This topic contains 11 replies, has 6 voices, and was last updated by ![]() Y_ 1 year, 9 months ago.

Y_ 1 year, 9 months ago.

- AuthorPosts

Russia’s Real Endgame [1][2]

James G Rickards

The Daily Reckoning[Y : This is a composite piece edited for brevity from the citations list. Thanks for reading. – Y]

James G. Rickards is the editor of Strategic Intelligence. He is an American lawyer, economist, and investment banker with 35 years of experience working in capital markets on Wall Street.

His work is regularly featured in the Financial Times, Evening Standard, New York Times, The Telegraph, and Washington Post, and he is frequently a guest on BBC, RTE Irish National Radio, CNN, NPR, CSPAN, CNBC, Bloomberg, Fox, and The Wall Street Journal.

He has contributed as an advisor on capital markets to the U.S. intelligence community, and at the Office of the Secretary of Defense in the Pentagon. Rickards is the author of The New Case for Gold (April 2016), and three New York Times best sellers, The Death of Money (2014), Currency Wars (2011), The Road to Ruin (2016) from Penguin Random House.

Russia’s Putin has never taken his eye off the ball.

His ambition is not global hegemony or European conquest. Putin seeks what Russia has always sought: regional hegemony and a set of buffer states in eastern Europe and central Asia that can add to Russia’s strategic depth.

In Syria, Russia has the warm water port of Tartus – which is important when you consider that most Russian ports are ice-bound for months of the year.

It is strategic depth — the capacity to suffer massive invasions and still survive due to an ability to retreat to a core position and stretch enemy supply lines – that enabled Russia to defeat both Napoleon and Hitler. Putin also wants the modicum of respect that would normally accompany that geostrategic goal.

Understanding Putin is not much more complicated than that.

In the twenty-first century, a Russian sphere of influence is not achieved by conquest or subordination in the old Imperial or Communist style.

It is achieved by close financial ties, direct foreign investment, free trade zones, treaties, security alliances, and a network of associations that resemble earlier versions of the EU.

Russian military intervention in Crimea and eastern Ukraine is best understood not as a Russian initiative, but as a Russian reaction.

It was a response to U.S. and U.K. efforts to attack Russia by pushing aggressively and prematurely for Ukraine membership in NATO. This was done by deposing a Putin ally in Kiev in early 2014.

The Russian-Ukraine situation is a subset of the broader U.S.-Russian relationship. Here, the opposition comes not just from domestic opponents but from the globalist elite.

Globalization emerged in the 1990s as a consequences of the end of the Cold War and the reunification of Germany.

For the first time since 1914, Russia, China and their respective empires could join the U.S., Western Europe and their former colonies in Latin America and Africa in a single global market.

Globalization relied on open borders, free trade, telecommunications, global finance, extended supply chains, cheap labor and freedom of the seas.

Globalization as it existed from 1990 to 2007 made steady progress under the Bush-Clinton duopoly of power in the U.S. and like-minded leaders elsewhere. The enemy of globalization was nationalism, but nationalism was nowhere in sight.

Larger picture: https://i0.wp.com/www.armenpogharian.com/wp-content/uploads/2015/08/map-of-most-valuable-exports-by-country.jpgThe financial crisis of 2007–2008, caused by the elites’ own greed and inability to grasp the statistical properties of risk, put an end to the easy gains from globalization.

Ironically, globalization gained in the short-run despite financial calamity. The same elites who created disaster were empowered to “fix” the situation under the auspices of the G20 Leaders’ Summit. This global rescue began with the first G20 summit hastily organized by George W. Bush and Nicolas Sarkozy, then the President of France, in November 2008.

Despite the financial bailouts and central bank easy money of the decade following the crisis, robust self-sustaining growth in line with pre-crisis trends has never really returned. Instead the world has suffered through a ten-year depression (defined as depressed below-trend growth), which continues to this day.

What little growth emerged was captured mostly by the wealthy, which led to the greatest income inequality levels seen in over 80 years.

Discontent was palpable in middle-class and working class populations in the world’s major developed economies. This discontent morphed into political action. The result was the U.K. decision to leave the EU, called “Brexit,” the election of Donald Trump, and the rise of politicians such as Geert Wilders in the Netherlands and Marine Le Pen in France, among others

What unites these politicians and political movements is nationalism. This can be defined as a desire to put national interests ahead of globalization.

Nationalism can mean closing borders, restricting free trade to help local employment, fighting back against cheap labor and dumping with tariffs and trade adjustment assistance, and rejecting multilateral trade deals in favor of bilateral negotiations.

This brings us to the crux of the U.S.-Russia relationship.

Simply put, Putin and Trump are the two most powerful nationalists in the world. Any rapprochement between Russia and the U.S. is an existential threat to the globalist agenda.

This explains the vitriolic, hysterical, and relentless attacks on Trump and Putin.

The globalists have to keep Trump and Putin separated in order to have any hope of reviving the globalist agenda.

Just as Trump and Putin are the champions of nationalism, President Xi Jinping of China and Chancellor Angela Merkel of Germany have emerged as the champions of the globalist camp.

Understanding this dynamic requires consideration of the paradoxical roles of Xi and Merkel.

Xi positions himself as the leading advocate of globalization. The truth is more complex.

President Xi is the most nationalist of all major leaders. He continually puts China’s long-term interests first without particular regard for the well-being of the rest of the world.

But, China’s relative military and economic weakness, and potential social instability, require it to cooperate with the rest of the world on trade, climate change, and supply-chain logistics in order to grow. Xi is in a paradoxical position of being nationalist to the core, yet wearing a globalist veneer in order to pursue the nationalist long game.

Angela Merkel, Chancellor of Germany is also in a paradoxical position — but the opposite of Xi’s role. Merkel knows Germany must embrace globalism both because of its unique historical burden of being the source of three major wars (Franco-Prussian, World War I, and World War II), and the necessity of German integration with the EU and Eurozone.

At the same time, Merkel has advanced her globalist agenda by promoting German interests through exports and cheap foreign labor.

For the globalists, the world breaks down into Manichean struggle between the nationalists, Trump and Putin, and the globalists, Xi and Merkel.

Globalists may be playing a two-sided game of nationalists versus globalists, but they need to widen the lens to see that the world today is really a three-party game.

There are really only three superpowers in the world today — Russia, China and the U.S. All other nations are secondary or tertiary powers who may be aligned with a superpower, neutral or independent, but who otherwise lack the ability to impose their will on others.

In any three-party dynamic, whether it’s a poker game or a struggle for global control, the dynamic is simple. Two of the powers align explicitly or implicitly against the third. The two-aligned powers refrain from using their power against each other in order to conserve it for use against the third power.

Meanwhile, the third power, the “odd man out,” suffers from having to expend military and economic resources to fend off adventurism by both of its opponents with no help from either.

China is the greatest geopolitical threat to the U.S. because of its economic and technological advances and its ambition to push the U.S. out of the Western Pacific sphere of influence.

Russia may be a threat to some of its neighbors, but it is far less of a threat to U.S. strategic interests.

Therefore, a logical balance of power in the world would be for the U.S. and Russia to find common ground in the containment of China and to jointly pursue the reduction of Chinese power.

Instead, the opposite seems to be happening. China and Russia are forging stronger ties while the U.S. finds itself at odds with both Russia and China over different issues. This two-against-one strategic alignment of China and Russia against the U.S. is a strategic blunder by the U.S.

Some analysts may be surprised to see Russia on the superpower list, but the facts are indisputable.

Russia is the twelfth largest economy in the world, is one of the three largest energy producers, has abundant natural resources other than oil, has advanced weapons and space technology, an educated workforce and, of course, has the largest arsenal of nuclear weapons of any country.

Russia has enormous problems including adverse demographics, limited access to oceans, harsh weather, and limited fertile soil. Yet, none of these problems negate Russia’s native strengths.

Russia is also the world’s largest oil producer, with output of 10.6 million barrels per day, larger than both Saudi Arabia (10.5 million barrels) and the United States (9 million barrels).

Russia has the largest landmass of any country in the world and a population of 144 million people, the ninth largest of any country. Russia is also the third-largest gold-producing nation in the world, with total production of 250 tons per year, about 8% of total global output and solidly ahead of the U.S., Canada and South Africa.

Contrary to many analysts’ perceptions, Russia is on a sound financial footing. Russia’s government debt-to-GDP ratio is 12.6%, which is trivial compared with 253% for Japan, 105% for the United States and 68% for Germany.

Russia’s external dollar-denominated debt is also quite low compared with the huge dollar-debt burdens of other emerging-market economies such as Turkey, Indonesia and China.

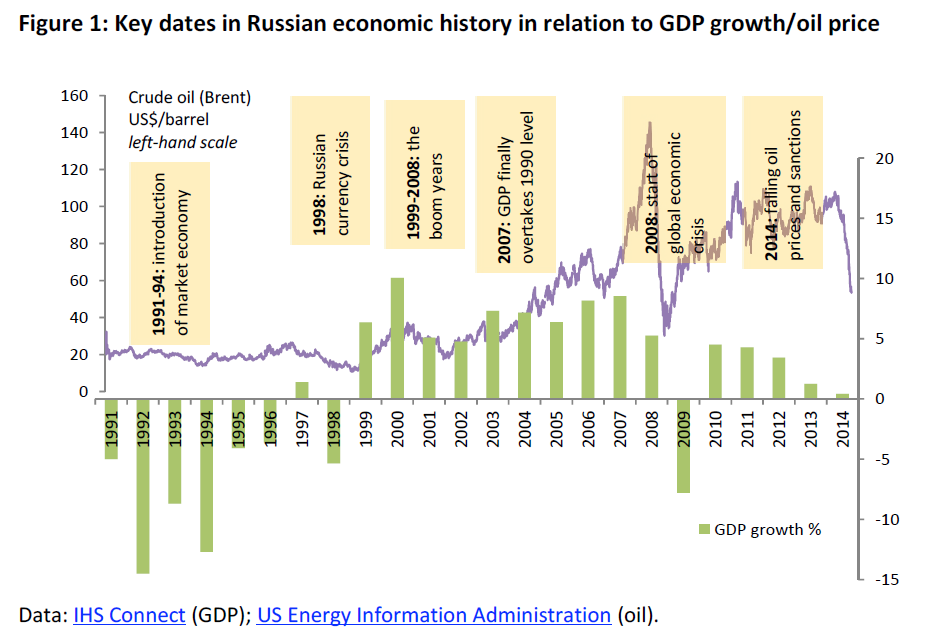

Under the steady leadership of central bank head Elvira Nabiullina, the Central Bank of Russia has rebuilt its hard currency reserves to $455 billion after those reserves were severely depleted in 2015 following the collapse in oil prices that began in 2014.

Even as Russia’s foreign exchange reserves dropped from $525 billion in late 2013 to $355 billion in mid-2015, Nabiullina never stopped acquiring gold for the central bank.

Total gold reserves rose from 1,275 tons in July 2015 to almost 1,900 tons today. Russia’s gold-to-GDP ratio is the highest in the world and more than double those of the U.S. and China.

Russia’s exports are not highly diversified, consisting mostly of oil and natural gas. Still, Russia is highly competitive in the export of nuclear power plants, advanced weaponry and agricultural products.

This export sector produces a positive balance of trade for Russia, currently running at over $16 billion per month. Russia has not had a trade deficit in over 20 years.

More to the point, Russia is a nuclear superpower on par with the United States and well ahead of China, France, the U.K. and other nuclear powers.

With this economic and geopolitical backdrop in mind, what are my predictive analytic models saying about the prospects for the Russian economy and its markets in the months ahead?

Right now, the Russian economy is poised for strong growth, which will be reflected both in higher Russian stock prices and a stronger Russian ruble.

The biggest single factor leading to this conclusion is the high level of real interest rates in Russia.Right now, the central bank policy rate in Russia is 7.25%. Inflation is only 2.20%, slightly higher than in the U.S. and Europe but rock-bottom compared with many past inflationary episodes in Russia.

As a result, the real interest rate in Russia is 5.05% (7.25% policy rate minus 2.20% inflation equals 5.05% real rate).

By way of comparison, the real rate in the U.S. is only 0.15% (1.75% policy rate minus 1.6% core inflation equals 0.15% real rate).

This high real rate gives the Central Bank of Russia enormous ammunition to stimulate the Russian economy with a series of rate cuts.

At a time when other major central banks such as those in the U.S., U.K., Japan and Europe are taking steps to tighten monetary policy through rate hikes, forward guidance or asset purchase tapers, Russia will be the only player that can actually produce monetary ease.

[Y

This is important in the case of a geopolitical event or global liquidity collapse, Russian government bonds will still be liquid and may be used to reliquify Russian assets and also possibly its partners just like the US Federal Reserve did to Wall Street in 2008. Russian bonds (and the ruble) would in this scenario be backed by gold and non-convertible to useless paper currencies. This will give it enormous clout in the new world economy.

-Y]Also, Russia’s success in working with OPEC, especially Saudi Arabia, to maintain oil production quotas has put a floor under oil prices for the time being.

This means that Russia’s reserve position will continue to grow. This gives the Central Bank of Russia room to cut interest rates without having to worry about capital outflows and a weak ruble.

This coming policy ease and stimulus from the Central Bank of Russia will be a major catalyst for capital inflows and a much higher Russian stock market.

Notwithstanding the prospect of improved relations, Putin remains the geopolitical chess master he has always been.

His long game involves the accumulation of gold, development of alternative payments systems, and ultimate demise of the dollar as the dominant global reserve currency

Jim Rickards

The Daily ReckoningCitations

[1] https://www.zerohedge.com/news/2018-04-12/russias-real-endgame

[2] https://dailyreckoning.com/u-s-reaching-russia-not-risking-war/Nice.

It’s good to see articles about what’s going on in the world without the spin and hype.

Thanks for posting.

If push comes to shove, Russia would deploy its latest missile tech, detonate a powerful EMP weapon over the U.S and send it back to the dark ages.

They’d wait until the inevitable self-destructive chaos that would ensue and waltz right into a hot war with a tech-debilitated U.S military and wipe it out in a day.I believe that’s exactly what would happen if the government of Russia runs out of all diplomatic options with the United States.

Don't let them Blame, Shame or Tame you!

Give 'em NOTHING, not even an answer!

#GenderSegragationNow!If push comes to shove, Russia would deploy its latest missile tech, detonate a powerful EMP weapon over the U.S and send it back to the dark ages.

They’d wait until the inevitable self-destructive chaos that would ensue and waltz right into a hot war with a tech-debilitated U.S military and wipe it out in a day.Agreed about EMP but the best place to detonate would be at both poles to scramble all satellite communications. A sub at both poles would do the trick nicely. I am sure Russia have comm backups in place for this.

Agreed about EMP but the best place to detonate would be at both poles to scramble all satellite communications.

ONE EMP detonation powerful and high enough above the country would render any communication with satellites useless as the surface hardware would be fried, even if the satellites are untouched.

Don't let them Blame, Shame or Tame you!

Give 'em NOTHING, not even an answer!

#GenderSegragationNow!Agreed about EMP but the best place to detonate would be at both poles to scramble all satellite communications.

ONE EMP detonation powerful and high enough above the country would render any communication with satellites useless as the surface hardware would be fried, even if the satellites are untouched.

True – but the USA has an alternate CENTCOM in the Antarctic plus do not forget US forces all over the world would still be functional. The Russians/Chinese need to take out as many satellites as they can to be sure.

True – but the USA has an alternate CENTCOM in the Antarctic plus do not forget US forces all over the world would still be functional.

True, but if we know about it you can be sure the Russians have it it targeted as well. And those troops in foreign lands, without a central command, would be sitting ducks without clear and pertinent orders on who to hit and where. It would certainly be a mess.

Don't let them Blame, Shame or Tame you!

Give 'em NOTHING, not even an answer!

#GenderSegragationNow!What the those individuals so focused on destroying Russia do not realize is Russia is playing second fiddle to China.

If these individuals are able to drive Russia out of the Middle East without starting a war, then China will move into the Middle East to fill the power vacuum.

China has already negotiated with the governments of Iran, Pakistan, Sudan, Somalia and Kenya where China has built, or is in the process of building military bases and naval ports: https://en.wikipedia.org/wiki/String_of_Pearls_(Indian_Ocean)

China is ready to make its move into the Middle East, all China is waiting for is the proper excuse to do so.

Then, said individuals will have to make a hard choice of whether the power they hold in the Middle East is more important than the factories they control and profit from in China and the rest of Southeast Asia.

If these individuals are able to drive Russia out of the Middle East without starting a war, then China will move into the Middle East to fill the power vacuum.

I would not say that exactly although I agree that China would try as you say to fill in the void – militarily.

China however is not militarily that adept (as yet) and that is not their intention at this point in time. Big Brother Russia is doing all the heavy lifting to keep the wolves at bay and China on working on the other more important angle.

China’s role in the Russia -China partnership is to take down the US economic hegemony. The CIPS payment system to replace SWIFT, the AIIB to replace the IMF, the petroyuan futures to replace the WTI futures and SGX for gold to repalce COMEX/LGX.

There are no better businessmen than the Chinese – they were born for business. They can do this if they have the military cover from Russia.

China is making sure the dollar alternatives are there for the time (very soon) when the ME starts selling oil in yuan.

That is the reason the US is going into Korea – it has nothing to do with Kim. The US cannot have China complete this yuan pertodollar and the OBOR initiative. The Pacific theatre is one where the US have never won after WWII. China has that area covered. Kim is acting out his part.

When that stalled now Washington is trying Iran –> Russia –> China. This is desperation. You can see it..

China intends to start yuan – oil trades later this year and Washington is terrified.

No f~~~ing way bro. My money is on the Stars & Stripes to prevail. America is top gun, son.

Russia is an American allie, there will never be a hot war with Russia, period.

There’s an old saying: Russia is not as strong as it seems, or as weak as it seems. Their military power is what keeps them relevant, since their economy is one-tenth the size of the United States.

No f~~~ing way bro. My money is on the Stars & Stripes to prevail. America is top gun, son.

Russia is an American allie, there will never be a hot war with Russia, perio

The purpose of the AngloZionist Empire is to dismantle Russia and carve up the resources as they have done to the citizens of the USA and EU.

They will try everything including a war since they are not sane. It is only a matter of time for this war unless the US economy crashes first.

There’s an old saying: Russia is not as strong as it seems, or as weak as it seems. Their military power is what keeps them relevant, since their economy is one-tenth the size of the United States.

Russia is not looking to exert an Empire. They are able to defend themselves if attacked, History has shown this. If the Empire wants to commit suicide and launch a nuclear strike they are ready for that too.

Their economy cannot be compared to the US in terms of size but that is not the point. The point is they have sufficient resources and means of production to survive a global monetary catastrophe. The US will be the first to collapse under a mountain of debt. No country is going to continue to supply goods for a piece of paper. Already the US bond market is in trouble this year – the overseas buyers are staying away. The end game may be closer than most people think.

- AuthorPosts

You must be logged in to reply to this topic.

921526

921524

919244

916783

915526

915524

915354

915129

914037

909862

908811

908810

908500

908465

908464

908300

907963

907895

907477

902002

901301

901106

901105

901104

901024

901017

900393

900392

900391

900390

899038

898980

896844

896798

896797

895983

895850

895848

893740

893036

891671

891670

891336

891017

890865

889894

889741

889058

888157

887960

887768

886321

886306

885519

884948

883951

881340

881339

880491

878671

878351

877678