This topic contains 9 replies, has 5 voices, and was last updated by ![]() Y_ 1 year, 9 months ago.

Y_ 1 year, 9 months ago.

- AuthorPosts

Who will buy US Treasuries when Social Security stops buying them? [1]

Chris Hamilton

Econimica

Feb 21, 2018As of the latest Treasury update showing federal debt as of Wednesday, February 15, 2018 – Federal Debt jumped by an additional $50 billion from the previous day to $20.76 trillion. This is an increase of $266 billion essentially since the most recent debt ceiling passage. Of course, this isn’t helping the debt to GDP ratio at 105%.

But here’s the problem. In order for the American economy to register growth, as measured by GDP (the annual change in total value of all goods produced and services provided in the US), that growth is now based solely upon the growth in Federal Debt. Without the Federal Deficit Spending, the economy would be shrinking.

The chart below shows the annual change in GDP minus the annual federal deficit incurred. Since 2008, the annual deficit spending has been far greater than the economic activity that deficit spending has produced.

The net difference is shown below from 1950 through 2017 plus estimated through 2025 based on 2.5% average annual GDP growth and $1.2 trillion annual deficits. It is not a pretty picture and it isn’t getting better.

Even if we assume an average of 3.5% GDP growth (that the US will not have a recession(s) over a 15 year period) and “only” $1 trillion annual deficits from 2018 through 2025, the US still continues to move backward indefinitely.

The cumulative impact of all those deficits is shown in chart #1 above. Federal debt is at $20.8 trillion and the annual interest expense on that debt is jumping, now over a half trillion.

So, for America to appear as if it is moving forward, it has to go backward into greater debt? If you weren’t troubled so far, here is where the stuff starts to hit the fan.

With the change to the Unified budget, effective as of 1969, the Social Security surplus was “unified” into the federal budget. The government gave themselves a ready buyer for US debt while simultaneously allowing the SS surplus to be spent in “the present”.

Congressionally mandated to buy US debt, from 1970 to 2008, the Intra-Governmental (IG) Holdings (over half from the Social Security surplus) purchased over 45% of all Federal Debt issued. This meant “only” 55% of US debt was auctioned into the market, or “marketable debt”.

But the annual SS surplus has declined by 90% (from over $200 billion a year at the peak in 2007 to perhaps $20 billion this year) and, according to the SS trust fund, the last surplus will be recorded in 2020 or 2021.

After that (or essentially now), the Congressionally mandated buyer (which consumed almost half of all US federal debt for 4 decades) will cease. Not only will the IG Holdings no longer be a buyer, they will need additional debt created to make good on those $2.9 trillion in SS “reserves”…and all the debt issued will be “marketable”.

The chart below shows the “marketable” debt vs. IG Holdings. As noted above, IG consumed nearly half of all US debt up to 2008 – but since 2008, IG has consumed just over 10% of all the new issuance and nearly 90% of new debt been auctioned into the market. IG has essentially ceased to be a buyer – meaning that marketable debt will continue to soar.

So who is a buyer of US Treasury debt? Only three possible groups remaining; 1. “foreigners”, 2. the Federal Reserve, and 3. private domestic sources (pensions, banks, mutual funds, individuals).

I will show that foreigners have essentially ceased buying, that the Federal Reserve isn’t a buyer and in fact is reducing its balance sheet…and this means there is only one buyer remaining to soak up the surging marketable debt.

But before I detail these – I want you to remember Harry Markopolos. Markopolos is a financial investigator and he gave clear evidence of Bernie Madoff’s Ponzi to the SEC as early as 2000, again in 2001, and again in 2005. The SEC did not see what they didn’t want to see and it wasn’t until the great financial crisis of ’08 that Madoff’s fraud was exposed and the loss of approximately $65 billion realized (below, from Wikipedia).

- When Markopolos obtained a copy of Madoff’s revenue stream, he spotted problems right away. Madoff’s strategy was so poorly designed that Markopolos didn’t see how it could make money. The biggest red flag, however, was that the return stream rose steadily with only a few downticks—represented graphically by a nearly perfect 45-degree angle. According to Markopolos, anyone who understood the underlying math of the markets would have known they were too volatile even in the best conditions for this to be possible. As he later put it, a return stream like the one Madoff claimed to generate “simply doesn’t exist in finance.” He eventually concluded that there was no legal way for Madoff to deliver his purported returns using the strategies he claimed to use. As he saw it, there were only two ways to explain the figures—either Madoff was running a Ponzi scheme (by paying established clients with newer clients’ money) or front running (buying stock for his own account, based on knowledge about his clients’ orders).

With that in mind and the largest single buyer (IG) now a seller, let’s look at the remaining “buyers” and consider the nearly $21 trillion US Treasury market.

BUYERS –

Federal Reserve presently allowing Treasury bonds and MBS (mortgage backed securities) to mature, reducing it’s balance sheet on a monthly basis.

The Fed plans to roughly halve its balance sheet from $4.5 to $2.2 trillion between now and 2022 (a $250 billion annual reduction in Treasury holdings).

That is a net increase of available Treasury debt of $250 billion annually above and beyond the trillion plus in new issuance and trillions being rolled over every year.

Foreigners presently hold $6.3 trillion in US Treasury debt but since QE ended in late 2014, foreigners have essentially gone on strike, adding just $150 billion in a little over three years (chart below).Foreigners added an average:

’00 to ’07 : +$160 billion annually

’08 to ’14 : +$540 billion annually

’15 to ’18 : +$50 billion annuallyThe current pace of foreign Treasury buying is less than 1/3 the pace of the early ’00’s and a 90% reduction from the pace of ’08 through ’14, when QE was in effect

Just three buyers hold over half (55%) of all debt held by foreigners; China, Japan, and what I call the BLICS (Belgium, Luxembourg, Ireland, Cayman Island, Switzerland). The chart below shows each nations/groups US Treasury holdings from ’00 through December of ’17. Entirely noteworthy:

China ’00 to ’11 +$1.2 trillion…but China has been a net seller of Treasury’s since the July of 2011 debt ceiling debate

Japan ’00 to ’11 +$600 billion…Japan’s holdings did rise after the July 2011 debate but are fast declining now toward the same quantity it held in July of 2011

BLICS ’00 to ’11 +$300 billion…It has been the $800 billion surge in BLICS buying since July 2011 that has kept foreign demand alive.

As for the BLICS, their buying patterns since ’07 have grown increasingly bizarre, as if profit isn’t their motive? However, if maintaining a bid for US debt is the motive, the massive surges in buying at the worst of times makes sense.

So, I’ve shown US federal debt is surging but the only thing keeping the US economy “growing” is the size of the deficit and debt incurred. I’ve show the traditional sources of net Treasury buying have ceased except for the domestic public.

That the Intra-Governmental holdings are essentially peaking and will be a net seller within a couple years and all new debt issued will be “marketable”.

I’ve shown the Federal Reserve plans to “roll off” approximately $250 billion a year for up to four years. I’ve shown that China ceased net buying Treasury debt in 2011 and foreigners have essentially gone on strike since QE ended.

The only real foreign bid remaining is from some pretty shady demand that looks an awful lot like it could be central bank buying, but regardless the BLICS, foreign demand for Treasurys (on a net basis) has essentially stopped.

This leaves the domestic public to purchase all the surging new issuance, plus the portion the Fed (and soon enough, the IG) is rolling off, and with little to no assistance from foreigners (even the possibility the strike turns into an outright selloff!?!).

The domestic public currently holds about $6 trillion in Treasury debt and will need to buy in excess of $1.5 trillion annually (indefinitely) between picking up the roll off and the new issuance.

If the public “willingly” do this at low interest rates, it will represent 7.5% of GDP going toward Treasury purchases that yield well below needed returns.

If the Public don’t do this “willingly”, interest rates will soar far more than shown above and the US will be overwhelmed by debt service.

The only other option is that the Federal Reserve makes a U-turn to re-start QE and openly engage in endless monetization.

Chris Hamilton

Econimica

Feb 21, 2018[Y : A few things I wish to add.

This is by no means the full story on the US debt market, but a good enough primer for understanding who buys debt and what the future of US debt is likely to be.

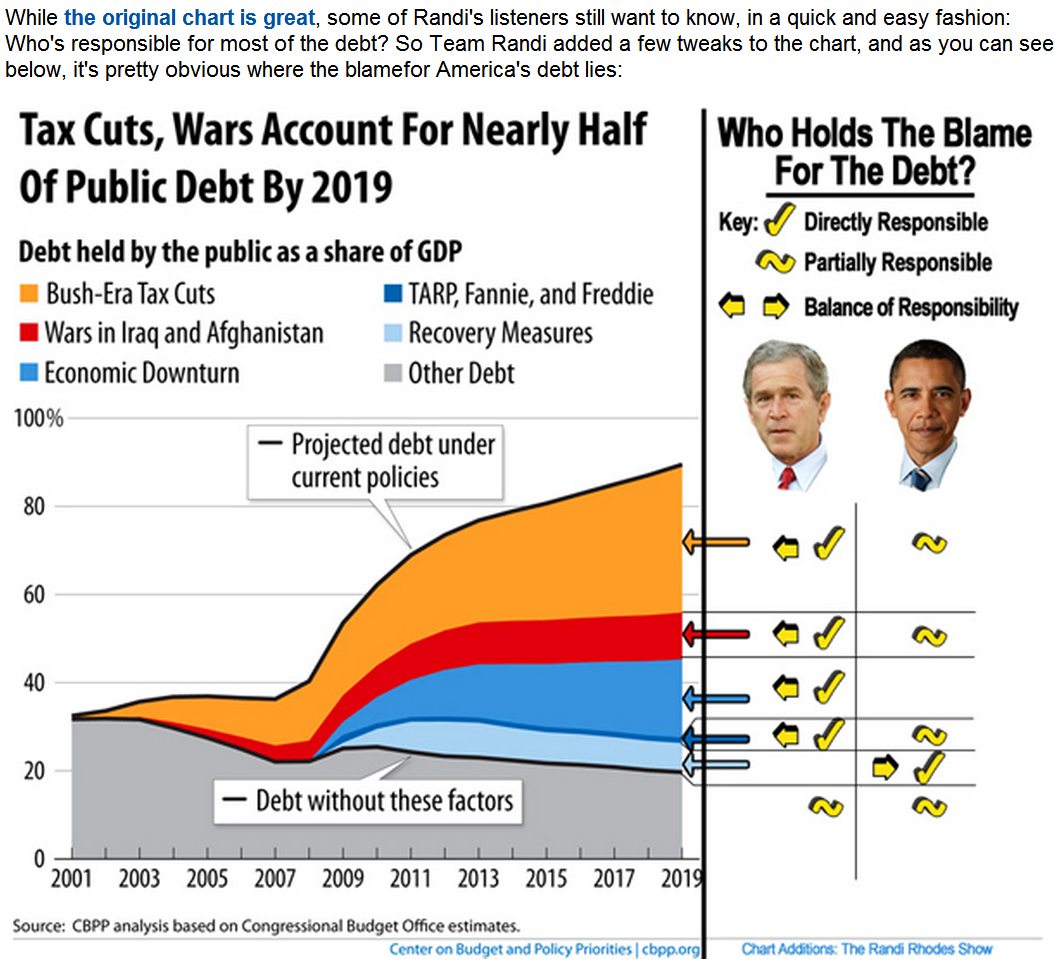

The impact of the Bush tax cuts is shown in the following diagram. Again we can expect much the same reaction to debt from the Trump tax cuts.

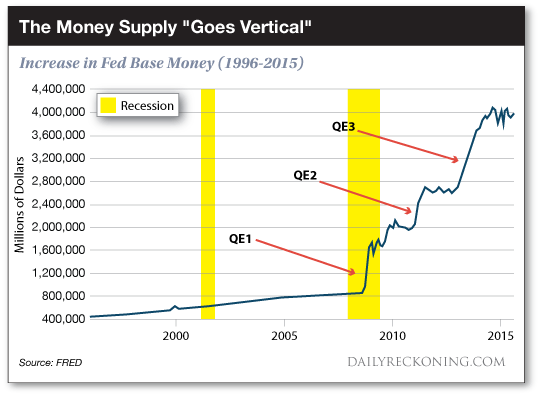

It was stated the Federal Reserve is liquidating $2.2 trillion of the M1 currency supply over the next 3 years. This is not exactly correct.

This is QE currency used to prop up the banks and create liquidity after 2008. However the banks created the stock market bubble, the tech bubble, the housing loan bubble and the auto loan bubble with this currency as the base.

Now think of what is gong to happen when the Federal Reserve removes this amount of M1 [2] from circulation at the same time raising the Fed Funds Rate (or loosely the interest rate) – the impact on M2 & M3 will be exponential. M4 is a different matter and can be taken as inconsequential.

What is mentioned in passing is the social security crisis where funds are now unable to pay retirement pensions to millions of baby boomers. As pensions are underwritten by the Federal Government, guess who is going to pick up the tab for this?

The bond market yields for the April 2018 Treasury Auctions have already begun to rise above 3% – which indicates that as expected – buyers are struggling to accommodate the $3 trillion worth of bonds on sale. This is again – as expected – having a significant effect on the stock market.

The Plunge Protection team seems to be having a tough time keeping the yields down. There is as yet no inversion of the yield curve but the 2, 10 and 30 year yields are starting to flatline.

It appears traders are liquifying assets to meet margin calls on higher Fed Fund Rates. This is the current view of market watchers. If the current FFR is increased at the next FOMC by 25 basis points then we are expecting a market correction led by FAANG stocks. Expect high volatility if you are setting hard stops or trading options. Exercise extreme caution in CD’s and naked short positions.

-Y].

[1] https://econimica.blogspot.sg/2018/02/who-is-it-that-wants-to-buy-trillions.html

[2] https://en.wikipedia.org/wiki/Money_supplyWow. Lots of good info here. Too much to cover in its entirety, but in response to 105% of GDP. We look really good compared to other economies. This is one reason why we are the reserve currency. For now…

“Who will buy treasuries when social security stops buying them?”

From various published public reports, the original plan by the globalists under Obama was to federalize/seize 410K accounts and other savings by U.S. citizens. Though, I doubt President Trump would allow this.

I can see how this could play.

Economic crash engineered by the globalists to be used as a pretext for federalizing of all private property and wealth held by non-globalists U.S. citizens to go into the coffers of the globalists and enslavement of the U.S. population.

President Trump refuses to do this. President Trump is deposed by the deep state and globalists. Then, immediately after, the globalist figures heads in charge announce they are by fiat banning/criminalizing private ownership of guns, censoring/criminalizing all “hate speech” (anything that disagrees with globalism), federalizing all private savings accounts held by U.S. citizens, and federalizing the election process (which Obama did by executive order on his last month in office, but the Trump Administration has ignored and not implemented) to make sure the globalists never have another nationalist win elected office.

Then, all hell breaks loose in the U.S.

Faust is correct as usual. The plan was called MyRA.

It was not popular.

That was what is was called. I just did not remember the name.

Thanks, Market~~~cher.

Too much to cover in its entirety, but in response to 105% of GDP.

Tip of the iceberg. Just that. Being the Reserve Currency will only make the fall harder when it happens -and it will happen. 🙂

“Who will buy treasuries when social security stops buying them?”

From various published public reports, the original plan by the globalists under Obama was to federalize/seize 410K accounts and other savings by U.S. citizens. Though, I doubt President Trump would allow this.

I can see how this could play.

Economic crash engineered by the globalists to be used as a pretext for federalizing of all private property and wealth held by non-globalists U.S. citizens to go into the coffers of the globalists and enslavement of the U.S. population.

President Trump refuses to do this. President Trump is deposed by the deep state and globalists. Then, immediately after, the globalist figures heads in charge announce they are by fiat banning/criminalizing private ownership of guns, censoring/criminalizing all “hate speech” (anything that disagrees with globalism), federalizing all private savings accounts held by U.S. citizens, and federalizing the election process (which Obama did by executive order on his last month in office, but the Trump Administration has ignored and not implemented) to make sure the globalists never have another nationalist win elected office.

Then, all hell breaks loose in the U.S.

Then as all hell breaks loose, a few people I know fan out with sniper rifles and globalists start growing 3rd eyes in their forehead as a result.

All my life I've had doubts about who I am, where I belonged. Now I'm like the arrow that springs from the bow. No hesitation, no doubts. The path is clear. And what are you? Alive. Everything else is negotiable. Women have rights; men have responsibilities; MGTOW have freedom. Marriage is for chumps. If someone stands in the way of true justice, you simply walk up behind them and stab them in the heart-R'as al Ghul.

The rest of the world, from poor to rich, view the U.S. population as an endless supply of wealth to steal from. Some of the rich in price so they transfer their debts to the U.S. population to pay. All of them think this theft is going to last forever.

Well, the U.S. population, outside of globalists owned cities are almost broke, with only their guns and bibles to cling to. The rest of the world have driven the U.S. population in outside of the major cities to be ready for workers revolution, that is communist in everything but name, to take but what has been stole from them by the rest of the world.

A good example this theft by rest of the world is this article on why NATFA: https://theconservativetreehouse.com/2018/04/30/under-the-radar-mnuchin-lighthizer-and-kudlow-head-to-china-korea-nafta-and-china-trade-deal-all-merge/

They are not almost broke they are broke. I saw a good example today of why things need to collapse. I was in a dollar store waiting to pay. In front of me two big corpulently fat black women one way older than the other. And the younger holding a small screaming kid. So in front of me is three generations—and what are thy doing? Buying snacks and cell phone equipment WITH an EBT card. Now it gets good. Guess what they drove to get there? A Saturn 4WD full size SUV. Yup we’re doomed. Thank God!

They are not almost broke they are broke… Yup we’re doomed. Thank God!

/about/end-is-near-lk1010ad-57c814c43df78c71b6d6d26a.jpg)

- AuthorPosts

You must be logged in to reply to this topic.

921526

921524

919244

916783

915526

915524

915354

915129

914037

909862

908811

908810

908500

908465

908464

908300

907963

907895

907477

902002

901301

901106

901105

901104

901024

901017

900393

900392

900391

900390

899038

898980

896844

896798

896797

895983

895850

895848

893740

893036

891671

891670

891336

891017

890865

889894

889741

889058

888157

887960

887768

886321

886306

885519

884948

883951

881340

881339

880491

878671

878351

877678