This topic contains 87 replies, has 23 voices, and was last updated by ![]() IGMOW (I Go My Own Way) 1 year, 10 months ago.

IGMOW (I Go My Own Way) 1 year, 10 months ago.

- AuthorPosts

Question here: Can you say what is bad about borrowing with interest? If you say there is nothing, then you aren’t understanding debt.

———————————

There is nothing wrong with borrowing money and paying interest on it. Debt is a tool. Its not different than a hammer…one person might build something magnificent with other, and another might crush their thumb.For example…I’ve got a small balance on my mortgage I could pay off any time, but I’m paying less than 3% interest on it. During the past few years that I could have paid it off at any time but opted not to, I haven’t had less than a 10% year in the market. Additionally, that debt has allowed me to build equity instead of rent…my 410 dollar mortgage is building me equity, and I’m not paying 850-900 in rent.

</quote>

Pardon me here if this is formatted wrong. I am going into HTML on here, to make sure my replies fit in it.Here is a problem with a system of interest, as a means of funding investing: There isn’t enough money in the system to be able to pay back the debt. This is particularly true with the U.S central bank system, that borrows the fiat money into existence. To be able to service the debt, you release more debt into the system. It leads to a situation of like zero percent interest they had going on and the economy not responding. There is too much debt in the system now, and not enough money to service it. During an economic slowdown, more and more debt goes bad, and it spirals out of control.

One can say, “debt is just a tool”. Yes, but it also makes presumptions on what the future will hold, and that gains from economic activity will outpace the interest. Also, with the housing crisis, this debt got spun off and divided up, and all got messed up, and was presumed to be able to be sustainable by diversifying and dividing. Everything went to crap back then.

This is the bad side of debt.

No interest means no gain as a lender. But, who says you have to run a system where there is debt and interest? There are other ways to start and fund ventures.

———

You mean like someone with a great idea for a startup who lacks funding could have an ICO to raise funds, and people would essentially get future gains based on the success of the startup? Do you realize this isn’t new? Its how the stock market works lol…coins based on an underlying business are essentially just stock. Coins based on speculation, like Bitcoin, are are ponzi scheme.There is a difference. Stocks are based on controlling a percentage of ownership. The way tokenization works, you base it on other things, and have greater flexibility, such as currency in a business, and not just equity. ALL investing, used for funding new ventures, is based on the success of the venture. An investor would need to do their homework and validate if it is working or not. This is fundamentals. Speculators just rely on technical analysis and price shifts. Speculators play into next sucker syndrome, and hopes that such will pan out. There is a lot of that with the Crypto arena, as price evaluation alone, is used.

Coin-based systems, unless the tokens somehow pay income based on new money entering the system, is NOT a Ponzi. Ponzis are that. What it is, is prone to bubble behavior, as is anything where everyone buying is merely buying because they presume price will go up, and another sucker enters. There IS a difference between bubbles and Ponzis. The Tulip Bubble wasn’t a Ponzi. Ponzi’s original attempting to do arbitrage on differentials in postal stamps between nations, that got closed as investors entered, is a Ponzi. It ends up a rob Peter to pay Paul thing.

Another thing about ITOs, is that it allows for more crowdfunding, and more smaller investors to get involved.

In regards to my other post about Bitcoin price, it went over $10000 within 24 hours of my post where I said that, and it is on the way to $11000.

And your also the guy posting about the bloodbath in the markets and crypto being safer than stocks right before the S&P has its best week since 2013. If I’m looking long term on investments…what can you tell me about Bitcoin to make me believe it will be around and be more valuable in 20 years? You’ll probably just puke out some garbage out it being limited in quantity, even though cryptos as a whole we have over 1000 coins available right now and literally anyone can start one lol. Or you’ll probably say something about the underlying technology, yet be 110% unable to say how Bitcoin will monetize opensource freeware and profit off it, or how Bitcoin is any better than any of the other 1000+ coins out there.

When I speak on Cryptocurrencies, Bitcoin is a reference of one. I have no idea how it will turn out, or its long-term potential. What I do know is that it is driving technological developments. What I speak of is the area of tokenization as a means of financing and investing, and that being the future. I am not seeing the economy centering around Bitcoin as THE replacement for the dollar. I do see, if it holds, and as digital version of gold, and one of a number stores of value. It will end up as a place to park currency while uncertainty in the market remains. You are also likely to see governments do versions of Cryptocurrency, releasing a finite about that will grow in value, that can be used for pay taxation and other services.

What I am saying is the technology, and systems are evolving into what is the future, with tons of currencies floating and exchanging.

As for what I hope for long term is currency to go away completely and people able to just swap goods and services for goods and services, with the network sorting things out, and promises on future production being a way to have things happening. As the economy grows, more tokenized items enter and are exchanged, and things find their way about. Because of inefficiencies in things, and delays, you likely will need a temporary placeholder for things, until the exchange goes through, and that is where tokenized form of currency goes.

There is miles more work to go here, which is being worked on. There is way too much hyped behind blockchain as a cure-all, and it isn’t. All it is, is a ledger that can be auditing that shows the system is reliable. It is the place of final record with things distributed. To exchange off it directly is a problem. I personally hold out hope for distributed exchanges, where I can put items I have to offer, in token for, and list what I want, and have the system sort it out.

"I am my own thang. Any questions?" - Davis S Pumpkins.

Im not an economist, but I don’t think crypto are any diferent from all the electronic money (or debt) that exist.

The problem with money is you can print more, problem with crypto is you can create more.

You wanna solve the increasing debt problem?

Chain money to gold, silver, other precious metal, water supply or land.

That’s it.

Every other thing is just a mambo Jambo to get the same mess rolling.

VIRTUAL WORLD has no limit, earth and reality has a limit.

The limit on crypto was set to be X, it was set, it doesn’t means it is.

To those following me, be careful, I just farted. Men those beans are killers.

Crypto and the blockchain is a new frontier , a new way or a new opportunity. Being not that much regulated by countries and governments means that there are still millionaires to be made out there.

If you check, precious metals, stocks or bonds, real estate etc… All these markets have really few opportunities to change the life of someone. It’s up to the individuals to make some moves that could be quite beneficial for them. Indeed many scams, fake ICO’s crappy coins and useless people are around the corner but if you put little money, that you can afford to lose without feeling like s~~~ then it may be interesting to go into crypto currency…

Remark : Indeed I do not foresee the future of any type of investment, do your own research as I cannot be accountable for your financial situation and decisions regarding investments.

Leo the wise : Giving to all men their needed uprise My MGTOW YOUTUBE channel, first vid : https://youtu.be/Xt-tJgVUGuI

Crypto and the blockchain is a new frontier , a new way or a new opportunity. Being not that much regulated by countries and governments means that there are still millionaires to be made out there.

If you check, precious metals, stocks or bonds, real estate etc… All these markets have really few opportunities to change the life of someone. It’s up to the individuals to make some moves that could be quite beneficial for them. Indeed many scams, fake ICO’s crappy coins and useless people are around the corner but if you put little money, that you can afford to lose without feeling like s~~~ then it may be interesting to go into crypto currency…

Remark : Indeed I do not foresee the future of any type of investment, do your own research as I cannot be accountable for your financial situation and decisions regarding investments.

Every single current form of investment can get tokenized and traded as tokens, which can be seen as a form of Cryptocurrency. I am going to say this is coming, and the technology matters.

As for Bitcoin, I used it as an example of one form of Cryptocurrency. It may have issues that need to be resolved, I need to look into more. If Bitcoin keeps increasing need for computational power, EVEN AFTER it has all been mined out, it is unsustainable. Other cryptocurrencies could stand, but then Bitcoin will fail.

I consider a sane Crypto to invest in is one that will be released over time and have a finite amount, be involved in genuine economic activity, and have other long-term fundamentals behind it. I would want to get into the initial ITO/ICO time period when its price is being set, not later on.

"I am my own thang. Any questions?" - Davis S Pumpkins.

This just scares me even more.

I must buy my land and prepare all my GTFO plan as soon as possible, I have less than five years to make it to a safe location and be autosuficient.

To those following me, be careful, I just farted. Men those beans are killers.

This just scares me even more.

I must buy my land and prepare all my GTFO plan as soon as possible, I have less than five years to make it to a safe location and be autosuficient.

The entire system currently is based on assumed trust, where everyone presumes that everything will improve, to some degree, and losses aren’t really possible. This is one of the key foundations to civilization functioning. Specialization allows you to end up producing surplus that allows you to go and get things you need and want, you couldn’t produce for yourself. This requires a degree of trust here, to work it so, to make everything work.

You can choose to go completely off-grid, and totally produce for yourself, but be prepared to have a lot less of everything. My interest is in decentralized everything, that can adapt to situations, and prevent bottlenecks or shutdowns by anything. I am way not good at everything, so I am specializing in knowing the area involved in the new Crypto era of the exchange of value between individual entities.

"I am my own thang. Any questions?" - Davis S Pumpkins.

There isn’t enough money in the system to be able to pay back the debt.

And crypto currencies make disappear how exactly?

There is a difference. Stocks are based on controlling a percentage of ownership. The way tokenization works, you base it on other things, and have greater flexibility, such as currency in a business, and not just equity. ALL investing, used for funding new ventures, is based on the success of the venture. An investor would need to do their homework and validate if it is working or not. This is fundamentals. Speculators just rely on technical analysis and price shifts. Speculators play into next sucker syndrome, and hopes that such will pan out. There is a lot of that with the Crypto arena, as price evaluation alone, is used.

Arguing this one is like trying to land a punch while shadow boxing because the function of coins can be so different from coin to coin. If you have a coin that has some underlying asset backing it, such as the coin simply being a glorified stock or the coin having some sort of exchange rate with a business for goods or services, that is 100% different than Bitcoin…which is backed by absolutely nothing.

Coin-based systems, unless the tokens somehow pay income based on new money entering the system, is NOT a Ponzi.

The way the average person has made “income” off Bitcoin is to sell it for more than they bought it. The only thing that drives Bitcoin’s value up is new money entering the system.

Ultimately Bitcoin does not produce anything, so the only way for Person A to make a dollar is for Person B to lose a dollar.

Its no different than Madoff…people who got in early with him made money…its just that money was coming directly from other people’s investments, and not because Madoff was actually investing their money in real estate or businesses. A lot of Bitcoin investors are going to learn first hand how a lot of Madoff investors felt in 2008.

When I speak on Cryptocurrencies, Bitcoin is a reference of one. I have no idea how it will turn out, or its long-term potential. What I do know is that it is driving technological developments. What I speak of is the area of tokenization as a means of financing and investing, and that being the future. I am not seeing the economy centering around Bitcoin as THE replacement for the dollar. I do see, if it holds, and as digital version of gold, and one of a number stores of value. It will end up as a place to park currency while uncertainty in the market remains. You are also likely to see governments do versions of Cryptocurrency, releasing a finite about that will grow in value, that can be used for pay taxation and other services.

Its really not. A lot of them are either purely speculative junk like Bitcoin, essentially a stock that is called a coin, or essentially a glorified gift card.

I suppose Blockchain may have some uses going forward if it turns out to be an easy, secure, and transparent system…but again…we run into the whole concept that its open source freeware and coins really don’t have any way right now to monetize that.

I personally hold out hope for distributed exchanges, where I can put items I have to offer, in token for, and list what I want, and have the system sort it out.

So what your saying is basically I could buy pizza tokens for when I want a pizza, beer tokens for when I want beer, gas tokens for when I want to fill my car up, etc…only the problem is, why do I want to convert my dollars into all kinds of different tokens for different purposes when dollars are universal tokens. That is literally a step in the wrong direction.

What you are trying to pass off here as a good idea is basically like Walmart they will only accept gift cards for payment, and the only place you can get gift cards is off their website. That would be annoying as f~~~…not a step in the right direction. I’d rather just pay cash at walmart than have to convert my cash to a gift card just to do with said gift card what I could do right now with cash.

Dollars are the universal token.

Bitcoin is a dangerous gamble.

Less dangerous than marriage though

To those following me, be careful, I just farted. Men those beans are killers.

Beer, I am too lazy to try to go ahead and reply directly into your message. I just wanted to sum up a few point:

* I don’t care about the long-term future of Bitcoin. I don’t consider it the single currency that will be backed. It has issues of sustainability. I do like that it is driving innovation, which will help advance financial tech. It is purely driven by what people think markets will do, and is an anti-gold in the sense it is virtual, and not stable pricewise. If it can be sustained, after all of it is in circulation, that is great. The instability may be a feature. It can crash also, or go to $1 million a unit. Again, I don’t care what happens to it long term. I care the tech get developed to help secure the exchange of tokens, and best practices for financing without bank debt, or giving up equity, comes about. I mention Bitcoin as just a lead example, but don’t think it is all that.

* As for the function of coins differing from coin to coin, I like this. I want tons of token types out there, that can be freely exchanged, that are optimized for different markets, to do what they need. I am a fan of tokenizing everything so it can move decentralized across a network, and not tied up in a centralized point, where it is vulnerable to theft and other attacks. We are in an area where the best practices of tokenization need to be found.

* The reason why I say that Bitcoin, and the tulip mania isn’t a Ponzi, but a Bubble, is that owning it doesn’t promising ongoing returns. It is a case of gains from appreciation only. IF Bitcoin were such, where it promised ongoing returns every month, paid out by new money coming in, then that is a Ponzi. You want to see what is likely a Ponzi coin, check out Bitcoiin (yes, with 2 i’s). This promises 1% return each month, and has a pyramid payout schemed, and endorsed by Steven Seagal:

https://www.avclub.com/its-not-too-late-to-invest-everything-in-steven-seagals-1823159043I would send you to the site, which I saw earlier, but it trigger a web anti-virus warning.

* The tokens I say on my part, are what abstracts out what goes on in an economy. People produce goods and services and gets goods and services. An economy exchanges these. What I would want is that if I have anything, I can offer it up, and get back what I want. Having open exchanges allows this. And, it would be also good, if I want a pizza, I can hold a claim to pizza I acquired and get back a pizza at a future date. I don’t hold a claim back to a pizza and get back less than a pizza. That is what happen. What you say you want a dollar, you want the freedom to decide more immediately what you want when you want it, but what you hold is something that continually decreases in value, is backed by the same thing that backs Bitcoin (people want it) plus some government thuggery to force people to take it, that was borrowed into existence, or someone has to pay for it.At least the pizza token is worth something down the road, so long as it can be claimed. The token is a claim on physical assets, just as the physical asset.

"I am my own thang. Any questions?" - Davis S Pumpkins.

What you say you want a dollar, you want the freedom to decide more immediately what you want when you want it, but what you hold is something that continually decreases in value

You say that like people with lots of money are sitting in .5% interest savings accounts while we average 2-3% interest per year. People with money are typically investing it. Long term market averages for example are about 10%.

In other words my net worth is in investments passively growing each year because I’m getting gains that are greater than inflation, its not sitting in cash getting pummeled by inflation. Tokens that hedge against inflation are a net loss for me.

At least the pizza token is worth something down the road, so long as it can be claimed. The token is a claim on physical assets, just as the physical asset.

Its just a bad idea man. How does it work? You have a pizza token? Ok…I want a buffalo chicken pizza. I can go to the really good place up the road that sells a really awesome large buffalo chicken pizza for 24 bucks. Or I could go to the ok place that sells one for 18 bucks. Or I could go to Walmart and get a s~~~ty frozen one for 6 bucks. Whats my token worth when all pizzas aren’t equal?

Or whats the other option…I have tokens for each different place? Then its right back to what I said…”tokens” are nothing more than glorified gift cards and they are nothing but a hassle when cash works everywhere.

Beer, my interest isn’t what some people do, like the top or elite, or someone quotes to me what others are doing here. You can name ponzi pushers who do real well. I actually know of one I spoke to, who is likely being investigated by the SEC now. I am not interested in consolidation of wealth into fewer and fewer hands by means of the international banking system, that is driven by debt. The interests have remained so low for so long, due to the debt that is out there, and the money being printed servicing that debt.

My interest is a more sustainable system, which enables things to recover, and grow more organically, without a set timer interest rates, which can undermine something. I am interest in what is sustainable. What I see now is a not a centrally backed banking system that plays games with interest rates to sustain the money supply that risks stagflation, and gets screwed up by black swan events that appear. I would rather the money supply grow organically, and map to production of goods and services. Think of it as akin to the gold standard, but backed by goods and services. And with this, the exchange is so instant, it enables the obtaining what I would want due to what I can produce. The system doesn’t crash, and the boom and bust cycle is gone. That is my goal. But yours seems to be more interested in liberty to pick what pizza you want, eventhough what backs it is crap currency that is only run by trust, and leverage up the wazoo that overheats.

As it stands now, you don’t even know how to get an economy going with zero percent interest rates. That is what we had for years, in the name of “QE”.

What I offer here is more stable prices, so I can expect a pizza to remain the same costs as it was a year ago. I expect that if prices go up, it is due to increased value added to the pizza, to make it better, not inflation. Inflation is theft, and inflation comes from interests rates, or also production of desired goods and services not keeping up with the money supply.

In regards to your gift cards, the current system is tied up in centralized servers. What you have when the records are distributed across a network, is that you can take that card, turn it into a token, or a piece of it, and find a market for it, and get what you want instead. The difference here, at the bottom of what I have, with maybe currency as a temporary placeholder, is all the currency is backed by something, rather than just demand and presumption of value. The only differences between government money and Bitcoin, is that Bitcoin isn’t forced on people to be taken at gunpoint, and it is finite. Well, technically, unless they fix other issues with it, it is going to turn into a giant energy consumption ball that will consume this planet, unless massive renewable energy is found. Bitcoin is immensely stupid that way, that it forces changes likely not intended by anyone.

The pizza token would be for a specific pizza anyhow, or goods at specific store. And the tokens anyhow, represent what goes on in the economy anyhow. I produce X, I get Y, with currency as a placeholder.

"I am my own thang. Any questions?" - Davis S Pumpkins.

By the way, what I said I want, isn’t likely to happen. BUT, what is happening is everything is getting turned into tokens so it can be exchanged on the Internet. This is happening now. ICOs are now part of the way things are for a number of start ups. The technology is coming along also, and governments are looking to do token versions of their currency. You had the Petro being announced, by Venezuela, and being released in the coming months, which is backed by oil. So, the currency is pretty much oil at this point. It is done to bypass sanctions, but stay tuned here. NY state is looking into this:

https://www.coindesk.com/new-york-lawmaker-proposes-study-state-backed-cryptocurrency/Expect a world of BABOT to be coming (Billions And Billions Of Tokens). The Internet of Things will connect also to this. When price differentials get shrunk down to next to nothing, then you are trading fractions of things for other things.

"I am my own thang. Any questions?" - Davis S Pumpkins.

Problem is…

The difference here, at the bottom of what I have, with maybe currency as a temporary placeholder, is all the currency is backed by something, rather than just demand and presumption of value.

This is what dollars are…a temporary placeholder. I keep 5,000 dollars in my checking account. When my balance gets up to 10,000 I transfer 5,000 over to my brokerage account to be invested. The 5,000 is a temporary placeholder…its what I’ll pay my bills with for the month and a little buffer so if something unexpected happens I have easy access to money. Losing 2% of 5,000 to inflation is nothing when I have hundreds of thousands in the market with a long term average for me that is well ahead of inflation.

The only differences between government money and Bitcoin, is that Bitcoin isn’t forced on people to be taken at gunpoint, and it is finite.

Problem is Bitcoin isn’t the only crypto, so there goes the finite argument. Anyone can start their own crypto. You are essentially trying to say if the number of 1 dollar bills in circulation was limited they’d hold real value, even though the amount of 5s, 10s, and 20s being produced could be shooting through the roof.

You had the Petro being announced, by Venezuela, and being released in the coming months, which is backed by oil. So, the currency is pretty much oil at this point.

Do you realize Venezuela isn’t doing this because they’re on the cutting edge? They’re doing it because they are a bunch of stupid socialists that can’t even keep a country afloat while they sit on massive oil reserves. Their economy, their currency, and their country are all in the gutter, the crypto thing is the government’s lame attempt to act like they have a handle on it. Ultimately if they’re producing 2 million barrels a day, and can’t figure out how to sell it for xxx currency and make ends meet, they aren’t going to be able to produce 2 million barrels a day and trade it for petro tokens and make ends meet. A change in currency doesn’t fix a broken country.

The system doesn’t crash, and the boom and bust cycle is gone.

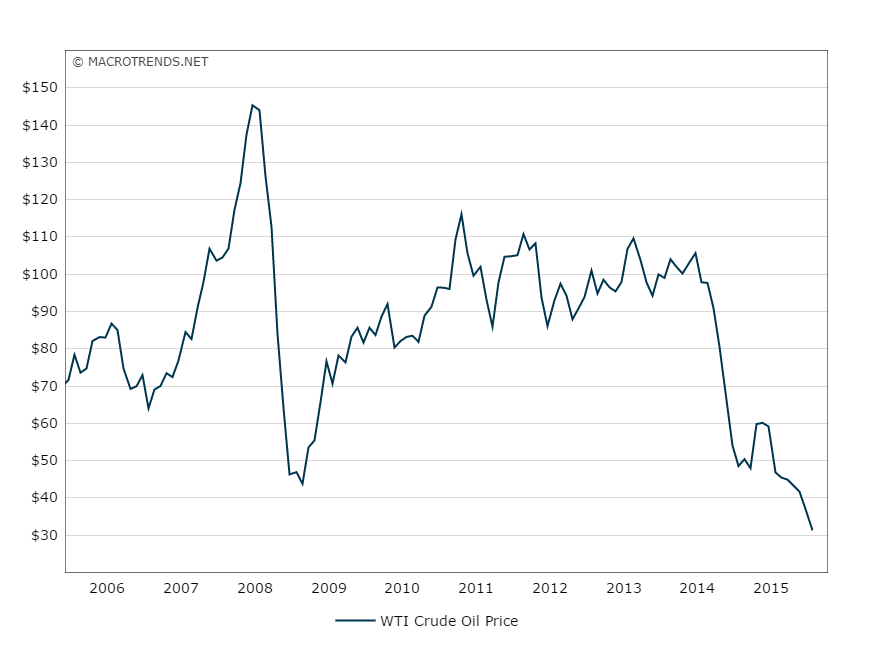

You are living in a fantasy land. Let’s look at that Venezeula crypto being backed by oil as an example. If its backed by oil its value is pegged to the value of oil…let’s see how that would work out.

Not really sure what you’d call it other than boom and bust when it can’t hardly go a year without a 20% swing in prices and has had several times in recent history where it increased >100% or dropped >50% in a relatively short time span.

The odds of me joining the s~~~show called Bitcoin is close to the odds of me doing a 3some with my ex and her Chad.

Which is 0%.

All my life I've had doubts about who I am, where I belonged. Now I'm like the arrow that springs from the bow. No hesitation, no doubts. The path is clear. And what are you? Alive. Everything else is negotiable. Women have rights; men have responsibilities; MGTOW have freedom. Marriage is for chumps. If someone stands in the way of true justice, you simply walk up behind them and stab them in the heart-R'as al Ghul.

The odds of me joining the s~~~show called Bitcoin is close to the odds of me doing a 3some with my ex and her Chad.

Which is 0%.

I got convinced some how, invested 1000€ on it. Now I got 0.08 bitcoin with 650€ worth.

Stick to your guns, ranger, stick to your guns.

To those following me, be careful, I just farted. Men those beans are killers.

There are a LOT of sub-economies now, in games, and in other virtual areas. They also produce items that managed to get sold in markets, such as what happened with World of Warcraft. This is going on now. The difference with tokenization is that the items are then freed to leave the system and be distributed. This is going on now. Again, the difference is a way to have the management of transactions be decentralized.

As far as “bitcoin isn’t the only crypto”, “the dollar isn’t the only currency” and “gold isn’t the old finite commodity that stores value”. There is no one anything we are in, and if there were, then it would become a Bubble. When economies end up valuing one single thing over anything else, they become sick.

As far as Venezuela goes, they are doing it to bypass sanctions, which is contributing to their problems they have. The sanctions aren’t the only reason,. but they do impact things. The sanctions were part of the strategy by the Obama administration to topple the regime there.

Venezuela could screw things up with the Petro, and it is likely. Doing a Crypto is so counter to what top-heavy state would do, which is why you see China trying to block it left and right. But desperate times, as they say.

"I am my own thang. Any questions?" - Davis S Pumpkins.

There are a LOT of sub-economies now, in games, and in other virtual areas. They also produce items that managed to get sold in markets, such as what happened with World of Warcraft. This is going on now. The difference with tokenization is that the items are then freed to leave the system and be distributed. This is going on now. Again, the difference is a way to have the management of transactions be decentralized.

Not really sure what you are even getting at here. People can sell game related items and accounts for cash on a lot of games right now if they want…not really sure how tokens would change that.

In fact, I’ve played games that have set up marketplaces, and you could pay cash for marketplace currency…and one of the first things they do is crack down on players paying players cash for items/characters/accounts because when you make a transaction through the game run marketplace, they skim a %…which actually gives you less freedom, not more, because the game marketplace currencies have no value outside of the game…ie…glorified gift cards. You can’t exchange them for cash, and you can’t exchange them for currencies in other games, because the people running the game have their boot on your throat when they control the currency.

As far as Venezuela goes, they are doing it to bypass sanctions, which is contributing to their problems they have. The sanctions aren’t the only reason,. but they do impact things. The sanctions were part of the strategy by the Obama administration to topple the regime there.

So tell me how exactly this is going to help…

Venezuela does not allow its citizens to buy foreign currencies. Venezuela is not accepting Bolivars in exchange for petros. Venezuela’s own citizens can’t even buy it lol.

It’s unclear why investors would buy at that price, said Russ Dallen, the managing director at Caracas Capital. There’s no guarantee that they’ll be able to exchange Petros for oil.

Well…so much for being backed by oil lol. This crypto is such a joke.

Or how exactly will it allow Venezuela to bypass US and Euro sanctions? You probably can’t give me an answer, and that’s ok, because Maduro doesn’t have an answer for this one either.

Venezuela could screw things up with the Petro, and it is likely. Doing a Crypto is so counter to what top-heavy state would do, which is why you see China trying to block it left and right. But desperate times, as they say.

So in other words…Venezuela’s crypto is the way of the future, unless it totally bombs, then its just because Venezuela screwed it up? Yup…that’s gotta be it…clearly its just not going to fail because its pointless. You have to remember…Venezuela isn’t in the gutter because of the Bolivar, the Bolivar is in the gutter because of Venezeula. If they basically rename their currency…guess what…they’ll put that one in the gutter as well, because they are still the same f~~~ed up country that wrecked their last currency.

Actually Venezuela found a way to apparently screw up the Petro as a currency. They had a good pre-ICO with it, raised some funds. Next up, they will ICO their diamonds. They are going to do so man different damn Cryptocurrencies, they aren’t currency, just tokenized forms of commodities they are doing to bypass the sanctions. It can bypass the sanctions if people are willing to buy it, and use it as currency. Cryptocurrency exchanging has show itself very immune to government shutdown. Its decentralized nature makes it difficult. With Venezuela, they are working with Russians to do the currency, so Russia would be more than willing to run anything outside of the grasp of U.S sanctions. When I say Russians here, I mean people in Russia. It can be said that Putin would be able to have his thumb on it, but crypto, like the internet, is hard to stop.

I will post this in another thread, it is one of the odds that different governments start to take payment in taxes in Cryptocurrency. This article says legislation is coming about in different state legislatures in the United States, to accept payment of taxes in Cryptocurrency:

https://cointelegraph.com/news/us-georgia-next-state-in-line-to-accept-crypto-for-taxes-licensesWhy this is important is the TOP argument for fiat currency, that legitimizes it, is that it can be used to pay taxes. So, moment governments start to take cryptocurrencies as payment for taxes, it legitimizes cryptocurrency as currency.

There is an issue here, about how smart it is to try to invest in it. Even the main person behind Ethereum warns that there is a chance Cryptocurrency can drop to zero.

"I am my own thang. Any questions?" - Davis S Pumpkins.

I want tons of token types out there

Actually Venezuela found a way to apparently screw up the Petro as a currency. They had a good pre-ICO with it, raised some funds. Next up, they will ICO their diamonds. They are going to do so man different damn Cryptocurrencies, they aren’t currency, just tokenized forms of commodities

Lot’s of tokens = good.

2 tokens in Venezuela = fail?

I’m not following your logic.

they are doing to bypass the sanctions. It can bypass the sanctions if people are willing to buy it, and use it as currency.

Again…Venezuela uses the Bolivar and will not accept Bolivar as payment for Petros. It is illegal for Venezuelans to buy currency other than Bolivar. The common person in Venezuela can’t even buy Petro’s…how are they going to use it for currency?

With Venezuela, they are working with Russians to do the currency, so Russia would be more than willing to run anything outside of the grasp of U.S sanctions.

I don’t think you grasp that most official government currencies these days are electronic anyhow. If they couldn’t find a way to skirt the sanctions with the Bolivar, they won’t be able to with the Petro. If America and Euro countries want to place sanctions on their financial dealings with Venezuela, what Venezuela calls their currency is going to be irrelevant.

With Venezuela, they are working with Russians to do the currency, so Russia would be more than willing to run anything outside of the grasp of U.S sanctions.

I don’t think you grasp that most official government currencies these days are electronic anyhow. If they couldn’t find a way to skirt the sanctions with the Bolivar, they won’t be able to with the Petro. If America and Euro countries want to place sanctions on their financial dealings with Venezuela, what Venezuela calls their currency is going to be irrelevant.

You do understand how tokenization works, correct? To shutdown a cryptocurrency, you have to totally shut down every single point where the distributed ledger contain and validated. Bitcoin can’t be shut down either this way. The information for exchange is turned into token forms and passed around the network. These transactions are stored in distributed ledgers. The Russia will be hosting the servers, and other countries which don’t play with the sanctions, the currency still lives.

Yes, it is all in electronic form. It is just that tokenization decentralizes it, and eliminates points of vulnerability.

Now, the Petro may suddenly not be able to be redeemed for oil, for the country doing things, which makes it useless that way. But the more it is uses as a placeholder, the more it serves other purposes.

And if you get all the countries out there who are under attack by U.S sanctions, then you will have an alternative financial network happening. Of course, the government then try to shut down centralized exchanges to block this. But, decentralized, and even distributed, exchanges are coming. I am actually looking into distributed exchanges myself, and positioning there.

"I am my own thang. Any questions?" - Davis S Pumpkins.

- AuthorPosts

You must be logged in to reply to this topic.

921526

921524

919244

916783

915526

915524

915354

915129

914037

909862

908811

908810

908500

908465

908464

908300

907963

907895

907477

902002

901301

901106

901105

901104

901024

901017

900393

900392

900391

900390

899038

898980

896844

896798

896797

895983

895850

895848

893740

893036

891671

891670

891336

891017

890865

889894

889741

889058

888157

887960

887768

886321

886306

885519

884948

883951

881340

881339

880491

878671

878351

877678