Home › Forums › MGTOW Central › Women hold the majority of college debt

Tagged: Australia, Austudy, HECS, help, MGTOW, student debt, student loan, women pay no tax

This topic contains 17 replies, has 12 voices, and was last updated by ![]() Puffin Stuff 1 year, 7 months ago.

Puffin Stuff 1 year, 7 months ago.

- AuthorPosts

No surprise, women hold the majority of college debt:

https://www.cnbc.com/2018/06/06/why-women-hold-the-majority-of-student-loans.html

Little snowflakes who believe their bulls~~~ Liberal Arts degree is worth $100k in debt, and end up earning $10/hr working at a daycare. Saw the story on the local news, here in my ultra liberal cuck state, and the soy boy beta cuck newscaster blamed their inability to pay it back on the “wage gap”. OMFG, these cucks will try to wedge anything into the wage gap hoax.

So what happens first:

Law to force companies to give women salaries they don’t deserve, saying it’s the patriarchy’s fault that they can’t pay back loans with their useless degrees?

Bill in senate to give women a break on their loans, fabricating and spinning numbers that loans are unfair to women because muh patriarchy?

Law stating women should be given reduced rate loans?

Law stating colleges must give women reduced tuition?

All of the above?

Sovereignty above all else.

My wife and I lived in Europe together while I finished grad school. A married couple we knew did the same except went all the way to their PhD’s in a different European country, and did a lot more travel than we did. We had the highest respect for them . . . If this were the show Breaking Bad, they would have been more like Elliot and Gretchen Schwartz, the socially higher and cleaner upwardly mobile couple.

Ten years later when both our wives filed for divorce, I recall the other wife ending an email to me with a reference to how she’ll have to begin paying off her undergraduate student loans eventually. Then I realized she is fiscally irresponsible. She’s still living it up overseas and has spent her entire adult life in debt. In my case I paid my student loan off before I got married at 21, and insisted we pay off my wife’s as the very first thing we did. It was the best thing, as it cleared the slate and allowed us to build wealth . . . which led to her taking it and leaving me, which is how I discovered the red pill.

"Once you’ve taken care of the basics, there’s very little in this world for which your life is worth deferring." -David Hansson. "It’s not when women are mean or nasty that anything is out of the ordinary. It’s when they are NICE to you that you have to be on high alert..." -Jackinov.

us to build wealth

You built wealth.

It sounds like you would have become wealthy sooner had you not had to pay for her student loans. Basically you gave her free money. Student loans are privately owned and are the responsibility of the debtor and is not community property (it was an issue in my divorce).

Shocking news alert: Women get 60% of college degrees and men get 40%. And yet why women have more student loans must be the result of sexism expressed by the patriarchy.

Women should get lower tuition in jobs that are essential but pay low. Like day care worker. They should be able to be art majors so they can realize their dreams despite having to care for other real professional women’s children all day so every woman is working.

Thanks feminism.

#icethemout; Remember Thomas Ball. He died for your children.

So what happens first:

Combination. Women are already overpaid and thanks to things like FMLA, they take off for up to a year and cannot be replaced. Everybody is trying to hire more women, and the lower percentage of men in the work force are doing increasingly more work to offset the women. Oh, and they’re mostly not getting compensated for the extra work.

Whatever happens is going to one-two punch the economy, as debt collection is a HUGE industry and most of the banking wealth out there is tied up in buying and selling debt.

You can give all the women loan forgiveness, wipe the slates clean, and they’re still not going to be qualified to do anything. It won’t actually help them, it’ll just let them start over again and amass the debt all over again.

Millennials are basically debt-capped. They simply cannot carry any more debt. The market is saturated. There’s no actual wealth out there.

Cupcakes are Cold. MGTOW is Absolute Zero.

“Let us wait a little; when your enemy is executing a false movement, never interrupt him” –Napoleon Bonaparte, 1805Young people are increasingly given the impression that you cant put a dollar amount on the value of “education”. Our culture often gives young people the impression that money is no object when it comes to schooling. Kids live it up for 4+ years and are too far removed from the debt their amassing to really make heads or tails of it. The sticker shock/buyers remorse doesn’t come until they get their first post grad paycheck and compare it to their student debt totals.

I worked at a halfway house full time while I was going through college. Almost all of the counselors at this place were female and all of them were very open about their college debt. These were women who had accumulated 100K in debt and were making 45K a year. After they did the math, they all decided it was best to stay where they were in the job force and hope to get in on some bogus program that would erase their debt if they worked for a non-profit for 15 years. Cant say that I blame them.

I’m also curious as to the effect our marriage culture has on young women and the way the legal system is structured related to divorce. Many women probably think they will meet a man and he will end up taking care of the debt. If not, she can divorce him and take half of his things and get alimony and child support. Almost seems insidious when you think about it that way. In my own personal life, I paid off my wife’s student loans and then went after my own. I knocked her’s out completely and have just under 3K left of my own 2 years after divorce. The fact that I paid off her student loans was never factored into the equation when my assets were being split in half after she decided to leave and serve me papers.

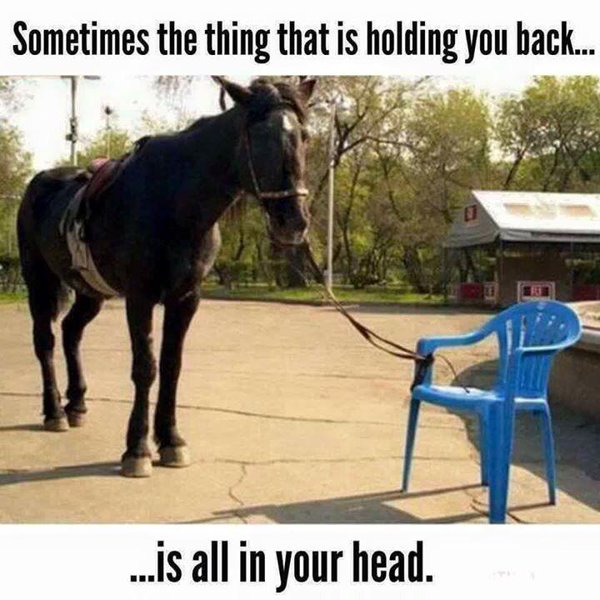

Interesting that the schools are never to blame for what they charge. Interesting that personal responsibility is never part of the equation. Interesting that financial institutions are never held to account for being loan sharks when it comes to higher education. It’s all about unfairness and someone else holding you down.

"To be nobody but yourself in a world which is doing its best, night and day, to make you like everybody else - means to fight the hardest battle which any human being can fight; and never stop fighting." E.E. Cummings.

Anonymous3Young women like to brag they make more money than young men, and there are no good men worthy of them, demand countless days off and government regulations and programs for their benefit, and then whine about their own laziness and refusal to pay off their debts.

Well it’s a double whammy. They sold out to the government that attacked and destroyed men, and p~~~ed off men enough that less and less men are willing to destroy themselves to save women from their own idiocy. It’s time for women to see how much fun it is to deal with an entity backed by the government, in this case the bankers. Men should do nothing. Men should always do nothing when it comes to women.

I whole heartedly believe that women are at the root of the vast majority of global debt.

They want as much as they can have and they want tomorrow today. I think it is because deep down inside on a biological they want the best security and know they have limited time before their expiry dates.

Whether it is young lads splashing out on cars or holidays on credit to impress or meet girls, whether it is men buying one house size bigger than they can afford to please their wives or whether it is women buying a new sofa, it all female generated. So when they want to go to college and ride the c~~~ carousel while studying to get a “better career” its the same thing take what you can have today and someone will have to pay tomorrow, hopefully not you.

Maintain sovereignty. Never let a woman suck your mind into her gravity. She is a black hole financially.

A woman is like fire -fun to play with, can warm you through and cook your food, needs constant feeding, can burn you and consume all you own

And yet women enjoy thinking rheir smarter than men.

Enjoy the slave labor for the NEXT 30 YEARS!

Shit Tested, Cunt Approved.

You know, all of us know the deal. Most of these ho’s never planned on paying back the money they borrowed with their own labor. As said before, they are just buying their time waiting for some dumb f~~~ing simp to come in and clean up their mess. I just hope and pray that young men who are not red-pilled enough to stay away from women are at least smart enough to stay away from the ones in debt. The student debt bubble will burst soon enough. I am very curious to what is going to happen. The thing is by pushing men out of the work force, the amount of money that can be stolen from men diminishes. The feminist system almost has no choice but to cannibalize itself. Not that I give a rats ass.

Millennials are basically debt-capped. They simply cannot carry any more debt. The market is saturated. There’s no actual wealth out there.

I think the whole student loan thing is massively overblown. Roughly 40% of millennials have student loans to begin with, and if you listen to how they portray how much student debt people have, they always say “The average student debt of a millennial with student loans(let’s just ignore the other 60%) is about 30k at graduation.” That is about the price of a new car…its not exactly a life breaking amount of money.

Now lets factor in the 60% that have no student loans, and the fact that not all millennials graduated yesterday and some have actually got worthwhile degrees and have been paying their debts down without expecting a bail out…whats the true average student debt per millennial then…10k?

The media just does a fantastic job finding extreme cases of stupidity to parade around like they are the norm. The people who end up with a six figure debt load for a trash degree are at the extreme end of the spectrum of making bad life choices…sure they’re out there, but again with the way averages work…for every one of those people they are dragging the average up considerably for a bunch of people who graduated with less than average student debt.

I worked at a halfway house full time while I was going through college. Almost all of the counselors at this place were female and all of them were very open about their college debt. These were women who had accumulated 100K in debt and were making 45K a year. After they did the math, they all decided it was best to stay where they were in the job force and hope to get in on some bogus program that would erase their debt if they worked for a non-profit for 15 years. Cant say that I blame them.

Yup…I know a group of girls who are social workers who are all doing this. Its pretty much a joke to them…they ran up six figure debt loads in college…they had to borrow extra for spring break trips, winter vacations, shopping, and partying, and now its like bragging rights who ran up the biggest balance. They just end up on programs that scale their student loan payments to their income, which is low, and wipes the balance after a period of time…so basically…some of them I don’t think are even covering interest on their loans but it all gets wiped eventually.

Ultimately though the joke is going to be on them. They’ll think they are walking away free and clear after 10 years or whatever of playing the game, only the year the debt gets forgiven, it all counts as income and they’ll owe taxes. I hope they get creamed in IRS penalties when none of them have 30,000 to throw at the IRS that year.

Many women probably think they will meet a man and he will end up taking care of the debt.

Yeah…I think this is truly what a lot of them thought would end up happening…only marriage rates are plummeting, so a lot own’t be getting saved. I think at one point the old saying about women in college was a lot of them go to meet their future husband, but these days a lot of them just go for the partying and to be a whore, which ironically decreases their odds of finding a good husband. Prime example, see that thread about Nikki Yovino.

I think the whole student loan thing is massively overblown. Roughly 40% of millennials have student loans to begin with, and if you listen to how they portray how much student debt people have, they always say “The average student debt of a millennial with student loans(let’s just ignore the other 60%) is about 30k at graduation.” That is about the price of a new car…its not exactly a life breaking amount of money.

Now lets factor in the 60% that have no student loans, and the fact that not all millennials graduated yesterday and some have actually got worthwhile degrees and have been paying their debts down without expecting a bail out…whats the true average student debt per millennial then…10k?

The media just does a fantastic job finding extreme cases of stupidity to parade around like they are the norm. The people who end up with a six figure debt load for a trash degree are at the extreme end of the spectrum of making bad life choices…sure they’re out there, but again with the way averages work…for every one of those people they are dragging the average up considerably for a bunch of people who graduated with less than average student debt.

It isn’t just the student loan debt. There’s also the auto loans, the credit cards, and making just enough money to make the minimum payments plus interest every month.

But I do agree, the media definitely overplays the student loan debt. They’re trying to stoke empathy for idiots (women) chasing useless degrees with unmarketable skill sets. “You don’t want her to be homeless, right?” I don’t care. She won’t be homeless–if for some reason Daddy Gov backs out, she can always polish a knob. She’ll be fine.

Cupcakes are Cold. MGTOW is Absolute Zero.

“Let us wait a little; when your enemy is executing a false movement, never interrupt him” –Napoleon Bonaparte, 1805Why do all these situations women willingly CHOOSE to get themselves into become “national crises”? Why do I, the taxpayer, always end up having to pay the price for women’s CHOICES?

And yet women enjoy thinking rheir smarter than men.

Ya, no.

There’s this teacher at a local city college I occasionally f~~~. She teaches western literature or some s~~~. I’ve never bothered to ask. Anyways, last week she was bitching and complaining about the poor millennials permanently stuck in wage slavery due to crushing student debt. This was right after her ranting about how she deserves a raise to pay off her own crushing mortgage (and presumably also her own student debt). I then pointed out that their student loans paid her salary. For all her education (and the fact that she even writes Ph.D. in her f~~~ing signature) she did not have any response to that (other than to be angry at me for the rest of the day).

tl;dr: Women fundamentally believe they live in a universe where they can have their cake and eat it to. How smart is that?

It isn’t just the student loan debt. There’s also the auto loans, the credit cards, and making just enough money to make the minimum payments plus interest every month.

But then your talking about people who made a whole string of bad decisions…not just whoops I f~~~ed up with the college thing…

Besides though, its not really “bad” from a broad view of things as long as people are spending money. Those in debt obviously have to lower their standard of living at some point because of it, but for the rest of us its really no different for me if I’m collecting dividends from a credit card company or a cruise line, or from an automobile company or a big bank, and I think a lot of guys on here would prefer we have a lot of renters compared to homeowners because they make money off their tenants.

It only really becomes a problem when too many people all at once can’t pay, and realistically we aren’t going to get there with student loans any time soon because unlike the mortgage meltdown where a lot of people simply opted to stop paying underwater mortgages because they could with very little consequence(credit score takes a hit, its not the end of the world), with student loans the government will just start garnishing wages and confiscating tax returns if need be. They aren’t going to care if you get your new car repossessed, can’t afford to go out every weekend, or have to go years without a vacation when they want their money.

and realistically we aren’t going to get there with student loans any time soon

But we are going there with $21,200,000,000,000.00 in public debt.

Which is why I don’t see student loans being forgiven any time in the near future. There simply isn’t the money to bail them out, and attempting to do so would literally kill the economy, hyperinflation style.

Why do all these situations women willingly CHOOSE to get themselves into become “national crises”? Why do I, the taxpayer, always end up having to pay the price for women’s CHOICES?

Good question. If I could give you an answer my exit plan wouldn’t involve retiring early, retiring abroad, and paying dick for taxes to this country for hopefully a majority of my life, provided I live long enough for that to hold true lol.

Anyways, last week she was bitching and complaining about the poor millennials permanently stuck in wage slavery due to crushing student debt.

Even though most of them could pay off the balance within a few years of graduation if they sucked it up and prioritized it.

Or despite the crying about it people do, its not impossible to avoid them altogether. I’m a millennial…I paid for part of my college with a UPS scholarship. They’d pay up to 3,000 a semester towards my tuition(covers pretty much 100% to take classes at the local community college and a good chunk if you commute to an in state university)…all I had to do to earn it was show up and load boxes on a truck for 4-5 hours a morning and get a C’s or higher. Oh yeah…the UPS scholarship also included an hourly paycheck(which if you were smart you could use part of for tuition as well if need be), health insurance, and credit time towards a pension for me. Oh wait…it wasn’t a scholarship, it was a job. I’m pretty sure most big chains offer such programs, I know place like Home Depot, Lowe’s, and Walmart just to name a few do offer various forms of tuition reimbursement for part time employees and offer flexible hours you can work around a college schedule…but from what I’ve seen of my peers a lot of them just wanted to have the “college experience,” which meant lots of time to f~~~ off and do nothing constructive, so I’ve got zero pity for people with student loans.

If you take person A, who lives at home, commutes, makes 10-20k a year part time at some joke job, and gets another 5k a year in tuition paid for, and person B, who earns 0, and borrows a bunch of money for a dorm and “living expenses,” then figure out their difference in net worth after 4 years…it becomes a pretty huge amount of money pretty quickly even though person A never had a high earning year. It just amazes me that with the way the media covers the student loan “crisis” there isn’t more of a push by parents to be person A instead of person B.

This was right after her ranting about how she deserves a raise to pay off her own crushing mortgage (and presumably also her own student debt). I then pointed out that their student loans paid her salary.

And then you notice the pattern…someone who voluntarily put themselves in a s~~~ty situation financially and hasn’t figured out how to fix it, even though I’m sure she makes decent money and could if she wanted to, can’t understand that other people who are in a s~~~ty financial position also put themselves into voluntarily, and many also have the financial means to fix it if they prioritized it.

One thing I’ve realized about listening to people like this talk about finances is that its pretty much like listening to a first grader try to explain calculus to you…they don’t have a clue.

I then pointed out that their student loans paid her salary. For all her education (and the fact that she even writes Ph.D. in her f~~~ing signature) she did not have any response to that (other than to be angry at me for the rest of the day).

Haha…f~~~ing win. I bet she’s super liberal and thinks we should have free college for all and free healthcare for all and has put exactly 0 thought into what tax brackets would look like to support that.

But we are going there with $21,200,000,000,000.00 in public debt.

Which is why I don’t see student loans being forgiven any time in the near future. There simply isn’t the money to bail them out, and attempting to do so would literally kill the economy, hyperinflation style.

Pretty much. A huge majority of people I know that are sympathetic towards student debt either have a lot of student debt themselves, or works in(or is retired from) education and obviously doesn’t want to kill the goose that is laying golden eggs for them. I think its just one of those issues where a silent(or at least silenced by the media) majority think mass student loan forgiveness is a horrible idea. If there was a serious push for some major bailouts I think there would also be some serious backlash.

And lets be realistic about it…if you have problems with debt, and student loans are just a part of it, getting pretty much a one time lump sum isn’t going to fix your problems. For a lot of them its just going to be “Woohoo…student loan payment is gone…that frees up 500 a month to go lease a new car!”

I think its just one of those issues where a silent(or at least silenced by the media) majority think mass student loan forgiveness is a horrible idea. [b]If there was a serious push for some major bailouts I think there would also be some serious backlash.[/b]

I think you’re right. Even Clinton barely dared to bring the issue up on the campaign trail.

More important than the tax burden a bailout would place on the other 60% is the fact that it would benefit people who spent the last two decades being haughty.

It was like I was in medical school. They offered HEAL loans. These had a 12% interest rate and no forgiveness period. The simply started compounding the loan from the day you take it. I took 28,000.00 in loans and ended up with 70,000.00 when I finished med school.

They gave us these loans because we would be able to pay them back. College educated people earn more than non-college educated and should pay off their student loans.

There is no excuse. The only people I’ve known that didn’t pay their student loans had to go underground and be claimed as a dependent into their 60’s by their elderly parents.

It’s not worth it.

I got rid of my student loans in a home refinance.

#icethemout; Remember Thomas Ball. He died for your children.

Many women probably think they will meet a man and he will end up taking care of the debt. If not, she can divorce him and take half of his things and get alimony and child support. Almost seems insidious when you think about it that way.

This is spot on – great summary. To quote The Australian newspaper about the Australian perspective –

“Australian taxpayers’ exposure to university students’ loans will explode more than fivefold to $185.2 billion in 2025-26, accounting for 46.3 per cent of the nation’s public debt, according to an independent review of the Higher Education Loans Scheme.”

Women are now 60 percent of college/university students here in Oz and government data shows many of these ‘independent’ snowflakes will never pay back their ride on the taxpayer funded gravytrain;

.

GRAPH: Proportion of higher education enrolments by gender, Australia, 1950-2013

.

Truth is society can’t afford to continue to fund ‘snowflake’ jobs where women do essentially non-productive tasks, sitting on the arses in climate-controlled HIVE ‘service’ environments. I was new car shopping the other day and watched a female employee at the Nissan dealership spend half an hour scrolling through Fakebook on her smartphone while a man did all the work getting me all the info I needed about a possible purchase. I could see her through the window of this man’s office, but had her back to us and didn’t know we could see what she was doing. I pondered how p~~~ed off this bloke must get doing all the legwork while his female colleagues wasted hours on social media.

It’s baffling how our economy has strayed away from men actually making and doing things, but I believe we are in for a major correction sooner or later. After all, you can’t eat a spreadsheet, feminist blog or online travel ‘zine’ –

.

#ManOut

- AuthorPosts

You must be logged in to reply to this topic.

921526

921524

919244

916783

915526

915524

915354

915129

914037

909862

908811

908810

908500

908465

908464

908300

907963

907895

907477

902002

901301

901106

901105

901104

901024

901017

900393

900392

900391

900390

899038

898980

896844

896798

896797

895983

895850

895848

893740

893036

891671

891670

891336

891017

890865

889894

889741

889058

888157

887960

887768

886321

886306

885519

884948

883951

881340

881339

880491

878671

878351

877678