This topic contains 16 replies, has 5 voices, and was last updated by ![]() StanAndreas 4 years, 2 months ago.

StanAndreas 4 years, 2 months ago.

- AuthorPosts

So I’m looking for a new accountant who will make use of, and pass on the cost savings, of the automated accounting software packages that are readily available in today’s market. Specifically, I’m looking for an accountant who will do my tax returns and prepare my books using the professional suite offered by Xero.

Xero has created a system that automatically feeds your daily transactions into its cloud database. It literally keeps a running total of your various accounts in real time (24hour delay). To complement this, on the professional side of their system, accountants have a package that will automatically prepare all the relevant financial statements, and tax returns (formatted and submitted directly to the tax department) at the ‘click of a button’. In theory, this system, all but fully automates the accountant’s job. The accountant is then simply the ‘qualified’ person that puts their stamp of approval on the tax statements prior to them being submitted to the government.

Therefore, I believe that significant savings to my business should be made possible if I can find an accountant who actually does what Xero allows them to do. However, this is proving to be far easier said than done. I met with an accountant who has implemented the professional Xero package. However, rather than pass these savings on to me, he is simply wanting to charge me based on the old model of how much turnover the business is doing.

I told him that there was no need for him to see my financial statements to provide a quote. And that they were sensitive information. After all, the work is in preparing the accounts. And, given that Xero software will be doing the work, what difference does it make to them whether my company makes $100,000 or $10,000,000 per year. It seems clear to me that he has the attitude that, ‘if you’re making more money, then I can charge you more to do the accounts (even if it requires the same amount of work)’.

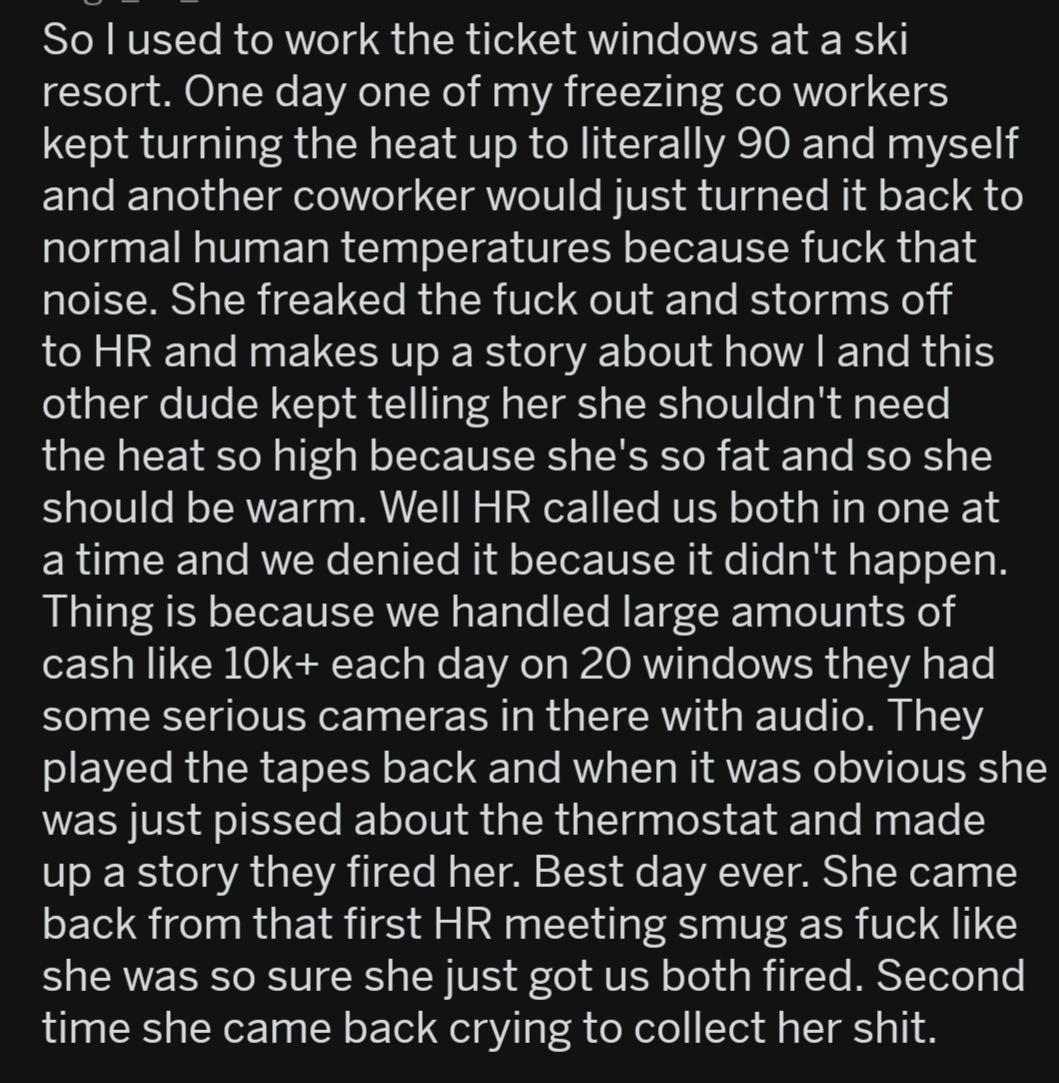

Here’s the letter I got in response from him.

Anyone wish to analyse it? It has got me in quite a mood as there seems to be an outright hostility in his tone.

Personally, I think this letter is the behaviour of a whore. At the end he is rejecting me, but I’m the one who is potentially going to be paying him…

He shows his hand when he said that he could have worked out the quote, on the spot, if I had brought all the financial information with me at the meeting. This obviously, means that he is really only interested in the business turnover. Otherwise, he would not have had enough time in our brief meeting to go through how much ‘work’ it would take to handle our accounts.

Hi,

It is absolutely imperative that we see the prior year financial statements and tax returns to verify the following:

1. Your turnovera. To determine the amount of work involved for us. Remember…we don’t do timesheets…so we have standardised our pricing around models (for example a partnership with turnover of $500K-$1M would cost $xxxx and a company with turnover of $1M-$2M would cost $xxxxxx).

b. To determine which of the two tax systems you are preparing your tax returns under (there is more to it than merely cash or accrual)

2. The complexity of your setup

3. Whether there are any inter-company loans

4. The amount of franking credits (if any) remaining in the franking account

5. The depreciation schedules to verify which of the two systems you are operating under

6. Any tax losses carried forward in the entities

7. Any tax losses carried forward in your individual names

8. The amount of interest earned in your personal names

9. The amount of Dividends earned in your personal names

10. Whether your entities have been processed as part of a consolidated group for tax purposes or grouped together for GST

All of these factors have an impact on the price we charge. We must know EVERYTHING about you…or we may end up under-quoting/over-quoting.

We recently parted company with a client, because he told us he was a company with turnover of under $1M. What we found out when we got his books was that he had a company, he owned 3 properties in a partnership and his wife was a member of a trust that was trading separately to him. It effectively doubled the price that we were going to charge him. We copped-it-sweet in the first year…because we quoted a price and we stick to our quotes. However, in the second year…we gave him an upfront quote which was double the previous year…and he walked. I’d rather avoid all this unnecessary angst (and wastage of time) by quoting you properly upfront.

We need to see the real figures…and the tax returns as well…so that we know what we are dealing with (if you send them electronically, we will destroy them immediately if you do not accept the quote…alternatively, send them registered post and we will send them registered post back to you…and not copy them). We cannot give you a genuine quote and stick to it – if we don’t know what we are dealing with – it is all the “side issues” that cause the additional complexity (Division 7A, Depreciation, Tax Losses, Inter company loans etc).

It would have been great if you had them with you when you met with us the other day. We could have sorted it out on the spot.

I’m sorry, but if you aren’t prepared to let us see your previous financials and tax returns…then I don’t think we can do business together.

bowma:

His concerns about your complexity are completely legitimate IF he was charging you by the hour. It’s the standard charging that bothers me.

You are looking for someone who charges hourly rates so the savings can be passed on to you. In my opinion you should keep looking.

That said, you should be ready to answer the questions regarding how many entities, any carryover items you have, how many assets you are depreciating, etc. It will give them an idea of how many hours it will take.

When I was in college I worked for a small accounting firm. When a new client came in they always wanted to see last year’s tax return. Then they look for the accounting fees you paid at your old firm. It gave them an idea of what you are willing to pay. I referred to it as pain threshold billing. One of many reasons I don’t work for a firm anymore.

Order the good wine

bowma:

When I was in college I worked for a small accounting firm. When a new client came in they always wanted to see last year’s tax return. Then they look for the accounting fees you paid at your old firm. It gave them an idea of what you are willing to pay. I referred to it as pain threshold billing. One of many reasons I don’t work for a firm anymore.

This is why I do not wish to provide the statements to him.

I’m not sure if you are familiar with Xero, but their vision is to essentially fully automate the tax return procedure. I believe that they already have the system in place. And this particular accountant, told me that he has implemented the system. Yet, he is wanting to charge me based on the old model.

I am happy to provide him with details on those points, except for turnover. However, hasn’t he made it obvious that he’s only really interested in turnover? And, on that point alone, he is disrespecting me.

He has chastised me, disrespected me, and rejected me, in one letter. And I’m a potential ‘customer’. I think MGTOW has more applications than just with women…

I’m a tax professional in the US, and worked in CPA firms for many years preparing financial statements as well as tax returns. From the context, I’m guessing you’re in Canada, but a lot of the same principals apply.

I agree with the accountant’s letter, especially since he is talking about quoting a fixed fee. I would never quote a price based on a potential client’s assurance that it’s all in the software and all I have to do is sign off on it. In over twenty years, I have never seen business records that could go directly to financial statements or tax return with no analysis or adjustment. It really makes no difference how sophisticated the automated accounting system is – garbage in, garbage out. Just accepting whatever is in the database and signing off would be professionally irresponsible, not to mention begging for a malpractice claim. And yes, my signature goes on my work along with the client’s, which makes me legally responsible for the content. I take that very seriously because my license and livelihood are at stake in addition to whatever financial penalties might apply. And he correctly points out that there’s no way to tell how much work the job involves until you see the input data. I repeat, there is no such thing as ‘just press the button.’ If that’s all it takes, press it yourself and leave me out of it.

I also would not accept a client who refused to show me prior year financials or tax returns. Trust between me and my clients is critically important, and even preliminary ‘can we work together’ meetings are strictly confidential. Financials and tax returns tell me a lot about the person’s business practices and ethics. If I can’t see them, it hinders my ability to ‘read’ the potential client. If the potential client can’t dredge up enough trust to show me this important information, I have little faith that he will be forthcoming in any future dealings. That is sure to get me in trouble, and life is too short to accept clients who will get me in trouble.

You might be able to find a firm to accept your work on the terms you describe. My advice is, if you find such a firm, don’t trust them because they don’t know what they’re doing.

Safety rules: All guns are loaded. All knives are sharp. All stoves are hot. All women are like that.

Stan makes some great points. And at some point you do have decide if you can trust your accountant because they will deal with very private information.

I’m just curious though Stan, do you do flat rate billing or charge by the hour? As a client I’m not sure I would like flat rates unless I had a very simple return. And the fact that is all he does would make me look elsewhere. What I didn’t like about his letter was that he has all these legitimate concerns, but at the end of the day he was just going to quote a flat rate based on revenue ( I’m assuming turnover is Canadian for revenue).

Order the good wine

@taxguy, I don’t think the OP’s accountant was going to quote just based on revenue, since one of his concerns was to figure out how much work he’d have to put into the engagement.

I do all my work on a fixed-fee basis. Since I abandoned hourly billing, my life is much simpler and I haven’t had a single disputed bill. Fixed-fee billing is AGTOW. My clients like it because they know exactly what to expect, and because they don’t have to worry about me being on the clock whenever they talk to me.

For tax returns, I start from a by-the-form model, and add to it based on additional work needed for the particular client. For example, preparing a business return might work out to $XXX to prepare the forms and schedules, but I know from experience or from perusing the client’s records, that I’m going to have to spend some time sorting out his bad bookkeeping, and I add $YYY for that. I quote the fee up front and stick to it unless the client brings in some new thing he didn’t tell me before (“Oh, hey, I forgot to tell you I started selling used fleshlights on e-bay this year – it’s a goldmine!”) I charge a lot more for complex returns than for simple ones. 🙂

Safety rules: All guns are loaded. All knives are sharp. All stoves are hot. All women are like that.

I’m a CPA and have been doing this 15 years. I’ve seem some sets of books that are ready for the tax return. These businesses have all had skilled and qualified accountants internally. The worst sets of books you’ll ever see are ones that do a software coding import such as QuickBooks Online. There is also skill involved in getting your taxes correct. Your accountant is trying to be direct and up front regarding the fee. He’d like to know what he’s getting into. Assuring him everything is fine is not comforting, being unwilling to provide any information is a huge red flag. It makes you seem dishonest or uncooperative.

I would be reluctant to get involved also.

This industry is going in the s~~~ter. Each season is worse than the one that proceeded it. I’m glad I’m in private now.

I’m a tax professional in the US, and worked in CPA firms for many years preparing financial statements as well as tax returns. From the context, I’m guessing you’re in Canada, but a lot of the same principals apply.

I agree with the accountant’s letter, especially since he is talking about quoting a fixed fee. I would never quote a price based on a potential client’s assurance that it’s all in the software and all I have to do is sign off on it. In over twenty years, I have never seen business records that could go directly to financial statements or tax return with no analysis or adjustment. It really makes no difference how sophisticated the automated accounting system is – garbage in, garbage out. Just accepting whatever is in the database and signing off would be professionally irresponsible, not to mention begging for a malpractice claim. And yes, my signature goes on my work along with the client’s, which makes me legally responsible for the content. I take that very seriously because my license and livelihood are at stake in addition to whatever financial penalties might apply. And he correctly points out that there’s no way to tell how much work the job involves until you see the input data. I repeat, there is no such thing as ‘just press the button.’ If that’s all it takes, press it yourself and leave me out of it.

I also would not accept a client who refused to show me prior year financials or tax returns. Trust between me and my clients is critically important, and even preliminary ‘can we work together’ meetings are strictly confidential. Financials and tax returns tell me a lot about the person’s business practices and ethics. If I can’t see them, it hinders my ability to ‘read’ the potential client. If the potential client can’t dredge up enough trust to show me this important information, I have little faith that he will be forthcoming in any future dealings. That is sure to get me in trouble, and life is too short to accept clients who will get me in trouble.

You might be able to find a firm to accept your work on the terms you describe. My advice is, if you find such a firm, don’t trust them because they don’t know what they’re doing.

This is the argument that the taxi companies are using against Uber. Good luck with the dinosaur mentality is all I can say.

The fact is that the software packages today can prepare everything. This is fact. I know it destroys the antiquated model that you have become accustomed to, but it is a reality.

If the data being fed into the system is set up by the accountant at the start of the year then they are the ones providing the data to themselves. The only ones they need to trust are themselves. You have a customer side package and an accountant side package. The two packages are hosted by the same company, and are therefore compatible. The accountant has access to the customers books 24/7 through their own interface. Furthermore, the accountant could insist that you hire a bookkeeper that they already trust to handle your side of things.

Your trust argument is simply s straw man for the fact that you wish to charge people based on turnover. There are multiple ways to handle the trust issue without having to see people’s turnover figures. But of course, being imaginative is not what dinosaurs are good at.

Turnover = net income? Inventory turnover for a VAT?

We see all sorts of people’s net income. It is integral to what we do.bomwa:

A couple of points I would like to make, and I work for a company doing corporate tax so I don’t do this type of work:

1. You want your accountant to analyze the information and come up with ways to save you money. If you just want to download the information on a form and file the taxes you don’t need an accountant.

2. If the accountant is signing the return as as the preparer, he is signing under penalties of perjury that the return is true and accurate to the best of his knowledge. The potential to lose your license to practice will make you cautious to just download numbers and sign a tax return.

3. We are all just trying to help you out. Guys helping guys. If you don’t like what you are hearing from the three of us, I would again suggest filing on your own. I’m not trying to be a smart ass with that comment either, just trying to give a little professional advice to a brother.

I hope this conversation helps you out.

Order the good wine

This is the argument that the taxi companies are using against Uber. Good luck with the dinosaur mentality is all I can say.

The fact is that the software packages today can prepare everything. This is fact. I know it destroys the antiquated model that you have become accustomed to, but it is a reality.

If the data being fed into the system is set up by the accountant at the start of the year then they are the ones providing the data to themselves. The only ones they need to trust are themselves. You have a customer side package and an accountant side package. The two packages are hosted by the same company, and are therefore compatible. The accountant has access to the customers books 24/7 through their own interface. Furthermore, the accountant could insist that you hire a bookkeeper that they already trust to handle your side of things.

Your trust argument is simply s straw man for the fact that you wish to charge people based on turnover. There are multiple ways to handle the trust issue without having to see people’s turnover figures. But of course, being imaginative is not what dinosaurs are good at.

You asked for opinions. If you only want agreement, you came to the wrong place.

You couldn’t be more wrong, especially your last paragraph. Trust is no straw man. If I don’t trust you, I won’t work for you at any price. And if you won’t show me your stuff, I’m not going to trust you. ‘Turnover’ is not a concept that anyone in the US would base a fee on, so that part of your remark doesn’t even make sense to me. And if your only reason for not showing me your stuff, which I need to judge the scope and extent of the work and therefore my fee, is that you’re worried I’ll base my fee on what I see there, then there’s no hope of us working together in a mutually beneficial way.

If I’m working ‘in’ the client’s system at all times, monitoring and correcting in real time, it doesn’t change my billing model. It only changes when I do the work (in real time rather than afterwards), not how much work I have to do. In that scenario, I’d be even more interested in seeing the internals before quoting, because the volume of transactions bears directly on my work load of setting up, mapping accounts, monitoring, etc. If you hire me expecting me to be in your system watching and tweaking on the fly, I’m going to charge a premium for that. The financials and tax returns might be ‘press the button’ or close to it, but only because I did all the prep work in advance.

Trust issues aside, I’m not interested in working with a client who views me as a disposable utility and doesn’t value my professional expertise at the going market rates. That must just be my dinosaur brain at work. If you need my signature on your reports, it comes at a price because I have to back it up. Otherwise, press your own button.

Safety rules: All guns are loaded. All knives are sharp. All stoves are hot. All women are like that.

bomwa:

A couple of points I would like to make, and I work for a company doing corporate tax so I don’t do this type of work:

1. You want your accountant to analyze the information and come up with ways to save you money. If you just want to download the information on a form and file the taxes you don’t need an accountant.

2. If the accountant is signing the return as as the preparer, he is signing under penalties of perjury that the return is true and accurate to the best of his knowledge. The potential to lose your license to practice will make you cautious to just download numbers and sign a tax return.

3. We are all just trying to help you out. Guys helping guys. If you don’t like what you are hearing from the three of us, I would again suggest filing on your own. I’m not trying to be a smart ass with that comment either, just trying to give a little professional advice to a brother.

I hope this conversation helps you out.

I have looked into filing myself, however, I cannot access the professional software package unless I’m a registered accountant. Plus I know what is available through Xero would make it less efficient for me to file myself.

This is not about that though. This is about the benefits of a technological shift not being passed on to the customers. There is no other reason for it other than that the accountants have built up businesses based on the antiquated model. We know that accountants rely on their customer base as goodwill that can be sold at their retirement. It is not in their financial interest to adopt these technological changes.

I understand the legal obligations placed on the accountant. However, if he does provide a reasonable quote, and gets the job, then he will have access to all the information anyway. So that point is not valid.

You’re all in the industry but perhaps listen to a customer who is paying tens of thousands of dollars per year on accountant fees, that could otherwise be spent on improving my business.

The current system is based on fear. The average business person is s~~~-scared of the tax department coming after them. I’ve read some real horror stories about it in the US. So, they don’t trust themselves to correctly submit tax returns for more complicated businesses. Now, accountants know this (in exactly the same way that women know the laws are stacked in their favour) and literally behave like sluts.

Accountants put themselves on a pedestal saying things like, ‘I don’t want anymore clients but I could make an exception for you…’, or ‘look, you need to earn my trust before I’ll talk any further’, or ‘your books really are complicated, I’m going to have to charge a lot more for next year’, and ‘what were you paying the last prostitute (accountant) per night (tax return)?’ etc. A lot of these tactics work on the weak, fear-addled, manginas who visit them.

But I’m here to deliver the message to you that business owners are going MGTOW. Packages like Xero are the robotic sex-doll of the accounting world. You are the feminists that can’t see they are destroying themselves. MGTOW goes deep. Don’t shoot the messenger.

bomwa:

I have always viewed the relationship as you and I vs. the government. You seem to view the relationship as you vs. your accountant. I have never enjoyed moving data from one source to another. After 25 years of doing taxes it’s pretty f~~~ing boring. I’d rather have more work that engages my brain.

Maybe the accountant would have quoted you a reasonable fee….

You have received an inside look at how an accountant views their services. At some point I would say if you don’t value my 25 years of experience then don’t pay for it. You can always buy a tax software and enter the data into it yourself. It would probably take you a couple of hours and save you a bill from your accountant. Again not being a smart ass, just trying to help.

I would suggest trying a few more accountants and trying to get a quote. Without knowing what they would charge it is hard to know if it is worth it. You can’t do a cost\benenit analysis unless you know the cost.

Order the good wine

bomwa:

I have always viewed the relationship as you and I vs. the government. You seem to view the relationship as you vs. your accountant. I have never enjoyed moving data from one source to another. After 25 years of doing taxes it’s pretty f~~~ing boring. I’d rather have more work that engages my brain.

Maybe the accountant would have quoted you a reasonable fee….

You have received an inside look at how an accountant views their services. At some point I would say if you don’t value my 25 years of experience then don’t pay for it. You can always buy a tax software and enter the data into it yourself. It would probably take you a couple of hours and save you a bill from your accountant. Again not being a smart ass, just trying to help.

I would suggest trying a few more accountants and trying to get a quote. Without knowing what they would charge it is hard to know if it is worth it. You can’t do a cost\benenit analysis unless you know the cost.

Well this is the thing. I would gladly pay for tax advice from someone with 25years experience. But I will not gladly pay for that person to perform calculations that someone has spent hundreds of millions of dollars developing a software package for. That would be akin to me choosing to use my very experienced horse and buggy driver as opposed to FedEx.

None of you have said you’ve seen Xero yet. So, at the moment you’re not even seeing what I’m seeing.

Do I care if my taxi driver has 25 years experience, if my Uber driver uses his GPS and takes me directly where I want to go for a lower fee? I do not.

The accounting sex doll is here boys.

I have not seem Xero, but I do have software that moves my data from the general ledger to my tax return so I understand what you are talking about. And for the record, we all love that sex rebot.

You have already decided that you are going to get screwed before you even get a quote. That i can’t really help you with.

Order the good wine

registered

Chartered, in Canada. Certified (or possibly licensed) in the United States. What country are you in?

Now, accountants know this (in exactly the same way that women know the laws are stacked in their favour) and literally behave like sluts.

Right. Ad hominem attacks always make me warm and fuzzy. Here’s a response in that same vein. I’m going to be less polite than the other accountants here.

Here’s me. One degree in engineering, two in accounting, one in history. I’ve taught accounting as well at uni. I specialize in operations and cost accounting, but am also competent to prepare financial statements and tax returns. My professional career has largely been spent in controllership.

You’re assuming, to begin with, that your categorization of items is legally correct. I seriously doubt that, unless you have the simplest business in the entire world. Do you sell fruit at street corners? If ya’ do, I’m still going to bet you’ve misclassified your travel expenses.

Having worked with any number of clients, my guess is that you don’t actually understand what the different categories are that one can place different events into. For example, you haven’t mentioned the obvious fact that many events are treated one way for financial statements, and another way for tax purposes. They are almost certainly treated differently for cost accounting purposes, and depending upon various contractual relationships and other binding agreements, may have additional classifications. Xero and other software packages (we call them ERPs) are awesome if a professional accountant is using them; since I’m not familiar with Xero, I’m going to assume it’s another Office Depot / Staples type product that’s not really aimed at complex organizations or persons with complex financial portfolios. Do you own a house? Do you have rental property? Do you have children? Any trusts set up for them? Alimony? Do you own a car? Use it in your business? Does your business own any assets? Are they being depreciated properly?

Accountants get – and charge – a fair sum of money for their work because their work is complicated. Most bachelor’s degrees in accounting have about two years’ worth of classes that could be considered simply accounting courses. A master’s program is at least another year. Accountants themselves sometimes use specialists for specialized filings or projects.

Accountants, like doctors or engineers, do something rather more complicated than driving someone from point to point. Your analogy is invalid.

I don’t know why you’re angry at the profession in general, but we’re not your problem. In terms of financial statements, the goal is clarity for both outside and inside parties as to what is occurring within the business. F/S are set up to communicate information to *educated persons* who have been trained in understanding what they mean, much like medical reports communicate information to educated persons who have been trained in understanding what they mean. To uneducated persons, they don’t mean a whole lot. GAAP and IFRS have largely been created independent of governmental interference. Largely. While public accounting is increasingly bonkers as a profession, the rules of accounting are less structurally f~~~ed up than, say, medicine or law enforcement, and to educated persons, still largely communicate what’s going on in an organization.

I’d be willing to bet that you have incorrectly inputted any number of things into your software package, as has every client I’ve ever worked with who relies upon their own knowledge. Whether or not you think you know what you’re doing, no accountant on Earth has any reason to trust you – at all. Kind of like when you go to an emergency room and tell them what to do: they listen to you to try and find out what’s going on, but otherwise ignore you when it comes to prescribing treatment. You’ve inputted everything into the computer already, in a software package I don’t use because it’s too basic and is possibly untrustworthy? Awesome. Count on billable hours for me learning your inferior software package (I recommend Quickbooks Enterprise Edition – at several thousand + / license – for most SME clients), correcting all of your mistakes in classification, then rebuilding your financial system and recasting any number of events. Whatever tax work you’ve done is irrelevant, as I’m going to fill out your returns based on my understanding of the legal classification of the events that have taken place. Haven’t formally studied tax law and tax accounting? Awesome. Then you certainly don’t know enough for me to sign off on your results.

You’ve been responded to – repeatedly – nicely as to what accountants do and why they charge what they charge.

Oh, and also: the reason he wants to see your old f/s and tax returns is at least partially to make sure he can take you on as a client at all. If your f/s and tax returns are garbage, he’s going to make you recast things and refile, since his license is on the line with you as a client. Are you engaged in illegal activity? Are you engaged in illegal labor practices? Have you been foolishly cheating on your taxes in a way that an audit will discover in five seconds? I have zero way of knowing that about a stranger who walks in the door. Clients who don’t want to show me things like that are hiding something, it’s never a good something, and the clients are not worth having at any price.

"You can either love women, or understand women. You can't do both. Because once you understand women, you realize that there is really nothing to love."

Because it’s caused some confusion here, I looked up ‘Turnover.’ In this context, it’s Canadian for ‘Sales Revenue’ (gross revenue, net of discounts and sales taxes). We use the term quite differently in the US.

I don’t know how my Canadian colleagues do things, but a client’s revenue is not even a factor in my fee structure. Likewise, it’s not a factor in pricing for any of the firms I’ve worked in. For some, it might enter into whether they accept you as a client, having decided that some companies are just too small to deserve their attention.

That’s just for general info and clarity. It doesn’t alter anything I’ve posted here.

Safety rules: All guns are loaded. All knives are sharp. All stoves are hot. All women are like that.

- AuthorPosts

You must be logged in to reply to this topic.

921526

921524

919244

916783

915526

915524

915354

915129

914037

909862

908811

908810

908500

908465

908464

908300

907963

907895

907477

902002

901301

901106

901105

901104

901024

901017

900393

900392

900391

900390

899038

898980

896844

896798

896797

895983

895850

895848

893740

893036

891671

891670

891336

891017

890865

889894

889741

889058

888157

887960

887768

886321

886306

885519

884948

883951

881340

881339

880491

878671

878351

877678