This topic contains 14 replies, has 6 voices, and was last updated by ![]() Beer 3 years, 4 months ago.

Beer 3 years, 4 months ago.

- AuthorPosts

The Boston Tea Party happened because of a hike in tax of 3+%

Today in the USA that is getting close to 50% in real terms … but no rebellion yet.

Your $1 is actually worth only 20 cents.

The dollar will never return to a gold standard because if it did the USA couldn’t fund the welfare state or wars in the middle east.

The only thing keeping the cogs turning is money printing which is another name for tax.

The only thing holding the $ together is a government enforced confidence.

However, China is hoarding gold and banning its export.

If China decides to tie it’s currency to gold … then the $ is f~~~ed because global trade will immediately jump from a fiat currency to one that is linked.

More here:

https://mises.org/library/why-it-matters-if-dollar-reserve-currency

https://fred.stlouisfed.org/series/BASE

Money printing

Got gold and silver?

If stuck in 401k…

Stock.. cef

Allocated, real metals, not loaned out on paper

Totally agree Bunker.

It’s very troubling how knife edge the $ is and I can only see that edge getting thinner and sharper.

A collapsed dollar means no orders for their factories, either from the U.S., the UK or the rest of Europe because our economies are so interconnected.

But you’re right, ILive, they’re up to something — something big. I wonder what their timeline is for pulling the trigger on the dollar. Got any ideas about that?

Economics, love it.

Mr. Bill Still’s documentary “The Money Masters” and “The Secret of OZ” are both great primers for those new to economic ideas. I hold firm that gold and silver ARE money.

A collapsed dollar means no orders for their factories, either from the U.S., the UK or the rest of Europe because our economies are so interconnected.

But you’re right, ILive, they’re up to something — something big. I wonder what their timeline is for pulling the trigger on the dollar. Got any ideas about that?

I think its now out of western hands.

BRICs will hold the pin on that grenade I fear.

China is accelerating their gold purchase and also now copper with still some silver.

Other BRICs are doing the same.

Large swaths of Africa are owned by China.

Apart from minerals they are also future proofing their food and water supplies.

My other fear is Zimbabwe. On the edge of collapse its ripe for a buy out from the east.

Don’t forget before Mugabe f~~~ his country it was know as the breadbasket of Africa.

My main worry is we don’t hold the pin so we won’t know when it’s being pulled ….. they will.

I keep some gold but unfortunatly at this point I’m forced into Bitcoin- Gold is of no use to me if I can’t get it past TSA agents….

The way to get gold across borders is to buy the small coins. 1/4oz and 1/2oz coins look just like normal pocket change.

Still there’s a limit to how many gold coins you can fit in your pocket without arousing suspicion…

If/When I make my move to Asia, I can transport my Bitcoin private keys on a USB or in a brain wallet (memorize 12 words)…

Then I just visit a Bitcoin ATM in Thailand, Singapore, Hong Kong or wherever. Pull out local currency from time to time. If you anonymize your BTC properly, you can avoid capital gains taxes or exit taxes…

Not my property... Not my problem

I keep some gold but unfortunatly at this point I’m forced into Bitcoin- Gold is of no use to me if I can’t get it past TSA agents….

The way to get gold across borders is to buy the small coins. 1/4oz and 1/2oz coins look just like normal pocket change.

Still there’s a limit to how many gold coins you can fit in your pocket without arousing suspicion…

If/When I make my move to Asia, I can transport my Bitcoin private keys on a USB or in a brain wallet (memorize 12 words)…

Then I just visit a Bitcoin ATM in Thailand, Singapore, Hong Kong or wherever. Pull out local currency from time to time. If you anonymize your BTC properly, you can avoid capital gains taxes or exit taxes…

As an amateur magician can I suggest you look at ‘shell coins’

These are real coins hollowed out and/or so another coin can fit inside.

All you then do is split the shell coin, place gold coin inside and jobs done.

Just for magic demos of course.

Hmmm won’t these shell coins show up in a metal detector as having a round, coin shaped object within them?

Not my property... Not my problem

Anonymous24The dollar will never return to a gold standard because if the middle east.

it did the USA couldn’t fund the welfare state or wars in

The only thing keeping the cogs turning is money printing which is another name for tax.The only thing holding the $ together is a government enforced confidence.

However, China is hoarding gold and banning its export.

If China decides to tie it’s currency to gold … then the $ is f~~~ed because global trade will immediately jump from a fiat currency to one that is linked.

Indeed. Also note that Gaddafi was killed because he wanted gold for his oil, intended on creating a gold backed currency, and wanted to Unite Africa. This would have undermined the “Federal” Reserve notes as petrol dollar and world reserve currency. So, destroy an entire country that did nothing to it’s neighbors, once again.

China won’t do it for the same reasons other governments won’t, because FIAT money is the ultimate Ponzi scheme of all time allowing Governments and the Corporations who guide them do as they please, as the masses get pushed down to the bottom due to inflation without wages keeping up. Now that we are at the point where countries will be destroyed if need be to keep the Ponzi schemes running, but it won’t be any country with Nukes. So, to those around the world, if you like your country, sovereignty, and lives, push your governments to get Nukes. If not, you may end up like Libya if you decide to play the game differently.

I wonder if the U.S. even has much gold anymore, the last president to see it himself was Reagan… That was more than a few years ago… My guess is those who run central banks have horded as much gold as possible because they know it the best backup plan ever. Trade paper printed out of thin air for gold, that may again back paper one day, and you who printed the paper and made money out of thin air now hold all the gold as well… Ah, what a great scam.

The Boston Tea Party happened because of a hike in tax of 3+%

Today in the USA that is getting close to 50% in real terms … but no rebellion yet.

This is pretty disgusting. I make a pretty good wage but I’m not a 1%er…my upper income ends up in a 28% federal bracket, social security/medicare are another 7.65% on both me and my employer, and I’ll end up in a 6% bracket for my state. That is 41.65 or 49.3% depending if you want to count both halves of the ss/medicare taxes as self employed people making the same income I do would have to.

After that I get whacked for sales tax on almost everything I buy, plus property taxes on my condo and car. Even if I rented I’d still be paying property taxes, its just my landlord would be paying them on money he collects in rent rather than me paying them directly, and not owning a car for me is simply not practical considering the hours I work, the hours the buses run, and the routes they run, so property taxes are unavoidable.

Considering how many of my generation are fans of the Bernie and Hillary types that promise them more government hand outs, taxes are only going to go up unless a lot of my generation suddenly sees the light. I can’t imagine within the next decade I won’t end up with some of my upper income being in a bracket >50% all combined, and my property/sales taxes going up as well as my state is broke as f~~~ lol. The only thing that makes me happy about the whole situation if eventually when we get universal healthcare voted in, as Obamacare is working well to make health insurance even less affordable and our healthcare industry more expensive, I’ll be able to retire super early, get “free” healthcare, and thank all the people my age that are in debt and still working while paying an even higher tax rate to help subsidize my early retirement lol. Hey, at least I’ll be a polite leech and thank them for the handouts though, and not just be like most welfare leeches and complain and demand more.

FIAT money is the ultimate Ponzi scheme

To an extent though, we need an ever expanding money supply as the population grows. If we had a constant money supply we’d just end up in a constant state of deflation, and that wouldn’t really be a good thing either.

Unfortunately we’ve just ended up doing the opposite, where we have “created” way too much too quickly and the government is constantly trying to make it look like we don’t have ridiculous inflation by cooking the books and changing the formulas.

The fact is over the last decade our money supply has pretty much doubled while our population has only grown about 10%. If anyone honestly believes we are really coasting along at barely 2% inflation they have to be brain dead. I know I sure as hell don’t plan on holding large amounts of cash, I’m making sure most of my net worth is tied up in stock and real estate that will rise in value with inflation. They might not gain real value but their nominal value will increase so I’m not getting eaten alive like people who leave cash sitting in interest accounts yielding .1% interest.

Anonymous24FIAT money is the ultimate Ponzi scheme

To an extent though, we need an ever expanding money supply as the population grows. If we had a constant money supply we’d just end up in a constant state of deflation, and that wouldn’t really be a good thing either.

Unfortunately we’ve just ended up doing the opposite, where we have “created” way too much too quickly and the government is constantly trying to make it look like we don’t have ridiculous inflation by cooking the books and changing the formulas.

The fact is over the last decade our money supply has pretty much doubled while our population has only grown about 10%. If anyone honestly believes we are really coasting along at barely 2% inflation they have to be brain dead. I know I sure as hell don’t plan on holding large amounts of cash, I’m making sure most of my net worth is tied up in stock and real estate that will rise in value with inflation. They might not gain real value but their nominal value will increase so I’m not getting eaten alive like people who leave cash sitting in interest accounts yielding .1% interest.

All true and very wise. The real problem is the extent of which that we have printed once we completely detached from gold. The current system allows for a select few to get insanely wealthy as the masses slowly get pushed down and struggle with inflation.

All true and very wise. The real problem is the extent of which that we have printed once we completely detached from gold. The current system allows for a select few to get insanely wealthy as the masses slowly get pushed down and struggle with inflation.

I just laugh when the government and the liberal media try to sugarcoat it. They have recently been bragging about how wage growth is picking up. Big f~~~ing deal if wage growth accelerates a fraction of a % while its still 4-5% lower than the true inflation rate…people are still losing.

As far as our system only allowing a select few to get insanely wealthy…I don’t agree with that. Who are the richest people in the country right now…Bill Gates and Warren Buffet? They both built their empires from the ground up. Yeah I doubt anyone on this forum will ever have that kind of money, but realistically anyone that wants to can get rich enough to retire early and live off the interest…it just requires hard work, living below your means, and investing.

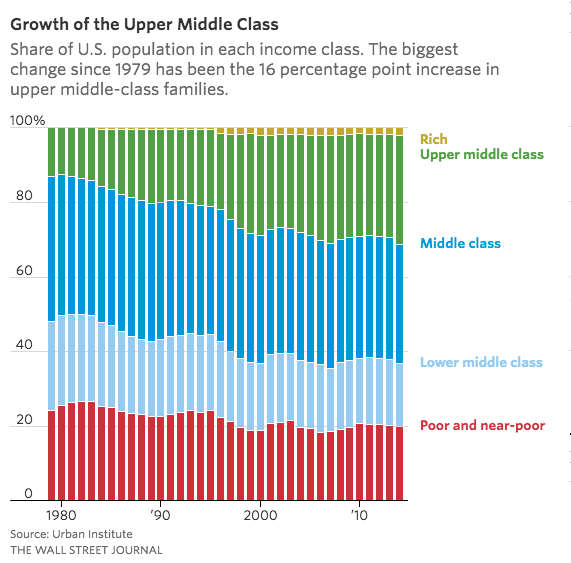

If you look at the wealth distribution in our country its becoming more of a barbell shape with more people on the bottom, more on the top, and less in the middle. When you hear about the middle class shrinking, they all aren’t taking a step down the ladder, quite a few are moving up as well. Before we hit our recent period of stagnant wages it was easier for a person with a middle class income to maintain middle class status even with s~~~ty spending habits, but what we are seeing now as wages stagnate(decline after taking inflation into account) is simply a more pronounced split between those who invest and those who live in debt. I know people making six figures with no wife/kids who are living in perpetual debt and think the system is against them, and I know people making half that who are on track to have a very comfortable retirement.

Anonymous24Yep, I guess I am just thinking it will be not so many at the top of the barbell, and the masses pushed to the bottom with the middle class being pretty much gone in the future.

Yep, I guess I am just thinking it will be not so many at the top of the barbell, and the masses pushed to the bottom with the middle class being pretty much gone in the future.

Its not true though, a lot of research is actually looking like this…

We have plenty of people moving up and we don’t really have a growing number of poor. Yeah I’ll admit, its a large, multi faceted issue that can’t really be briefly summed up in any meaningful manner in a paragraph or two, but its just my general view that I know a hell of a lot of people who make a decent amount of money who just can’t stop spending. When they want to bitch about wealth distribution I just kind of laugh, because there are so many people out there who have incomes well above the poor range who have a negative net worth. If you have a net worth of 5 dollars you probably have a higher net worth than the bottom 25% of the country combined.

I totally get some people have just had s~~~ luck in the job market, or have had health issues, and not everyone is going to have an average or higher wage, but I’m just saying…a lot of people make plenty of money to get their s~~~ squared away and get a nest egg growing IF they stuck to a reasonable budget and prioritized saving. If wealth distribution is becoming more of a barbell than a curve, people in the middle income ranges moving down the net worth ladder really have no excuse when others in the middle income range are climbing up the net worth ladder.

It really makes me wonder…do people just expect to have too much s~~~ these days? Just a quick example, when I was a kid we had one land line phone for the house, and one cable tv for the house…now I know people with a cell phone for each family member, a land line, multiple cable tvs, internet, hulu, and netflix…and all that s~~~ adds up. The average family of four probably spends 3-4x just on phones/tv than what my family spent when I was a kid, and when my parents were kids they had 1 land line and an antenna for the tv…so they probably spent twice as much as their parents spent. Maybe if some people could trim some of the fat and not “need” so much stupid expensive s~~~ they’d have some extra money to invest and we wouldn’t see so many people with middle class incomes unable to get out of debt or build any kind of savings over time.

- AuthorPosts

You must be logged in to reply to this topic.

921526

921524

919244

916783

915526

915524

915354

915129

914037

909862

908811

908810

908500

908465

908464

908300

907963

907895

907477

902002

901301

901106

901105

901104

901024

901017

900393

900392

900391

900390

899038

898980

896844

896798

896797

895983

895850

895848

893740

893036

891671

891670

891336

891017

890865

889894

889741

889058

888157

887960

887768

886321

886306

885519

884948

883951

881340

881339

880491

878671

878351

877678