Home › Forums › MGTOW Central › People thinking that other people making a lot of money are happy with their job

This topic contains 23 replies, has 13 voices, and was last updated by ![]() Beer 3 years, 7 months ago.

Beer 3 years, 7 months ago.

- AuthorPosts

I agree with you. I believe you should do what you like. You’ll be working 9-5 with something for maybe more than 40 years at best, so it better be something you like.

Now if you have a plan like Mr. Beer (do it just for the pay, then retire early), then its all good. But for the majority of people, money isn’t everything they want out of life, job satisfaction is important as well.

There are some things that I love doing, and if I get the chance, I would happily work a job where I get to do things that I like for a minimal, below-average pay. Of course, I’d have to make sure it’d be just enough for me to survive, but the MGTOW lifestyle makes things easier, doesn’t it?

The first job I got paid way more than my 2nd one, but I still switched because 1. I liked my second job (couldn’t care that I was working 10+ hours) and 2. There were good growth opportunities.

A bird in the hand is worth two in the bush.

Wait a sec. What is the tax rate of the US? because here you are getting f~~~ed in more ways than one.

FFS, tradesmen are expected to have more than 70% of their income taxed.

I’m going with happy over rich every time. I’ve tried it both ways, and I prefer happy.

Society asks MGTOWs: Why are you not making more tax-slaves?

Wait a sec. What is the tax rate of the US? because here you are getting f~~~ed in more ways than one.

Well…its complicated here lol. For starters we have a federal income tax which is taxes that come out of your paycheck for working.

On top of those tax brackets we also pay a social security of 12.4% and a medicare tax of 2.9%. If you work for an employer you pay half of that and your employer pays half. If you are self employed, you pay the entire tax.

Finally…many states have an income tax. I’ll just use my state for an example here…

Tax Bracket (Single) Marginal Tax Rate

$0+ 3.00%

$10,000+ 5.00%

$50,000+ 5.50%

$100,000+ 6.00%

$200,000+ 6.50%

$250,000+ 6.70%So for me…if I’m cracking 100k a year…the income on the high end for me I’m paying 28% to the federal government for income tax, 15.3% for social security and medicare, and another 6% to the state, so if I work an overtime day tomorrow the government is literally siphoning 49.3% of my productivity for the day.

Of course though…the way the brackets work…my first 9275 I’d only pay 10% on for federal income taxes, everything from 9276-37650 I’d pay 15% on, etc…so at the end of the year I’m not actually paying an effective tax rate of 49.3%…its probably going to be closer to 30%.

Other things to take into account…I’m also paying property taxes for my car and my home, and my state has a sales tax so judging tax rates based entirely on income tax isn’t accurate. An average house in a decent area around here, even with a small yard, is probably going to hit you for 4-5k in property taxes, plus a few hundred bucks a year for property taxes on a car, plus a 6.35% sales tax…for most people this is going to push your tax rate up 5-10%. Plus we have taxes on businesses that in reality just drive up the costs for consumers, so in a round about way we pay those taxes as well. In the end if you factor in all this s~~~ I wouldn’t be surprised if a person making 100k a year that buys a nice house and a fancy car and spends a lot more than they saves ends up giving more than half of their gross back to the government over the course of the year.

Another thing worth mentioning…we get a standard deduction and a personal exemption as well…which basically means we all get to “write off” about 10k a year worth of income…which if you are in higher brackets can save you a few thousand a year.

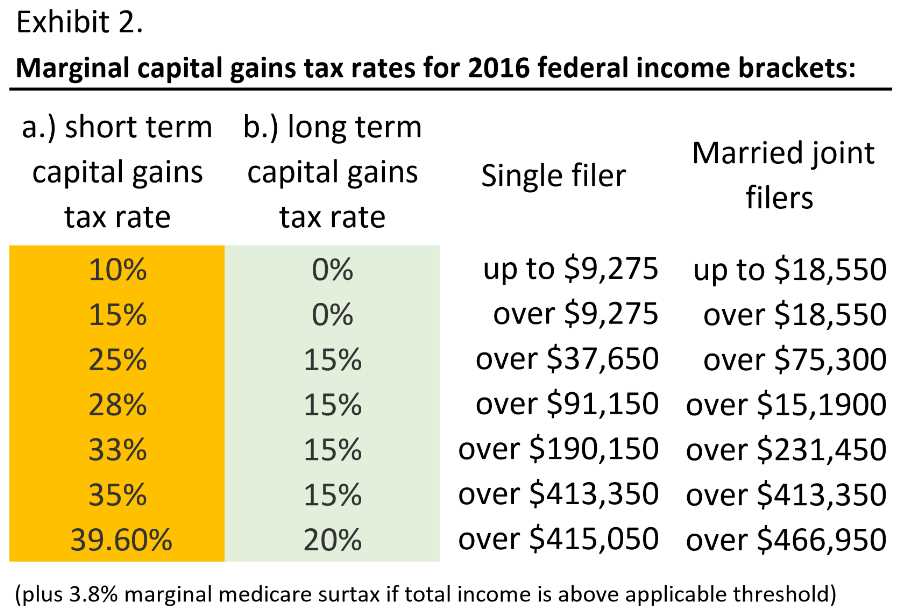

Finally…the thing I mentioned about capital gains earlier…here is what those brackets look like.

So basically if all you make is long term capital gains, which I believe counts as dividends on a stock you have held for at least 90 days or sale of a stock you held for at least a year, your first 37,649 dollars is taxed at 0%…plus your standard deduction/personal exemption you can make almost 50k a year in capital gains without paying taxes…where as the guy earning 50k a year in payroll, as you can see from the payroll rules, is going to be paying a considerable amount in federal/state income taxes, social security, and medicare.

That’s why it has become my main goal in life to hit a point where I’m making maybe 40k a year in dividends and then say f~~~ it and move out of the country. 40k in a lot of other places will allow me to live like a king while still reinvesting some, and if I sell my condo and my car before I leave I’ll have literally 0 tax burden here so I can keep my citizenship without having to fund the feminist socialist machine at all, but it will be great knowing I can come back here if WW3 breaks out, and that I’ll be able to collect SS down the road! I almost hate saying that because I know its pretty s~~~ty to basically say I intend to try to leech the system in a legal manner…but I despise how this nation is being run and the only alternative is to waste my life working and paying taxes just to support a f~~~ed up machine.

- AuthorPosts

You must be logged in to reply to this topic.

921526

921524

919244

916783

915526

915524

915354

915129

914037

909862

908811

908810

908500

908465

908464

908300

907963

907895

907477

902002

901301

901106

901105

901104

901024

901017

900393

900392

900391

900390

899038

898980

896844

896798

896797

895983

895850

895848

893740

893036

891671

891670

891336

891017

890865

889894

889741

889058

888157

887960

887768

886321

886306

885519

884948

883951

881340

881339

880491

878671

878351

877678