This topic contains 10 replies, has 8 voices, and was last updated by ![]() Badger 3 years, 9 months ago.

Badger 3 years, 9 months ago.

- AuthorPosts

I would love for some of our wiser members share their stratagems. How can men set themselves up for financial success?

What to invest in?

What to do with the money?

Please share your secrets.

Love is just alimony waiting to happen. Visit mgtow.com.

Have PM’ed you bro.

The guys in I think it was this book,

http://www.amazon.com/Wizards-Wall-Street-Kirk-Kazanjian/dp/0735201544ALL recommended reading THIS BOOK!

Quotes from Reminiscences of a Stock Operator (Jesse Livermore)

"It seems like there's times a body gets struck down so low, there ain't a power on earth that can ever bring him up again. Seems like something inside dies so he don't even want to get up again. But he does."

Anonymous1I would like to know how much you men start off with. I have 20 k that I would like to do something with. I know it is not a lot but we have to start somewhere.

My strategy is to collect assets that produce cash flow on a monthly or daily basis:

Rental property is great. You can always hire a property manager to deal with the headaches if you want to be mobile.

Virtual real estate is even better. I’m currently pivoting in this direction.

-websites

-apps

-software

-products you can sell 100% onlineLIQUIDITY is also highly important. You need liquid reserves that can be sold instantly to get you out of any jams or slowdowns.

As a rule I make sure 50% of my liquid reserves are in assets with no counterparty risk. Meaning you are 100% in possession.

-Cash is king. That means physical cash outside of the banking system

-Silver coins and bars!!! In my opinion superior to gold. (unless your a millionaire- then your effectively forced into gold)

-cryptocurrency (mainly bitcoin). It’s like holding gold in a swiss bank account that follows you anywhere on earth.

The rest of my liquid reserves I keep primarily in commodities. Commodities outperformed stocks and bonds in the last decade and I suspect they will continue to do so.

I took a big position on oil when it dropped to $30. Sugar, wheat, corn, coffee, cotton, etc. Just buy everything.

I figure if the economy picks back up, the world will consume more commodities. And if it continues to tank, you’ll need hard assets that can’t be printed to infinity.

I stay away from publicly traded stocks/bonds. The “public” is going to get slaughtered during the next downturn.

Central banks pull trillions out of their hat, but investment banks like Goldman Sachs borrow trillions from the central banks at 0%.

They then pump those trillions of free currency units into the stock and bond markets. It’s like weekend at bernies… Those markets are being propped up artificially.

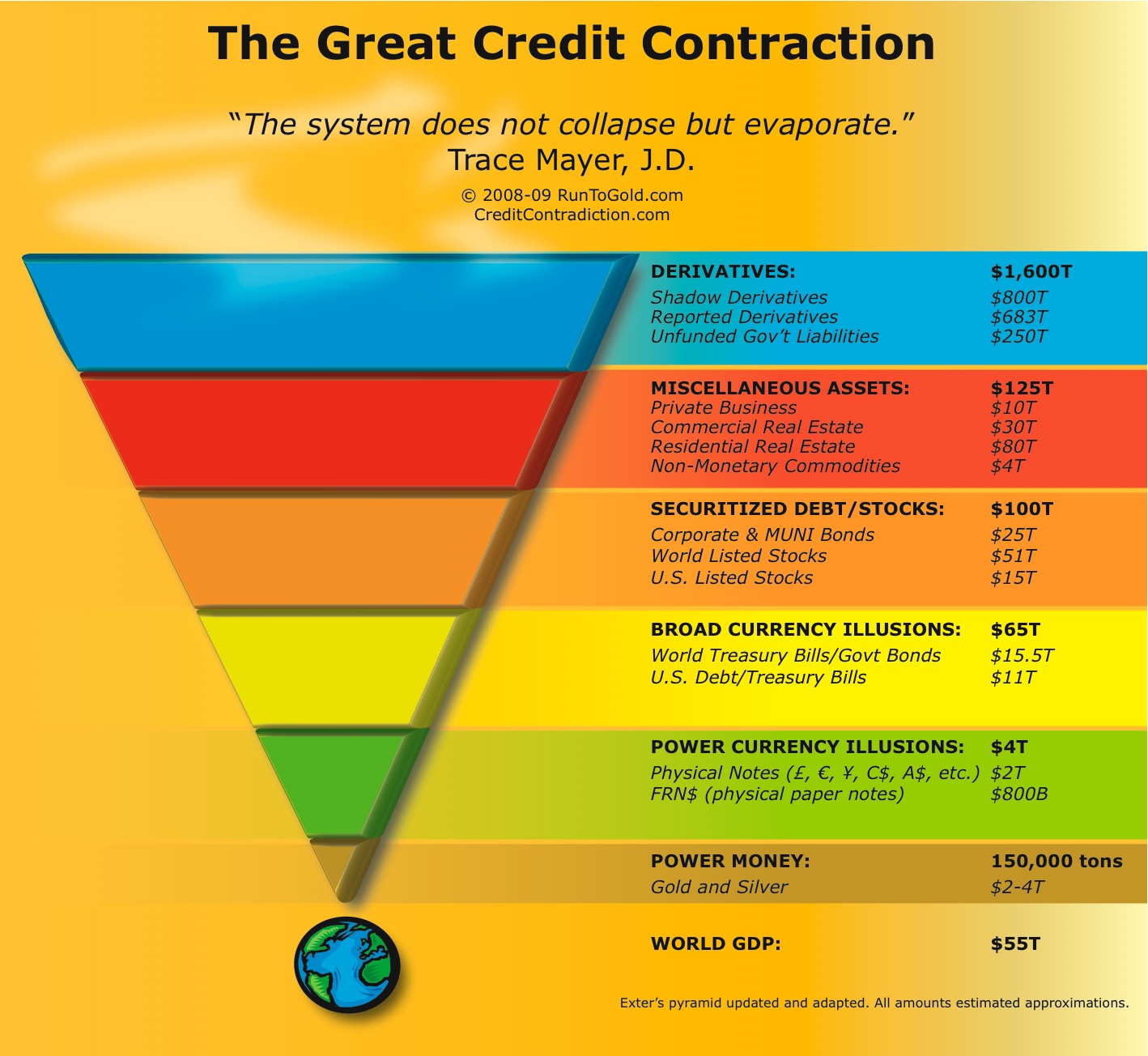

Overall this is a very risky time for capital. We seen a credit expansion during the 80’s and 90’s. Now we are going through the great credit contraction.

This means money is now flowing down the liquidity pyramid to safer and more liquid assets.

Not my property... Not my problem

I would like to know how much you men start off with. I have 20 k that I would like to do something with. I know it is not a lot but we have to start somewhere.

20k is a great start! Good job.

I would start by stashing 10k into highly liquid instruments.

Silver, Cash, Bitcoin (sorted by least risky to most risky)

Bitcoin is very promising but still being developed. In 5-10 years, a single Bitcoin will either be worth millions or nothing at all. The more you know about this technology the less risk you have.

————————-

As for the other 10k, I would put it into private equity(stock) or private bonds…

Not to be confused with publicly traded equities or bonds.

The best way to do that is start a business. That’s private equity.

Or if you know any businessmen you can trust, you can loan them money at interest (private bond), or invest in their business for an equity stake (private equity).

Rental property is also a great move if you plan on being in the same location for the long term. Buy a duplex to get yourself started.

My tenant pays my mortgage for me. Sure I have to maintain everything but its far cheaper then renting.

Most months I just collect the rent and it pays 90% of my mortgage. In time I will move out, rent both sides out and hire a property manager to deal with the bulls~~~. They take a 10% cut and just drop the rent checks into my account every month.

The best investment you can make is not financial. Invest in your own knowledge. Information is key in the Information Age. Read Read Read. Question everything.

Not my property... Not my problem

You have to develop some foundations first. It’s all about finding out what kind of investor you want to be, and what you’re capable of. You don’t want to get into stuff that you are not interested in, or have to put more energy into it than you’re willing. So, I recommend some foundational quick reads before you start picking stuff. Try these two books first:

-Rich Dad Poor Dad by Robert Kiyosaki

-The Cashflow Quadrant by Robert KiyosakiThey are great reads to undo all the conventional wisdom programming you’ve been exposed to your whole life. Then…

.

-Learn income taxes. Take the H&R Block tax course. It’s worth it for the books alone. It doesn’t mean a hill of s~~~ to make a ton of money if you can’t keep it, or use it in a tax efficient way.

.

Lastly, devour as many investment idea books as you can. You will find what interests you and what you’ll be good at. Learn about dividend stocks, growth and income stocks, growth stocks, life insurance, gold and silver, land, options, etc.

.

Then… Bring your ideas here, and let’s kick them around!

.

When I started keeping track, I was $55,000 in the hole. That was about 9 years ago. I started my Roth IRA with zero dollars and a commitment to put $50/mo into it. Today that Roth has $51,000 in it, I’m debt free and have $242,000 in total assets. There’s a lot more to that story, but the point is, that’s where I started.What’s my area of interest? Individual stocks, bullion, life insurance, taxes, and bare land.

***Stocks

I never liked paying mutual fund fees, and I hate the idea of being spread so thin you never hit it big. I also hated owning stock in companies I knew were s~~~. So I started trading my own. And I made a lot of mistakes. But I got better.

.

–Dividend stocks: Avoid high yielders. You will eventually get burned. End of story. If it’s over 5%, you’re playing with fire. That said, look for dividend “growers.” Some great examples from my portfolio are TRV, DE, MON, MMM, LMT, DOW, CVX, PFE.

.

–Growth stocks: Look at the three year operating cash flow history for solid ability to grow cash. I picked up AMZN, GOOGL, TSCO, AAPL, PCLN, when they were all in the dumps with the broad market and have made killings in the last couple years. The key is to buy the good companies during bad times. It’s not easy and it’ll take a long time to find an opening. And don’t ever move everything at once. You’ll always get it wrong. I move in small bites and it’s made the mistakes smaller, and unlocked better prices to buy later.

.

**Life Insurance

Those who don’t understand it will tell you it’s a s~~~ investment. It is a s~~~ investment, just like a couch cushion makes a s~~~ty snack. When you learn how to use it as a multi-functional tool, it’s a great part of a portfolio. It’s a good alternative to money in the bank. The key thing is to buy the right policy, from the right company, and the right amount.

.

I use a fraternal organization so they don’t have to pay shareholders, only you. Study the “Modal Paid Up Addition” rider. It allows you to buy less insurance and put more cash into the policy. Then with the right company, you can borrow from it and also use it as tax free retirement income when you’re older. You will get all your money back, will also make modest income over time, eliminate the bank, and short the tax man. It’s also a good conservative leg in your portfolio in case everything else crashes.

.

**Bullion

I’m a gold, silver, platinum bug. I only buy stuff that has a widely accepted value. Stay away from the historical and “collector” stuff. The values are not set in stone. I buy silver bars, silver eagles, gold eagles, and platinum half oz eagles (not recently, way too much markup.)

.

**Land

Bare land only. There are good and bad land deals. I am interested in wooded hunting land where I am. The government is buying it up so fast, there will not be much left in a decade or so, that is, except mine. Farm land is still in a terrible bubble and will likely stay there because the guys that inherited land will forever be better off than renters and keep paying way too much for it because they have nothing better to do with their money, and they are terrible investors.

.

**Taxes

There is a lot to learn, but it’s worth the time. Know the state you live in, and the states you may live in. Learn the dividend tax, capital gains tax, marginal tax rates, rollovers, conversions, re-characterizations, health savings accounts, etc.

.

—I have been on a plan to convert my old 401k to a roth ira for two years now. I took most of my deductions at 35% while in a high tax state. I now live in a tax free state making less money, so I am taking the opportunity to pay the tax now at 25% beings that I may move back to the high tax state later in life. That and I don’t want to pay taxes when I’m older and don’t want to work or worry about it.

.

—I keep a portion of my portfolio in a plain brokerage account. I earn dividends that are taxed at a lower rate, and it gives me capital that I can draw on that isn’t going to cause a major tax headache like a 401k withdrawal down the road. It also gives me more options for early retirement income if I pull the plug before 59 1/2.

.

—HSA’s. I maxed my HSA contribution for 9 years. It allowed me to accumulate $23,000 in that account. When I switched jobs, I was able to move it to a brokerage where I could invest it as I saw fit, and now I’m pulling down $700/yr in growing dividends and I’ve hopefully got another 25 years before old age medical needs kick in.Hi. I fully agree with @sovereign and @whackerguy2030

However before anyone starts investing I would highly recommend them to understand the fiat currency system first. “Guide to Investing in Gold and Silver” by Mike Maloney is 80% about the currency system and how they scam us, plus the videos “Hidden Secrets of Money” series on Youtube (I have posted the first of the series in this forum).This is not about gold and silver. The fundamentals are important if you want to invest for yourself.

Last and most important advice on being wealthy and of sound mind and body – never get hitched to a female EVER.

Good luck.

One of the first things you should find out is your risk tolerance. There are articles and quizzes on the Internet that one can take to discover if they are conservative with regard to losses, or more tolerant of losses on more risky assets. There are good strategies for whatever your risk tolerance might be. You then can research for those strategies.

Because of my life history, I was not really able to start investing until my late 30s. I am very risk tolerant. At one point early on I was losing $10K, but never flinched at my strategy.

Currently, I search the Internet for mostly Canadian mining stocks. Moreover, I look for stocks that have wealthy sponsors — Ross Beaty, Ernesto Echavarria, Keith Neumeyer, Pierre ?LaSondde, etc. and are in a safe country. It takes some digging, but the info is there if you look for it on blogs and press releases. The same for other areas for stocks in technology. If the company, though small, has big money behind it, they are likely to survive, and perhaps thrive.

I have done extremely well despite never having a salary beyond that of a librarian. It is not the amount you start with ($1,000 in my case), but the research and leverage you get from buying when the price is cheap.

I use the Genstein Formula and Coppock Curve to monitor when the overall Dow Jones Industrials are over or under valued. Right now both indicators show a declining trend. Precious metal stocks are generally counter cyclical to the overall stock market. You can see this at InvestmentTools.com, where the Dow/Gold Ratio shows that trend clearly. That site also shows that the ratio is declining.

These stock market movements are slow and deceptive. I suggest you go to zeallc.com and read the essays on Long Valuation Waves by Adam Hamilton. He can explain it better and more thoroughly than I can. John Hussmann at 321gold.com also is a good person to monitor. He always seems alarmist, but people ignore warnings before a market crash, and no one knows exactly WHEN the market will decline. Another person at 321gold to read is Stewart Thomson, not because you should invest in precious metals, but because he repeatedly says to succeed you must BUY WEAKNESS, SELL STRENGTH! That is much harder to do than you might think.

It takes a kind of reverse psychology to understand how all the media and pundits influence you to do the wrong thing. Just like casinos, they learn your every weakness and errors. Casinos set up the high paying slots at a point where the maximum number of other players can see the machine, so that when a big jackpot is scored, everyone can see it. Never play two slots side by side. They are alternated to have a low payout on one. Likewise with the stock market — everything you do is analyzed for weakness. They siphon off your money if you do not follow the rules.

I refused to engage in day trading, options, or any other type of market hyperactivity. You cannot easily beat those systems. The insiders know what trades you make, what trading program you are using, and all of your psychological weaknesses. Those programs might seem exciting, but they slowly drain away your money. There are studies on the Internet that show that few people can master day trading or options if they are not insiders. Investing for the average person should be dull if it is to be profitable.

I would strongly suggest that you obtain a copy of Willard and Marguerite Beecher’s BEYOND SUCCESS AND FAILURE: WAYS TO SELF-RELIANCE AND MATURITY. Read the reviews for it on Amazon.com. You will see that this is a highly praised book that will help you to master investing and other situations in life, including women. The first 300 pages of Wendell Johnson’s PEOPLE IN QUANDARIES might help you to better state and clarify problems that you confront, both at work and in your personal life. I have found both books to have been the most invaluable ones in my seven decades. I have read and reread them countless times. Read the reviews on Amazon.com for Johnson too.

You are more likely to get rich slowly but surely, rather that trying to hit the jackpot in a year.

I forgot to mention that if you are still very young, I would strongly suggest that you consider opening a Vanguard stock index fund with the Standard & Poor 500 stocks. The rationale for this was given by Jon Bogle, the Vanguard founder. You can search the Internet for him for his reasoning, or purchase his books. Basically, he is correct in saying you will save enormous amounts of money because their transaction fees for index funds are extremely low. Vanguard is employee owned, and I would prefer it over Fidelity or other funds that are not. Most important, you CONTROL your money in that fund — more about that later.

Your employer will try to convince you to contribute the maximum amount to their IRA or 401(k) plan. I made that mistake. Their fees are higher than Vanguard, their choices are limited, and you DO NOT CONTROL your money. Furthermore, when you retire, as I have, the Federal government puts a gun to your head at age 70 ½ and demands that you annually withdraw a specific amount, whether you want to and even if you don’t need to. If you don’t comply, they smack you with a huge penalty. Furthermore, if the market crashes before you can make your mandatory withdrawal, you are taking the money at the worst possible time. It reduces even more the remaining balance in your fund. Additionally, the market might be rising, and you are forced to sell before you want to, losing more gains plus paying taxes, so you can’t purchase back the same number of shares.

CONTROL of YOUR money is critical. They seize control of YOUR money but claim they have a right to make the rules. I withdrew ALL of the money in my 401(k) before hitting the mandatory age and invested it on my own. It has paid off immensely. I can sell when I WANT TO, or just leave it alone if it is appreciating. You still might be forced to contribute a minimum amount to a 401(k) despite your objection. There is nothing you can do about that, but I would never go beyond that minimum amount. It takes discipline to either save of set aside an amount from each paycheck to put it in a Vanguard S&P500 index fund, but believe me, by the time you hit age 50, you will be sitting pretty if you do so.

Many sources suggest that you “dollar cost average,” which means each pay period you add a specific amount to your index fund. This means investing during market gains and declines. You are solemnly warned that “you cannot time the market.” That is true for the majority of people, who have no insight into market dynamics and who have never done deep research into the problem. I mentioned the Coppock Oscillator and Genstein Formula above that can help show you when the overall market is over or under valued.

- AuthorPosts

You must be logged in to reply to this topic.

921526

921524

919244

916783

915526

915524

915354

915129

914037

909862

908811

908810

908500

908465

908464

908300

907963

907895

907477

902002

901301

901106

901105

901104

901024

901017

900393

900392

900391

900390

899038

898980

896844

896798

896797

895983

895850

895848

893740

893036

891671

891670

891336

891017

890865

889894

889741

889058

888157

887960

887768

886321

886306

885519

884948

883951

881340

881339

880491

878671

878351

877678