Tagged: algorithmic trading, research, risk management, trading, trend following

This topic contains 28 replies, has 16 voices, and was last updated by ![]() 743 roadmaster 1 year, 11 months ago.

743 roadmaster 1 year, 11 months ago.

- AuthorPosts

Any of you guys have any speculations on the price of oil taking a dip in the last couple of months? It’s good for the dollar, but I thought $100 barrel was the floor for the last couple of years. Any dip below that and it didn’t last long, but this looks like a great buying opportunity!

Be careful with oil. It’s not what it used to be.

I wouldn’t put money in that.

It’s a gamble, you might win but it might never go back to the levels you knew.Investing nowadays is very dangerous, forget everything you know.

If it hits $85 a barrel, I’m buying. It would be insane not to.

Oil is interesting because it will never be free. Everything – including styrofoam cups – is made with it.

We all get excited about a 50-cent dip in price at the pump….

I would get equally excited about it being $85 a barrel for the first time in years.And I just checked bloomberg and it’s crashed to just below $85.00

http://www.bloomberg.com/energy/

So I will buy a little tomorrow. Another little at $82. Go bigger at $80 and sit and wait.

The odds of it hitting $70 are almost NIL. They will start a war before that happens. But if it does. I will go all in.Just speculating.

If you keep doing what you've always done... you're gonna keep getting what you always got.Jesus Christ I can’t believe it. Oil dropping like a rock. Good for the dollar though.

How about silver? It’s dropped quite a bit it looks like.

The Children of Doom... Doom's Children. They told my lord the way to the Mountain of Power. They told him to throw down his sword and return to the Earth... Ha! Time enough for the Earth in the grave.@Chaos I don’t know enough about silver or metals. Gold I follow just to keep an eye on the dollars and it would look attractive below $1000 per ounce. Keymaster called it on oil. Hit mid 70s just before the mid terms last week just like he said. Up at least %1.3% premarket according to Bloomberg. Oil under $80 is a gift. It was looking scary but when oil goes down the buck goes up so it works out in the wash. I bet it will be over $100 a barrel again in June. If it’s a cold winter maybe higher. It should be $90 by Feb or sooner. Maybe by Christmas. Canadian dollar was at par in the spring now 20% cheaper than US. Place your bets gentlemen.

I guess it’s true what they say. When there blood in the streets, buy property.

$75 Oil right now. CRAZY! Averaged down and in for 6 months will wait and see in July. Not too worried because as it goes down the dollar goes up. It’s a good hedge against the buck. Not in for that much. But NatGas is already going meteoric it’s gonna be a BIG day tomorrow +3% right now. Already in for a couple of months and if this winter is anything like last year, I’ll be thrilled. just wish I waited a little longer to buy. Last year on Nov 12 I bought a chunk in a 3X ETF and watched it explode into February. So that’s my take If OIL dips into the 60s I’ll cut and run. But Nat Gas is my favorite horse right now.

If you keep doing what you've always done... you're gonna keep getting what you always got.Well you sure nailed that one. NatGas up 5% the other day and is up another 4.2% right now. One minute to the bell. Great call.

Total Lee, always buy strength (trending upwards), and sell weakness (trending downwards) and avoid sideways.

You do not need to predict the future, all you needed to do is ride trends by trial and error with good risk management (position sizing), and by performing some sort of empirical analysis with some simple mathematical indicator to quantify risk in your trading.

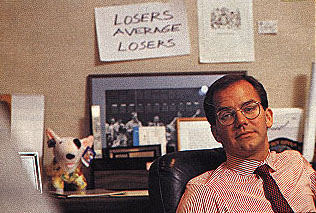

Key Master, “losers average losers – Paul Tudor Jones”, never average losers, a good trader loves taking (small) losses and hates taking (premature) profits, in trial and error process until trend happen and you end up ride those trends. You cannot predict the future, the only way to be in trends is to keep trying until they happen and others call you lucky but you know better for the losses you have taken until then – Luck is where preparation meets opportunity, where preparation is trial and error is the price of being lucky. That is what trading is all about, otherwise someone knows the future and they need not lose a penny.

Your answer: forget news, forget fundamental analysis, bloomberg and any prediction, and ignore your broker. The answer is Algorithmic Trading, be it Trend Following or Counter Trend, mainly keep your eyes and spreadsheet and equity focused on price only, do research for patterns using simple mathematics, and mainly quantify your trading.

Just imagine your self selling oil since mid July and pyramiding downward, just by following the price trend; that after losing little by little and only averaging in the months before this massive down trend.

I’ve always wanted to get into investing and buying stock but I’m not sure where to start.

Let this be a lesson, oil did what I couldn’t even imagine. Less than $65 a barrell??? I would have bet my house, my friends house, and his dog’s house it wouldn’t go that low. Glad I didn’t. This is unheard of – even to the most astute market analyst. $2.50 gas at the pump this year is not a fantasy. First time in years. Anyone who buys now will make 50% if (when?) it goes back up to $100 a barrel. So tempted to jump all over it. Oil in the 60s is RIDICULOUS.

@ZuberiTau Some very basics….

If you have a little capital, you can open a TD Ameritrade ( or any) trading account.

Stocks and companies have stock symbols. Like AAPL for Apple. And MSFT for Microsoft. And SNDK for Sandisk. etc.

Do a google search for AAPL and see the live (slightly delayed) trading for the day.Example:

https://www.google.com/search?&q=AAPLAll you need to know is “BUY LOW. SELL HIGH”.

The trick is knowing when it’s “low” and knowing when it’s “high”.There are two prices a few cents apart. THE BID and the ASK.

BID is what you can sell it for.

ASK is what you can buy it for.

The Market is open for trading in the US from 9:30 AM EST to 4:00PM EST

In any trading account you can do it electronically in real time… or phone someone to place a trade for you.Things like oil and natural gas are not stock. They are COMMODITIES. Careful there. They are much more volitile. Their price fluctuates based on seasons, temperatures, hurricanes, supply and demand. etc. You can go rich or poor trading commodities… but they are fun to watch and speculate on. (what we are doing here) Commodities include sugar, pigs and bacon, wheat and corn, precious metals, etc… Not the same as investing in companies. A hurricane in Jamaica can make the price of sugar go through the roof within hours. A frost in Florida can inflate the price of oranges. A war in the middle east can make oil skyrocket overnight. If you’re new, Stay away from commodities.

So lets say you believe in 3D printing technology…. or want to invest in DRONE technology… you look up and research companies that specialize in this field , look promising, and then you do plenty of homework – like educating yourself. This is called “due dilligence” and should be done before you buy anything. You can also invest on your gut just because you believe in something. Maybe you like a brand of coffee or want to buy stock in Monster beverages (HANS)…. whatever motivates you or you think is a good value. Tesla (Electric Cars – symbol TSLA) stock would have been an AMAZING buy in 2013. I watched it go from $30 to $240 a share. That’s 800%. $10,000 becomes $80,000 in 18 months.

Personally I like oil and gas because they are up and down. But I don’t like day trading them (buying in the morning and selling to make a few bucks within a day or a few hours) I buy and sell the bigger “swings”…. days… weeks.. months at the most.

GOING LONG means you want to go more long term and hope to BUY LOW so you can SELL HIGH later.

SHORTING is the reverse (not recommended unless you know what you’re doing). This is SELLING HIGH first (like borrowing) betting it will go down and buying back low (covering) and keeping the difference. So if you think AAPL is WAY over-valued you can short it. But any AAPL short in the last 15 years got fried and is living in the poor house. People throw themselves off rooftops over this s~~~.

But most importantly… the market is driven by FEAR. MOST people are “sheeple” and don’t have the b~~~~ to BUY LOW because it looks SCARY. The crooks out there want to instill fear in you to get you to SELL LOW and BUY HIGH. A losers game. A stock goes up, and everyone is euphoric and thinks it will never go down….so they buy and lose. This is called “pump and dump”. Likewise, when something dives, people are afraid and do what’s known as “panic selling”. Then the assholes buy up all the cheap shares and wait for a turn-around.

In 2008/2009 Sandisk went from $80 to $5. Now it’s $100+ again for a 2000% gain. Do the math.

So that’s a brief intro. DO NOT LISTEN TO ANYONE ON WHAT TO DO WITH YOUR MONEY – including me.

Anyone who tells you what to do with it, is selling something and they don’t have your best interests in mind.But,… having said that…. oil hasn’t been this cheap in a long time. You can see the live daily prices here:

http://www.bloomberg.com/energy/

You might want to watch it for a while. Keep a daily eye on it. Just for interests sake to get versed in it.

Just take my word for it and never invest more than you are prepared to lose.It’s not like Vegas or roulette because you can always salvage some of a bad investment.

In any case. Good luck and great fortune to you.If you keep doing what you've always done... you're gonna keep getting what you always got.PS. Thanks to “Man” above. Great seeing you back. Cheers.

If you keep doing what you've always done... you're gonna keep getting what you always got.Guys, please pardon me for the long post 🙂 I ended up writing and rewriting for hours! Just that by now I had spent over ten years studying trading and building a trading system, so excuse the length, and take it with a grain of salt and look around the internet your self, and please ask if you have any question.

KeyMaster, Buy Low. Sell High means that you are predicting the low or high, price movement is largely unpredictable because of all the transactions that is factored into the price, as humans exhibit illogical group decision making from time to time, and the prevalence of High Frequency Trading systems performing trades between banks and brokers in between your trades, and trading algorithmic systems used by hedge funds and banks, so the whole thing is a mess and unpredictable. Therefore any kind of speculation may lead us to See elephants in the clouds. The answer is to aim to quantify and control loss, to focus on controlling exit losses as opposed to entry opportunities derived from fundamental analysis, and this is why I am a Trend Follower, which I will explain below.

* A truely enlightening book is Market Wizards, by Jack D. Schwager. I like this book because it does not have any technical information, but only simple interviews with markets top traders and hedge fund managers, from which you will begin to understand the need to be a Systematic Trader, be it Trend Following or any other.

From another perspective, there is a related notion which says Buy Cheap. Sell High, this may apply to everything in life, but not in trading, because:

- In real life yes you can buy a car cheap and sell it expensive and make the difference, so the car has inherent value which deteriorate in time.

- In trading any position entered into the exchange has zero value, so there is not cheap or expensive stock because value is relevant to a later sell if you have bought and vice versa, in fact value always begins in the minus if you factor in the spread and commission if you are trading stocks, or premium if you are trading options, and from that point in time onward that position may appreciate or depreciate in value or remain somehow the same if the price doesn’t move.

KeyMaster, I have been where you are now, I averaged down in a martingale betting strategy, I watched the news, learned everything, had a great broker but still sometimes the market will go where the market will go with complete irrationality, and it may never come back for years, which mean you may end up holding on to losing trades and locking your money away from better use, and may end up liquidating such losing positions because of other factors, trades.

Just look at all the mayhem that is happening in the world right now, and you would think oil would surge but instead it was shot down. So prediction is truly and impossible chore.

The answer, kindly hear me out with an open mind:

I only speak from my own trading experience which began painfully dark but later I saw the light, so my humble advice is:

- Research a trading strategy called Trend Following, most hedge funds use a variation of the same, basically by devising rules solely based on price movement by using mathematics to do so, while ignoring everything else like news or fundamental analysis.

- Never buy any system that is out there, no matter how good it works on paper, because you did not create that system which means you may not fully understand how it works, especially charlatans that claim complexity or sophistication, as a good system has simple rules and allows for a good margin of error – You must have heard about a hedge fund called LTCM, those people had Noble Prize winners in their midst! *Personally this is why I like Systematic Trading, I am a no body compared to the rich and famous on Wall Street, yet with a mathematically systematic approach, I can trade not knowing how much money I will make but I know exactly the maximum about that may be lost during any time frame which I have full control over (positin sizing and stop placement), of course minus sudden catastrophic price changes but I need not worry such disaster in one or two positions because we trade conservatively and diversify objectively.

- Do your homework and create a system your self from scratch by studying raw OHLC (Open, High, Low, Close) data time series, there are tons of free historical OHLC data resources on the internet.

- You do not need to know complex mathematics to create a system, just the four operations (Add, Minus, Divide, Multiply) will take you a very long way in your research.

- Trading with Risk Management rules (stops, position sizing, timing) is not Gambling, but until you have done your research and created a solid foundation and have it tested thoroughly, otherwise do not trade at all, may be invest in a Hedge Fund that practice Trend Following – that is only if you see why this strategy is important from your own research.

- Trading is not investing, because the act of trading in entering a position into the market where such position always start with no value and may only appreciate or depreciate in time, in the future, so you must be able to measure the performance of any such position, thus the need for some type of mathematical system in order to measure how positions perform as time passes, measure probability of loss and amount of loss from which you may decide your position size, and to measure where the Stop placement.

- If you ever wish to become a Trend Follower, you would want to trade anything that is trending in the direction of the trend, by that I mean trade into breakouts from certain price levels in the direction of the breakouts which can be found from doing some research on historical price data, so you would buy and sell later if the price is going up, or sell then buy later if the price start going down, and do nothing if the price is stuck in range, which then you may look for other markets that have breakouts.

- You need not limit your self to any market because in Systematic Trading all markets prices are measured against a timeline and defined using simple mathematics, so with few measurements and adjustments you can normalise your positions sizes according to the risk you choose for any trade.

(e.g. some stocks move $2 a day on average, others move $10 a day on average, lets say if both were trending and you want in, you would calculate position size for each differently according to your global risk parameter that is how much you are willing to lose at a stop loss placement, so logically you would probably take a smaller position size on the stock that moves $10 a day in relationship to a larger position size for the stock that moves just $2 a day – such calculation is an example of the means of Systematic Trading, also known as Algorithmic Trading, Trend Following for example is a collection of such calculations and rules that is mainly geared towards going in the direction of the trend over the long term, however there are other systems that you can come up with that leverage from short term counter-trend patterns). - You need not limit your self to buy only, The Trend is Your Friend, in Trend Following you make money in falling and rising markets, you lose money in stale markets, where you also have the option of opting out as you need not trade if there is no good indicator of a trend.

- All price data is good for research (i.e. Stocks, Commodities, Currencies, Bond, …), as price data may look random and different from one another, yet they can all be normalised in percentage basis for purpose of researching or trading difference markets, because all price data series are stored against the same time intervals (minutes, hours, days, …) and therefore all have a property called Scale Invariance which means no matter how much dollar value they move a day, you can always adjust to that as mentioned in the $2 and $10 that is mentioned above in point 8, in fact Scale Invariance also applies across timelines of the same price data period, just look at any two charts of any totally different securities, also for example look at any daily and weekly where you could zoom into the daily and make it look at the same magnitude of weekly, regardless of direction that is just to explain the concept of Scale Invariance. Pardon the jargon, this Scale thing is a very simple yet important concept because it explains why you can trade any securities by only adjusting to differences in their type (priced in USD, GBP, commission cost, …), if you limit your information to price only and measure using mathematics.

- Research using mathematics for measuring price is more relevant to your equity because it is quantifiable, even margin of error can be quantifiable then, where as news and fundamental analysis is not directly quantifiable for use in determining position sizing and risk in general, and fundamental analysis can be so vast with all the information that is out there, and can be easily rigged at any time due to politics, or can lead you to some biased opinion, there is just too much chance in fundamental analysis although it can be used as a secondary measure to supplement technical analysis.

- The more historical data you research, the better, so if you are serious about this stuff and wish to create a system, get your self a copy of SQL Server and learn SQL programming, so you can import OHLC data, do research and create and manipulate data, its basically a much more advanced Excel.

Some resources:

- Trend Following

http://en.wikipedia.org/wiki/Trend_following - Turtle Trader – How two hedge fund managers trained random people from outside of the financial industry to become some of the world’s best traders using Systematic Trading methods

http://www.investopedia.com/articles/trading/08/turtle-trading.asp - Richard Donchian – The Father of Trend Following

http://stockcharts.com/school/doku.php?id=chart_school:trading_strategies:donchian_trading_gui - Jesse Livermore – An early Trend Follower

http://www.investopedia.com/articles/trading/09/legendary-trader-jesse-livermore.asp

DO NOT LISTEN TO ANYONE ON WHAT TO DO WITH YOUR MONEY – Do your own research, take your time to learn more and achieve more at a later stage.

Trend Following is such a radical idea that a lot of people I meet within the center of the financial industry deny, many very smart people still refer to trading as long term buy and hold investment just because their broker advice them to INVEST here and INVEST there, when the truth is that trading is not investing as I had explained above, and buy and hold is wishful thinking and a gamble when you discount the mathematical definition of risk management just because some smug hotshot self centred broker in a monkey suit hiding behind some old money big name, living off the conflict of interest that is called commission, instead of the decent and honest traders and hedge funds that charge performance fees and employ responsible risk management, just because the prevalence of EXPERT and all the sophisticated bulls~~~ that exist nowadays such as Bloomberg advisers and information stuffed terminals, hundreds of technical indicators claiming to predict the next winner, main stream noise such as CNBC others, up to the minute news (why would I care if I lose 6 hours of news in any day if I am objectively diversified and my stops are set, so I refuse to log around a smart phone unless I am traveling abroad, locally I use a simple Nokia with numerical buttons and no email).

There is truth in Trend Following because this simple strategy downplays the rampant noise and our self destructive quest to predict the future, Trend Following encourages Risk Management (stops, calculating position sizing) and downplays the role of position entry, yet encourages research into historical price data in order to build and update the trading system, yet discourages any other interference with the trading system (e.g a hunch, fundamental analysis, …), or any other information besides the results of solid research for which a system can be updated periodically.

Trend Following taught me modesty not just because I wish to level with others but also because when I am modest I live outside the noise and the extra needs that we think we need, and from there I learned preservation of capital not because I am stingy but because I choose to live without unnecessities and because no matter how much money you have, there is always a project that requires some cash, and since I live outside of the consumer culture I have plenty of time on my hands, hell I no longer listen to much music with lyrics anymore (unjustified second hand emotions) as I find solace by talking to my self that is that voice in your head which is continuously suppressed by actual noise that is everywhere in this city environment from some billboard that I forcefully read because I drive down some road frequently to some lyrics in some song telling me how to feel at the wrong time of the wrong day. Trend Following taught me about Faith, Fate and God, where Faith is some sort of a system of rules, applied randomly across a large number of tries (law of large numbers) would yield a specific result at some point in the future, prediction is forbidden in the faith that I was brought up into so it is mentioned that only God would know Fate, I am a skeptic of religion but Trend Following taught me to appreciate religion as a system which has become flawed because its interpretations were never updated with new research results from science because once upon a time religion worked miracles so it was never updated, and that is why religion nowadays seem so outdated, such an experience is consistent with my trading experience, and finally the definition of God, to me God is another word for Everything just like what the decentralised FX market to a trader or even to a bank at about $4 Trillion daily turnover, that market is very unpredictable but also very liquid and tradable by Trend Following without the need for any predictions because large trend often form there, yet its transactions are so complex, diverse and spread around the world that no one entity has control over its pricing over the long run, even if short interventions happen, so by such understanding I view God as everything that is too tiny or complex that is beyound the grasp of human’s control (e.g. Cancer, Accidents, …) or too large that is also beyound our control (e.g. Tsunami) and we humans are also part of God yet we live in the middle of those two extremes and have control only over each other with limited natural resources, so yes God is very real, in fact God to my current knowledge is as vast as planet earth including everything that exist, so by this definition God is a physical fact and not an entity living somewhere else, and unlike us that think independently, God is one huge complex chunk of earth that include us and therefore God is perfectly interconnected in a way that we cannot achieve even with our latest technologies and advancements, that is how real and controlling God is, and that is how logical Trend Following is.

What MGTOW did by radically uplifting my standard in positive manner, Trend Following did many years ago to my life and trading.

Regards.

Terrific! Thanks for taking the time to write all of that. Really appreciate it.

If you keep doing what you've always done... you're gonna keep getting what you always got.If you are interested,

Here is an algorithm to get you started, it is the only algorithm I personally use to measure everything:

Each price unit on the time line (an hour, day, week, …) has OHLC (Open, High, Low, Close), so to measure:

1) ACTUAL DISTANCE: You want to measure the distances the price travels in each row of your OHLC, based on logic (just like a car moving through a street from point A to point B, yet this car would go through wiggly road, so you want to measure the length of the wiggle)

NOTE: ABS means absolute value, which means no minus sign, because here we just measure how much the price actually moved, regardless of direction

- If Open > Close (Price went Down), then ACTUAL DISTANCE FOR EACH DAY = ABS (High – Open) + ABS (High – Low) + ABS (Close – Low) + Slippage ABS (Close – Next Open * e.g. the difference between close of today and open of tomorrow, because sometimes the price may defer which is called slippage, so we factor in that distance too)

- If Open < Close (Price went up), then ACTUAL DISTANCE FOR EACH DAY = ABS (Open – Low) + ABS (High – Low) + ABS (High – Close) + Slippage ABS (Close – Next Open * e.g. the difference between close of today and open of tomorrow, because sometimes the price may defer which is called slippage, so we factor in that distance too)

- If Open = Close (Price Opened and Closed at exactly the same) = You can use any of the two formulas above, because you will get the same Actual Distance so it doesn’t matter which you choose

2) Distance: This is the Distance between the first open and the last close + slippage = Open (first row Open) – Close (Last row Close from your chosen time frame + factor in the slippage which may appear at the beginning of the next day

3) ACTUAL DISTANCE = ACTUAL DISTANCE OF DAY 1 + ACTUAL DISTANCE OF DAY 2 + ACTUAL DISTANCE OF DAY 3 + … + ACTUAL DISTANCE OF LAST DAY (NOTE: This is the total distance that the price moved, regardless of direction, imagine the straight distance from your home to somewhere, and imagine the Actual Distance which includes roundabouts, bridges, u-turns and other turns which make the distance longer, this is what Actual Distance is all about)

4) Purity: This is how pure was the price movement across a number of rows (hourly, daily, monthly, … of the OHLC data of your choice)

- Purity = Distance / Actual Distance, the higher the Purity the better the trend, yet from research you would find that Purity always starts erratic and begins to become stable as you add rows from any point forward, and Purity always deteriorate to the mean ZERO in time even though the price may still be trending, the strength of the trend is the degree of this deterioration, a good trend has Purity deteriorating slower than a bad trend, thus the name Purity

Purity is a very simple measure, it is for example only the distance that the price moved from day 1 to day 100, divided on the complete distance that it moved in between, the result is a percentage which tells you how Pure is that trend, and from there you can do research and quantify position sizing, stops, and even derive probabilities.

You can download the same formula, ready in Excel, first check out the formula in some rows to understand it, then just replace the existing OHLC with any OHLC of any stock, commodity, currency, bond, ETF, … and you will begin see to the limits the price would move.

Note: this is not a prediction formula, there is no prediction formula, as this only allow you to quantify your decision making in relationship to your equity and it helps in such manner in many other ways:

https://drive.google.com/file/d/0B8EhiWKzXH__NWNhM2M5ZDctNmQyMC00ZWQyLTgzZGYtNDRjYjY1ZGU1MjI5/view?usp=sharingRemember that this is just a simple formula for a simple purpose that is to divide the distance a price moved onto the sum of Actual Distance in between, so the this concept is very simple and is not reliant on any foreign black box algorithm, because there is truth in simplicity as good research is better done using simple algorithm that produce complex yet useful statistics as you run it through heaps of all kinds of data, as opposed to complex algorithms that you may not fully understand and result in deluding sure ideas, LTCM was the largest hedge fund in the world and it failed because they resorted to the most “Advanced” formulas, but little did they now that the more advanced your formula is the more hidden tail risk that exist without you knowing, Trend Followers like , what is more important is the results of the research that you can do with it, or with other such formula because the prupose is not prediction but to quantify risk.

Regard.

It’s all politics as usual OPEC is keeping the taps open even though demand has dropped in countries like China. Up here in Canada big companies like Suncor & Syncrude are scaling down their operations a bit but make no mistake the mid East knows we have more oil deposits then they do so they are just trying to delay the inevitable where North America becomes oil free of the cartels.

KeyMaster,

$52 man, a technical Trend Follower would even sell just now against all odds, it is not even about predicting $30’s or $20’s, as prediction is forbidden for good reason, as all you needed to do is to go with the direction of the price flow, sell weakness and buy strength.

I urge you to listen to this song by legendary trader Ed Seykota, and you will begin to understand what trading is about:

* Ed Seykota is interviewed by Jack Schwager in his book ‘Market Wizards’, Mr Seykota is an old time Trend Follower, and there is wisdom in this song that even transcend trading.

Just imagine you had gradually pyramided a large Oil position since Mid July, ignoring all prediction and dumb ass big shot suggestion like those Bloomberg and CNBC talking heads, including your own perception. You would have made a fortune since July, minus previous losses when prices were sideways, that is when you would have been hunting for trends like this recent Oil. So trading is like being a hunter, you must accept short term small losses, as opposed to taking long term large catastrophic losses if you hold on to positions, and you must maintain long term Faith that large trends will eventually form somewhere in your diversified portfolio.

Happy New Year brothers.

Man. I would like to thank you very much for posting all this. The current price of oil is so unbelievable there must be speculators throwing themselves from rooftops. I got stopped out in a hurry but as I watch it just CRASH like this I have a smile getting louder every day. Amazing news for the dollar. But do you see a reversal? This is irrationality unlike anything I have seen.

In any case, a spectacular new year to you and look forward to future exchanges with you on the topic.

I regret I was so delayed in getting back over the holidays.All the best and BIG success for ’15.

If you keep doing what you've always done... you're gonna keep getting what you always got.I would NOT be getting into oil right now. The Saudi’s are playing games sitting on their supply. Russian is going down. US Workers are on hold and s~~~ is falling the f~~~ apart. Saudi’s are going to try and pull some s~~~ this year and Putin is scared as all f~~~. Look for more war around the globe. F~~~. Here in LA a lot of friends are not only going MGTOW in regard to women but also banks. Gold bars vs bitcoin anyone?

Happy to see I Am A Man in the ranks here.

- AuthorPosts

You must be logged in to reply to this topic.

921526

921524

919244

916783

915526

915524

915354

915129

914037

909862

908811

908810

908500

908465

908464

908300

907963

907895

907477

902002

901301

901106

901105

901104

901024

901017

900393

900392

900391

900390

899038

898980

896844

896798

896797

895983

895850

895848

893740

893036

891671

891670

891336

891017

890865

889894

889741

889058

888157

887960

887768

886321

886306

885519

884948

883951

881340

881339

880491

878671

878351

877678