This topic contains 4 replies, has 2 voices, and was last updated by ![]() Y_ 2 years, 12 months ago.

Y_ 2 years, 12 months ago.

- AuthorPosts

US Asia Pivot to China – The Impossible Trinity

Thanks to James G. Rickards at http://www.dailyreckoning.com / Strategic Intelligence for the material.

1.Overture

As President Donald J Trump begins a new chapter of economic policies steeped in the ‘America first’ sloganism – which resonates deeply with Americans of all persuasions desperately tired of the past sixteen years of empire-building by Washington at the expense of their livelihoods – the new administration is already capitalising on an Asian-Pivot policy instituted by the former president Barack H. Obama.

While revellers and protesters alike argue the merits of his appointment, the Asian Pivot will be the first test of his presidency that may make – or break – Trump’s economic policies and confidence in his administration. The symbiotic relationship between the United States and China cannot be defined in a ‘me right– you wrong’ set of rules that Trump may be used to in his TV shows and business deals. Therein lies the danger – that his business acumen under American business laws and ‘The Art of the Deal’ are the primary bases for international relations. To distil international economics down to Trump’s iconic ‘my way or the highway’ approach is a recipe for disaster that even Obama – in all his foolhardiness – did not dare tamper with.

Trump’s China policy hinges on convincing the American people that the current state of the American economy is in a large part based on Chinese economic expansion – and must be contained to allow America to reinvigorate her primary industries and therefore to bring jobs back. The contention is that for far too long financial expediency of the American commercial houses encouraged outsourcing to China, India and Mexico to enable greater profits at the expense of the American worker – aided by a corrupt political establishment built on corporate greed.

To practically implement a China containment – Trump must carry out a few legal (and possibly executive) manoeuvres.

Firstly – a trade barrier is the most likely scenario with trade tariffs and closure of tax incentives for companies importing goods and services in-lieu of local production.

Secondly – investment in R&D and new technologies at home – with high penalties for copyright infringement or misuse.

Thirdly – and the most aggressive action that can be undertaken – branding the Chinese government as a ‘currency manipulator’ in a series of executive and judicial decisions. This will open up another avenue of political and economic barriers to compensate for the currency bias.

This then is supposedly the answer to the China problem. Or is it?

In reality, China will be broke within a year – two at the most – under the current economic policies of the People’s Bank of China (PBC) and is struggling to keep the yuan pegged to the US dollar. Trump’s policies most likely will start a major trade and currency war and force China into a ‘nuclear’ option – in the monetary sense only.

We need to view this from a global economic standpoint to ascertain the current health of both countries and possible consequences of Trump’s proposed policies. Let us first understand how international trade works between China and the USA in simple terms.

2.The Impossible Trinity (or The Policy Trilemma)

The Impossible Trinity is a simple rule with deep implications. It was first uncovered by Nobel Prize-winning economist Robert Mundell in the early 1960s.

The Impossible Trinity : a country cannot have an independent monetary policy, an open capital account and a fixed exchange rate at the same time.

That’s it.

You can have any two of those three conditions. You can even have only one or none if you like. But you can’t have all three at the same time. If you try, you will fail — free markets will make sure of that.

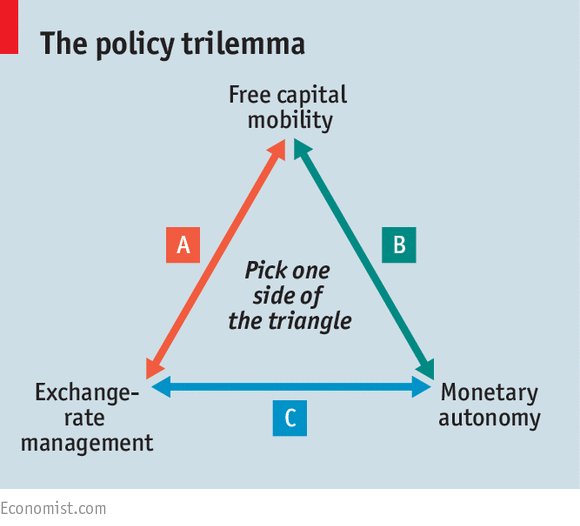

The diagram below represents the Impossible Trinity. The theory is this – it is impossible for a country to achieve A+B+C at the same time.

http://cdn.static-economist.com/sites/default/files/imagecache/original-size/20160827_EBC992.png

Understanding the Impossible Trinity is how George Soros broke the Bank of England on Sept. 16, 1992 (still referred to as “Black Wednesday” in British banking circles). Soros also made over $1 billion that day.

The first part of the Impossible Trinity is an independent monetary policy.

This simply means that your central bank can set rates where they want without regard for what other central banks are doing, If you want to ease to help your economy, and another central bank wants to tighten to prevent inflation, that’s fine. Each central bank does its own thing.

The second part of the Impossible Trinity is the open capital account.This refers to the ability of investors to get their money in and out of a country quickly and easily. If you want to invest in China, you’ll have to take your dollars, convert these to the yuan, and make the yuan investment in whatever stocks, bonds or direct foreign investment you choose. The investor dollars end up in the target country central bank, and the investor gets local currency to complete the purchase. This is one way central banks build up their reserves of U.S. dollars and other hard currencies, (the other way they build reserves is from trade surpluses.

So far – so good.

Now let’s say you want to sell your investment and get your money out of the foreign country. The process we just described works in reverse. The foreign central bank takes the local currency proceeds from your sale and gives you U.S. dollars from its reserves.

But sometimes the revolving door gets stuck with you in it. This happens when a central bank slaps on capital controls and doesn’t let your money out of the country. (Then the revolving door is more like the Hotel California “You can check-out any time you like, but you can never leave”). When this happens, we say the country has a closed capital account.

The third part of the Impossible Trinity is a fixed exchange rate.

This simply means that the value of your currency in relation to some other currency is pegged at a fixed rate.

Of course, formally binding pegs were abandoned in the international monetary system in 1974. This was not long after U.S. President Richard Nixon ended the convertibility of dollars into gold at a fixed rate under the Bretton-Woods agreement. Since 1974, all major currencies have technically been floating against others.

But many countries do implement currency pegs informally using central bank intervention and other policy tools.

There you have it.

Any country that attempts all three is doomed to fail – eventually. In the last fourteen years China has been attempting just that. Let’s see how this has played out using arbitrary numbers:

China wants to cut its interest rate from 3% to 2% to stimulate growth. (At the same time, China’s main trading partner, the USA, has an interest rate of 3%.) China also keeps an open capital account (to encourage direct foreign investment). China pegs its exchange rate to the USA at a rate of 10-to-1. This is a “cheap” exchange rate designed to stimulate exports from China to the USA.

What happens next?

The international money market arbitrageurs get to work. They borrow money in China at 2% in order to invest in the USA at 3%. This causes the PBC to sell its foreign exchange reserves and print local currency to meet the demand for local currency loans and outbound investment. Printing the local currency puts downward pressure on the fixed exchange rate and causes inflation in local prices.

Eventually either A or B or C will break in China and the signs of all three failing are evident. That is China’s Trilemma. A country that wishes to fix the value of its currency, have an interest-rate policy that is free from outside influence and also allow capital to flow freely across its borders cannot have all three at the same time.

The options for China are to either run out of its foreign exchange (broke) or being forced to close the capital account (China will print so much money that inflation will get out of control forcing it to raise interest rates again, something like this has been happening to Brazil lately) or breaking the currency peg (this is what happened to the UK in 1992 when George Soros broke the Bank of England).

The exact policy response can vary, but the end result is that China cannot maintain the Impossible Trinity. It will have to raise interest rates, close the capital account, break the peg, or all three in order to avoid losing all of its foreign exchange and going broke.

This shows you how powerful the Impossible Trinity is as an analytic tool. Once you see a country trying to achieve the Impossible Trinity, you can be sure their system will break down one way or another. You can begin to make investment decisions in anticipation of the breakdown.

Conversely, when you see a country avoiding the Impossible Trinity (by not targeting either A + B + C in the diagram), you can have more confidence in their economic management. That way you can make investment decisions based on that level of confidence.

The Impossible Trinity is a tool to separate countries with good policies from those with bad policies. It is also a tool used to make accurate forecasts based on the sustainability of those policies.

By the way, there is one big exception to the Impossible Trinity. That’s the United States of America.

The US sets interest rates independently and has an open capital account. The US does not officially peg the dollar to any other currency (thus technically not breaking the Impossible Trinity). Why does the US not suffer adverse consequences? Because the US does not need foreign exchange. The dollar is the leading reserve currency in the world (about 60% of global reserves and about 80% of global payments), so the US can never run out of foreign exchange to pay for things, it can just print more dollars!

This is what the French called the dollar’s “Exorbitant Privilege” in the 1960’s. Now you see why so many trading partners are trying to escape from a dollar-denominated global system. The game is rigged against other countries, and in favour of the U.S. (This is why the game won’t last. King Dollar’s days are numbered.)

Now I close this section with a corollary that will seldom – if ever – be displayed for fear it would cause a rethink of monetary policy. This the Keynesians cannot have. Please pay close attention to this one statement. The corollary is this:

“The Impossible Trinity is only valid for fiat-based currency systems wherein central banks are able to set arbitrary market polices and currency pegs. The Impossible Trinity is not valid under a Gold Monetary Standard or a viable proxy thereof.”

When gold is the basis of a free market monetary system – each country’s currency is pegged directly to gold and the Trinity vanishes. There is therefore no need for central banks as monetary policy is controlled by the free market. There is only need for a regulatory framework and enforcement.

3.Currency Wars

The idea of economic stress in China sounds strange to most ears. China has come from the chaos of the Cultural Revolution to the world’s largest economy measured on a purchasing power parity basis in just 35 years. Even using nominal GDP, it is the world’s second largest economy. This is based on trying to do all three aspects of the Impossible Trinity.

China’s economy grew over 12% per year in 2006-2008, and again in 2010. Even at the depths of the global financial crisis in 2009, annual Chinese growth was still over 6%. Chinese growth ran between 8% and 6.7% from 2011 to 2016. These growth rates are extraordinary compared to the 0% to 2% annual growth achieved by the major developed economies since 2007. But, much of China’s growth was completely artificial. It would not be counted if China were subject to more rigorous accounting standards.

The ‘growth’ is actually currency debt created by banks and financial institutions to lend to local and foreign investors, as well as capital flight to foreign money markets. (Side B of the Trinity). This is the fallacy of fiat money – there is no real wealth – just more debt.

Assuming half of China’s investments (45% of GDP) is wasted as non-performing assets (NPA), then by proportion, GDP should be reduced by 22.5%. This turns 6.7% growth into 5.2% growth at best. The situation gets even worse when you consider the amount of debt being used to finance this wasted investment. China’s bank debt assets in US dollar reserve holdings have grown from about $2.5 trillion to $40 trillion in the past 10 years, a 1,500% increase.

Most Chinese debt is “off the books” in so-called wealth management products (something like the CDO’s that sank Lehman Brothers in 2008), and derivatives. China has a huge “shadow banking” system of provincial guarantees, inter-company loans and offshore transfer pricing schemes. When all of this debt is taken into account, China looks like the greatest Ponzi scheme in history. There is now way too much debt and not enough repayments or further borrowing – as the economy (velocity of money) slows down – to keep lending houses solvent.

If the situation is so unstable and over-leveraged, why hasn’t the Chinese economy collapsed already as per the Trinity? The answer is that China is the greatest currency manipulator of all time. China did a 35% “maxi-devaluation” of the yuan in 1994 – this is a de-peg and re-peg of the yuan at a lower level (which enables China to cheat its way out of peg penalties requiring buying yuan with US dollars) – and is completely illegal in international trade.

This makes its currency globally competitive again and boosts its exports. In this way it especially saves its reserves which stood at 4 trillion US dollars in 2014 from being used up to defend the currency peg. However in reverse a freefalling yuan sucks the lifeblood from the Chinese economy. Literally. Capital’s already fleeing China in buckets, heading for the safer and greener (literally) vistas of the U.S. dollar. That sets in train a vicious cycle. More capital flight out of China leads to more weakness as investors dump yuan for dollars.

So China must put a floor under the yuan to end the capital flight. It’s true China wants a weak currency to spark its export economy. Weak, yes. But not too weak. And to maintain the peg they have to use their reserves. The devaluation took the yuan from about 2 : 1 in 1985 to about 7 : 1 in 2014 to the USD

Due to political pressure from the impact of devaluation on US stock markets the peg and de-peg have been used judiciously from 1996 onwards. The last time this happened in Aug 2015 – the PBC dropped the yuan 4% – and the Dow reacted by dropping about 11% or 508 points in one session — the Dow’s eighth-worst single-day crash in its history. The Fed managed once again to yank another rabbit out of its hat. The day of reckoning was averted — or at least postponed. It is noteworthy that none of this was ever really contested by the political establishment in Washington – their allegiance to Wall Street was too strong for any other response than a protest of sorts.In essence – a too sudden a devaluation or too large a devaluation may crash the Dow Jones and this would bring with it major US currency and trade retaliations. Until China was ready to leave the symbiosis it had to maintain the peg to avoid a real confrontation and play nice. And China – by its own world views – is playing nice.

The difference between 2017 and 2015 is that the U.S. is paying attention. In particular, as early as 2016 President Donald J. Trump has threatened to label China a “currency manipulator”, although he has not done so – yet.

China wants eventually to liberalise its capital account as a stepping stone to a modern financial system. To do so, it will have to live with a volatile yuan. Three out of three ain’t possible, but two out of three ain’t bad – but that is still some time away as the communist party is not noted for releasing controls. China is now part of the Special Drawing Rights (SDR) basket of currencies – and one of the requirements to maintain this position is an open capital account. Well – at least on paper.

However there is now a structural monetary problem in China – the years of fleecing the international financial system are finally taking their toll. The PBC has been dumping dollars to steady the yuan. But here’s Catch-22: To defend the yuan, it’s been selling dollars at such a gait that it’s burned a gaping hole through its dollar reserves. It’s unsustainable. China’s reserves fell nearly $320 billion last year, to $3.01 trillion. That’s piled on top of a record loss of $513 billion in 2015. $3 trillion in reserves may sound like a lot. But for China, it’s less than you might think…

As Jim Rickards says “China started 2015 with about $4 trillion in hard currency reserves. About $1 trillion fled the country in 2015 and 2016 based on fears of yuan devaluation. That’s classic capital flight. Another $1 trillion is relatively illiquid, including direct investments in mines and natural resources through sovereign wealth funds such as China Investment Corp. That’s wealth, but it’s not money that can be used in a liquidity crisis. Finally, $1 trillion has to be held as a precautionary reserve to bail out China’s insolvent banks and Ponzi-style “wealth management products.” Failure to bail out the banks… could lead to social unrest that would topple Communist rule, so that won’t be allowed.”

“That,” says Jim, “leaves only $1 trillion of the original $4 trillion in liquid form.” And if it keeps jettisoning dollars at this rate, “China will be devoid of useable liquid assets by late 2017.”

Those are the stakes. China’s recently enacted regulations limiting the ability of individuals and businesses to move money out of the country — capital controls, in other words — while denying they were capital controls. But capital controls, admitted or not, can only go so far. If folks are bent on getting their money out, they’ll find a way. They might even make things worse.

Which brings us back to another possible devaluation. Jim gives a foretaste of what could be next: “Yuan devaluation is happening in baby steps, but that may soon turn into a one-time ‘maxi-devaluation’ of 30% or more to stop the bleeding.”

This is what the important Chinese economists are saying. Yu Yongding, a former academic member of the PBC’s monetary policy committee, who overnight urged his former PBC colleagues to engage the “nuclear option” – a sharp, one off devaluation similar to what China did in August of 2015. n emailed comments to Bloomberg, Yongding said that China has a window to halt Forex intervention (i.e. pegging) and let the yuan depreciate to its equilibrium level with the US dollar.

Yongding believes that once Forex reserves fall below a certain psychological threshold, capital outflows will only accelerate, and while depreciation expectations may weaken occasionally, they will never disappear until the yuan free floats and finds its equilibrium. He also warned that concerns over depreciation have severely affected the PBC’s monetary-policy independence and said that while tightening capital controls is right move, this has massive side effects and can be evaded.

His conclusion: letting the yuan fall won’t be as scary as some imagine because Chinese companies have been paying down their Forex debt and a large a problem as feared on Chinese stocks won’t occur – and the worse-case scenario isn’t supported by the nation’s economic fundamentals. He is not alone in calling for a maxi-devaluation.

This is a question of when rather than if – China cannot afford to lose her reserves or the capital flows that sustain the communist empire. There may be other solutions which could involve currency agreements like that in the Shanghai Accord a few years ago. However with Donald J Trump at the helm, a call to arms such as imposing tariffs and China ‘currency manipulator’ tags will not help solve the issue – if any are possible.

If China was going to be labelled a currency manipulator anyway and tariffs to boot by Trump there would be no incentive for them to play nice. China may just say – stuff it. Let’s go nuclear – we’ve got nothing to lose. We’ll be better off and saved our reserves. No more Mr.Nice Guy.

The last times China devalued 2% and 4% the stock market practically shat itself. What will happen if the PBC devalues the yuan about 30% at one go? And what if the Fed can’t pull another rabbit out of that tired old hat?

What if this is the start of a new 1930’s style depression – something only a very very few are prepared for?

What if, indeed? But it would sure send Trump a message:

“You want a trade war? You’ve got one. Happy Inauguration Year – Loser!”

Citations

http://www.zerohedge.com/news/2016-12-28/china-facing-currency-liquidity-crises-ex-pboc-official-urges-use-nuclear-option

https://en.wikipedia.org/wiki/Impossible_trinity

https://dailyreckoning.com/china-drop-a-bombshell/

Jim Rickards – Strategic IntelligenceVery interesting (and a very important topic), thank you, but I did not understand it completely.

What are the most likely scenarios by the end of 2017?

Did you mean that the only likely scenario is a big devaluation by the end of 2017. Devaluation which is likely to cause a recession in the USA and big problems to Trump?

I do not understand how the devaluation would cause the recession.

What are the most likely scenarios by the end of 2017?

Did you mean that the only likely scenario is a big devaluation by the end of 2017. Devaluation which is likely to cause a recession in the USA and big problems to Trump?

Hi Feral – glad you asked. The response follows:

A big devaluation or a series of smaller ones have to happen to the yuan. Here is why.

Due to the Chinese economy creating massive amounts of currency the last 14 years the yuan value will be expected to fall naturally due to required currency printing to met the demand. Currency is now being borrowed locally and also outflows to the US and other countries to be invested in stocks and other assets (this is called an open capital account). However China chose to peg its currency to the US dollar to keep it from devaluing or depreciating. (I will explain how this peg works a bit later).

This is sufficiently accurate to provide you an answer.

I won’t go into why China started the currency peg in the first place – just accept for now that it was a decision that allowed their economy to expand very quickly through foreign investment. However there is a price to pay for keeping this peg.

The US investments by investors were done with the understanding the yuan would be kept pegged to the US$ so that the US$ value of the stock bought in yuan is guaranteed. Although not written in stone there is an international understanding that once you announce a peg you have to keep it or declare your intention to remove it for investors to get out

If China lets the currency devalue the US stock markets will dive as there are large amounts of stocks bought with a LOT of yuan borrowed from Chinese banks. The yuan devalues and is now worth less in US dollars than when invested – therefore the stocks will be worth less in US dollars as well since they are actually valued in yuan (or called yuan-denominated assets).

Unless the Fed or banks can come in and make up for the $ loss the stock value will drop. Then there is a panic and investors start taking their money out – hence a crash.

Therefore China has to keep the yuan pegged to the dollar or risk the wrath of the US – there will be retaliation and trade sanctions if and when the US stock market crashes and US investors lose their investments and with a possible economic recession.

China is only able to prop up or peg the yuan by buying it back with US dollars (increase demand for the yuan on the open market). This is called defending the currency. China tried a stealth devaluation in Oct 2015 of 3% – this caused the Dow to fall 11%. The Fed was able to contain the problem by printing and propping up the US stocks but it was close.

However China is quickly running out of US dollars to keep the peg.

China had 4 trillion in reserves, and after defending the yuan the last few years it is down to 3 trillion. It cannot use 2 trillion of this – 1 trillion is required to prop up the Chinese banks and 1 trillion are invested and not liquid. That leaves 1 trillion available / left for this.Within 1 year or 18 months on the outside – China will use up the 1 trillion it has left. Eventually the peg will break. The yuan will fall. Then there may be a ‘maxi devaluation’ that may be 10% or so.

A 3% devaluation in 2015 sent the Dow down 11% – what will 10% do?

Can the Fed print its way out again? Eventually it is possible – but not before the immediate damage to stocks is done.China may want an agreement on how to do this devaluation with the US and EU quietly. There is a very outside chance that Trump and China may agree on a way to somehow cushion the effect when it happens but it still looks bad. The US stock market in reality is shaky and can’t take a 3% hit let alone a 10%. The most affected will be pension funds.

Trump wants to call China out and place sanctions on them anyway even though they are ‘playing nice’. China may say ‘f~~~ him – let’s devalue now and save what reserves we have left’. That’s the ‘nuclear’ option.

So its only a matter of time for the devaluation – whether now or later or 10% spread out over a few months or in one hit the effect on US stocks will be massive. It is a likely recession and a possible depression.

Of course – Trump will be blamed for this – when it happens. How long the pain lasts will depend a lot on what Trump does and if the Fed have any ammunition left. No one really knows for sure. The most likely scenario is a crash and this as a possible trigger for a recession.

Hope this clarifies.

Thank you very much for your kind and articulated explanation / clarification.

Super interesting.

It is worrying.I am surprised that investors in yuan denominated investments/assets do not hedge / exit, considering that it is known that the currency is overvalued. Maybe not all investors get that China’s reserves are thinning so quickly?

I mean, I understand that a peg comes with the unwritten agreement of a due advance warning. Still, there seem to be enough bad/recent precedents and enough information about China’s reserves to call for caution / hedging / disinvestment even without waiting for an official warning.Also, as the Fed intervened as recent as 2015, it should have put in place some processes to prevent the issue from happening again without notice. Maybe Obama forced China to postpone the small devaluations to after his presidency so that his legacy would look better.

There is some political element to this story, as you mentioned. A sudden devaluation with short notice would make Trump look extremely bad, and giving that Trump has been very hostile to China so far, the Chinese might very well do it / threaten to do it.Also, Chinese people are trying to invest abroad big time (for example by buying lots of properties in London). Clearly they seem to signal the awareness of a yuan devaluation risk / or a risk of a closed door policy to capital flows.

I am surprised by the lack of preparation/risk management on the side of American investors / Fed.

Worrying times!

Since 2001, each crises seem to just build on top of the previous one, and they seem to get bigger and scarier (due to the tight integration caused by globalisation).I will keep following your very important and useful summaries that allow us to understand these complex issues.

I would not know where else to find such clear, unbiased executive summaries of very complex economic topics.

Economics has a big impact on our lives, and let us better understand this tightly integrated world we are living in.Thank you

You will go far my friend, I can see by the way you think that you may have your own blog one day. I really would like to see that.

As to all your really good questions – this will have to wait for a little while as it would take a substantial number of posts to explain.

I have already started and the first part is on this site “The Petrodollar and A Gold Standard – Part 1′. This series is an overview of how we got where we are.

I would also like to refer http://www.dailyreckoning.com and http://www.zerohedge.com to you for the kind of topics I cover.

Also on youtube look for Mike Maloney’s Hidden Secrets of Money’ (7 parts)

Happy reading.

- AuthorPosts

You must be logged in to reply to this topic.

921526

921524

919244

916783

915526

915524

915354

915129

914037

909862

908811

908810

908500

908465

908464

908300

907963

907895

907477

902002

901301

901106

901105

901104

901024

901017

900393

900392

900391

900390

899038

898980

896844

896798

896797

895983

895850

895848

893740

893036

891671

891670

891336

891017

890865

889894

889741

889058

888157

887960

887768

886321

886306

885519

884948

883951

881340

881339

880491

878671

878351

877678