are well known in their fields – some of the more important articles I have referred to in this and prior posts. The evidence for this is overwhelming.

Yep. Social Security has been limping for years. It’s been out of money for years. The trick has been to play magical hats with the money, hoping the normies don’t notice it.

I’m 32. It’s been pretty common whenever I have gotten into conversations about retirement that I’ll be working until I die, and that the final blow to SS is going to be the Boomers. It’s a matter of whether we want to rip the bandaid off now and amputate the finger, while they have time to adjust their lives and attempt to secure some kind of income, or whether we’re going to let the wound rot until the bandaid can’t cover it anymore and we have to amputate the forearm. People who expect that there is going to be money waiting for them at the end are going to get a rather depressing surprise.

The Boomers were a great thing about 40 years ago, when they were working age and supporting their elderly. The problem is, the Boomers were followed by the lowest birth rates in human history. There’s nobody propping them up, and the demographics pyramid that was bottom-heavy 50 years ago has now flipped over.

Cupcakes are Cold. MGTOW is Absolute Zero.

“Let us wait a little; when your enemy is executing a false movement, never interrupt him” –Napoleon Bonaparte, 1805You can’t keep raiding the pockets of people that haven’t been born yet, then sell their futures to the GANGBANKSTERS like they’re god damned blue chips!

The overall picture is bleak and the time is coming when all men work for a bowl of rice a day!

Won’t be long now Tower – there is almost nothing left. Can’t hide it much longer.

Won’t be long now Tower – there is almost nothing left. Can’t hide it much longer.

I remember when the surplus went away (2000-ish) and it was huge news. Everybody started panicking, not because SS was out of money, but because it was no longer taking in more than it was giving out. That was the point SS should have been terminated. Instead, we get a Republican talking about tax cuts and “smoking them out” and a Democrat talking about lock boxes

Cupcakes are Cold. MGTOW is Absolute Zero.

“Let us wait a little; when your enemy is executing a false movement, never interrupt him” –Napoleon Bonaparte, 1805I remember when the surplus went away (2000-ish) and it was huge news. Everybody started panicking, not because SS was out of money, but because it was no longer taking in more than it was giving out. That was the point SS should have been terminated. Instead, we get a Republican talking about tax cuts and “smoking them out” and a Democrat talking about lock boxes

Quite right. If you would kindly look at my other post (/forums/topic/who-will-buy-treasuries-when-social-security-stops-buying-them/) you will see the dilemma – there is no corporate or sovereign entity that can take up the slack.

So they are trying to keep this from exploding but very soon this may end up in court when hedge funds declare insolvency. Some pension funds are already in trouble and we will have to see how this plays out.

Regardless – no man should expect Social Security to work from this point on.

Regardless – no man should expect Social Security to work from this point on.

I didn’t expect SS to work out when I took an introductory economics course in high school almost 20 years ago.

Cupcakes are Cold. MGTOW is Absolute Zero.

“Let us wait a little; when your enemy is executing a false movement, never interrupt him” –Napoleon Bonaparte, 1805Quite right. If you would kindly look at my other post (/forums/topic/who-will-buy-treasuries-when-social-security-stops-buying-them/) you will see the dilemma – there is no corporate or sovereign entity that can take up the slack.

Oh, and just to be clear, I’m actually in favor of the tax cuts, but it requires massive scaling back on spending in categories that are not considered “discretionary”– I’m looking square at Medicare, Medicaid, and Social Security as none of those are prescribed in the Constitution as government powers and they’re more than half of the bloat. I want my government hungry.

Cupcakes are Cold. MGTOW is Absolute Zero.

“Let us wait a little; when your enemy is executing a false movement, never interrupt him” –Napoleon Bonaparte, 1805Oh, and just to be clear, I’m actually in favor of the tax cuts, but it requires massive scaling back on spending in categories that are not considered “discretionary”– I’m looking square at Medicare, Medicaid, and Social Security as none of those are prescribed in the Constitution as government powers and they’re more than half of the bloat. I want my government hungry.

I hear you bro’. There is a price to pay for tax cuts since it does not come with any other way to reduce the debt deficit.

It may help you now – but you will be paying whatever you gained back to the government with interest.

The current FFR for the 10 year yield has already risen to 2.94% and all that does is take more of what you have in the future to pay back the increasing debt that was created because of the tax cut.

Sorry about that.

Real tax cuts will never happen. The “deep state” (bureaucrats) will never allow it. They need eternal wars to keep the slush funds and extortion going. Administrations are extremely limited in what they can do other than keep declaring wars at the behest of the deep state. This keeps the sheep in fear while they are being fleeced.

One of two things are going to happen.

1) the raise the retirement age to 75.

2) reduce benefits below poverty line.All in all this sums it up…

It is by caffeine alone I set my mind in motion, it is by the beans of Java that thoughts acquire speed, the hands acquire shaking, the shaking becomes a warning; it is by caffeine alone I set my mind in motion.

Anonymous42Won’t be long now Tower – there is almost nothing left. Can’t hide it much longer.

It’s as real as the hundreds of tomatoes I hope to harvest, process, and freeze to add to my self sufficiency, that’s only the tomatoes! I have allot of other stuff! By fall my hands should be full along with my deep freezer! I’m doing it because I got real good at it! When all else fails I’ll still be rolling with the road tested know-how! Every year I only went bigger! Now I know I can feed much more than myself! Bumper years I donate my excess to a food pantry and poor people I know living on broken incomes and handouts from the gum’ment!

It may help you now – but you will be paying whatever you gained back to the government with interest.

The current FFR for the 10 year yield has already risen to 2.94% and all that does is take more of what you have in the future to pay back the increasing debt that was created because of the tax cut.

My first day as President, there are about 20 executive agencies that are immediately terminated, plus two “intelligence” bureaus and some parks. In fact, anything that I have the executive privilege to immediately terminate is f~~~ing gone.

Sadly, you have to persuade the better part of

538537 socialists to do the same in the Legislative branch.Cupcakes are Cold. MGTOW is Absolute Zero.

“Let us wait a little; when your enemy is executing a false movement, never interrupt him” –Napoleon Bonaparte, 1805- AuthorPosts

You must be logged in to reply to this topic.

921526

921524

919244

916783

915526

915524

915354

915129

914037

909862

908811

908810

908500

908465

908464

908300

907963

907895

907477

902002

901301

901106

901105

901104

901024

901017

900393

900392

900391

900390

899038

898980

896844

896798

896797

895983

895850

895848

893740

893036

891671

891670

891336

891017

890865

889894

889741

889058

888157

887960

887768

886321

886306

885519

884948

883951

881340

881339

880491

878671

878351

877678