This topic contains 12 replies, has 10 voices, and was last updated by ![]() Y_ 2 years, 11 months ago.

Y_ 2 years, 11 months ago.

- AuthorPosts

Hey guys. Gotta get something off my chest.

Years ago, when i first moved to NYC, mid-20s. Was dating a girl. Spent tens of thousands of dollars on her. Plus paid for it all while she & i were living together.

She dumped me. I spent a few years smashing my career in NYC. Made more money. Then i started dating a chick i’d eventually marry. Spent way too much money on her. Spent even more on the divorce.

But here’s the thing. All those extra hours i worked, i got two things:

1) Experience.

2) Bonuses/raises from all of MY hard work & long hours.#1 i still have. #2’s gone. After my divorce i was flat broke. And i was only married for 2 years.

I paid her. I paid lawyers. I paid the f~~~ing IRS because she filed first, separately (and i was still withholding at the married rate – my bad, i know) so i owed more in taxes.

Now that’s all over and done. I left the established bank a few months ago & now work for a startup. This is my first real bonus season. And it’s good. Not insanely great, but good. It’s better than back when i was consulting.

Everything i earn now is mine. No gfs or x-gfs or wives to spend it on.

To you younger guys out there. You don’t even have to make smart financial moves to get ahead. You just have to ***not*** make stupid decisions like i did.

No costs from marriage/divorce.

No costs from serious relations~~~s.

No credit card debt & live within your means.Do those 3 things, and you can retire early, guaranteed.

Anonymous42Nice…

Good for you man and i agree live within your means wherever possible.

It’s understandable that most people need a loan for a car but do you really need a Volkswagen Golf R that will get to 60mph in 5 seconds or will a ford focus or ordinary golf do what you need for less every month. Or at least get the GTI instead. If you can afford payments on a car of £400 per month the one at £200 per month and save the rest …

Same with mortgages.

http://www.leavemeansleave.eu

No costs from marriage/divorce.

No costs from serious relations~~~s.

No credit card debt & live within your means.Tatto this on your dick, so women can read it when you whip it out.

When women lead, destruction is the destination. -- Me.

All the ‘How To Become Wealthy…’ books don’t mean squat, they really don’t! The ticket to success is adopting a MGTOW mentality and securing sovereignty along the way. Even a MGHOW that spends without much forethought on himself will come out ahead compared to the married dude that has a bookshelf full of ‘How To Become Wealthy…’ books but also goes through divorce. Screw financially planning! Just become a MGHOW!

Know when it is your duty to give them zero explanations for your actions.

Very nicely done MattNYC.

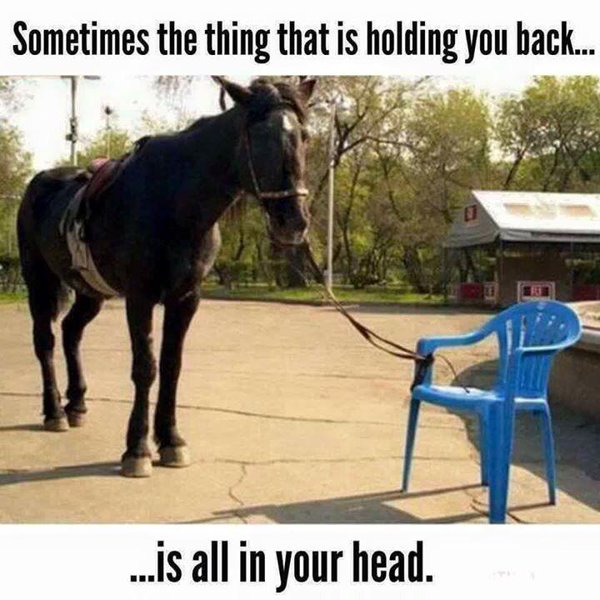

You just have to ***not*** make stupid decisions

Truth.

Since women are a liability, no relationship/marriage/divorce/cohabitation is an automatic WIN.

The AVERAGE working man can have $350K more in the bank by the time he is 50.

“The Wealthy Barber”. Good book too.

If you keep doing what you've always done... you're gonna keep getting what you always got.A key thing in life is surviving your mistakes. We will all make mistakes, big ones and little ones. And sometimes we make the same mistakes over and over again until we eventually learn.

Women’s Hypergamy, and how our Divorce Laws and Courts work is a WARNING

Ask yourself how many women have you dated make more money than you do?The laws and the courts favor the lower earning spouse when it comes to Alimony.

And the Courts almost ALWAYS favor women when it comes to Child Custody and Child SupportStatistics from the Census Bureau prove this beyond a shadow of a doubt.

Ask yourself – why its almost always women who push marriage, and its almost always women who file for divorce?

Answer –> MONEY

To you younger guys out there. You don’t even have to make smart financial moves to get ahead. You just have to ***not*** make stupid decisions like i did.

So true man. Most people never stop to think how painful debt is as far as your bottom line goes long term. Let’s just say person A has 100k in investments and person B has 100k in debt. Person A makes 6% next year, person B pays 6% in interest. The relative difference in bottom line between them is 12,000 a year.

If they both had a 50k a year job….person A could literally take off 3 months a year with no pay and have the same amount of money at the end of the year as person B.

Considering most of us will probably work for 40 years of our life…how big is 12k a year for 40 years equates to 480,000 dollars…almost a half million. Just by not financing a life you can’t afford on credit and tucking some money away…it can amount to a f~~~ing huge amount of money over a life time. You could actually buy more stuff over a life time paying cash for it than you could financing it all…or you could simply do with less and retire earlier.

Realistically though that is a rather simplistic way to look at it. Most of the people I know who are happy debt slaves seem to be constantly taking on new debt. Soon as a car is paid off they finance another one. Soon as they get some equity in their house they refi and blow it. The savers on the other hand…their money compounds. Just imagine that 100k comparison…only in 20 years Person A’s savings has grown to 300k where as Person B’s debt load has grown to 300k…add that same 6% again and the difference is now 36,000 a year. Person B would have to pick up a second job making 17 bucks an hour and work 40 hours a week just to make up the difference in what he is losing having debt vs not making interest. It definitely pays not to make bad money choices.

Everything i earn now is mine. No gfs or x-gfs or wives to spend it on.

The young guys think they’re bulletproof sometimes. Some will heed you. Others need to get burnt to know first hand not to play with fire.

Nice post. I am glad you got out ok. As I usually say – it could have been much worse. Now it will get a lot better. Cheers.

Thanks guys. I’ve been having this slow-moving manpiphany over the last 6 months or so; as much as MGTOW gives me the blank canvas so i can paint the life i want, i can’t help but think i should’ve been GMOW since i was 18. Where would i be now at 37 if i had?

Oh well. I f~~~ed that up. Most important thing now is that i learned that lesson & am using it to make the future better.

Thanks guys. I’ve been having this slow-moving manpiphany over the last 6 months or so; as much as MGTOW gives me the blank canvas so i can paint the life i want, i can’t help but think i should’ve been GMOW since i was 18. Where would i be now at 37 if i had?

Oh well. I f~~~ed that up. Most important thing now is that i learned that lesson & am using it to make the future better.

Hey its not that bad. If you got your s~~~ together now at 37 with no debt and are crushing the savings, you could still probably retire comfortably before 50 if you want…which considering most people +/- 15 years of you will work til they die or live off cat food in retirement…you are still doing awesome. Learning your lesson in your 30s is better than being in your 40s or 50s getting crushed by divorce, or even worse miserable, married, and broke in your 60s thinking what the f~~~ have I done with my life.

Your typical hardworking male can die a millionaire, and require no 9-5 job by his 30’s for the rest of his life without marriage. Especially if you invest young and reap the full benefits of compound interest.

If you’re married be lucky to retire by 65-70 with a couple hundred thousand dollars. Most of your income goes to you’re family. At least 30% but most men put about 90% to there family including their wife.

Dating, rings, weddings, honeymoons, marriage, children, divorce, child support, alimony, family vacations. Housing, clothing, transportation, utilities, maintenance, food, entertainment, education.

Oh well. I f~~~ed that up. Most important thing now is that i learned that lesson & am using it to make the future better.

Beer is right. As a MGHOW you make your own rules.

As a MGHOW life is one long retirement and you live as you wish. Since when do men live in 4 bedroom townhouses they cannot afford? No – you can and will be happy in a small rental if it suits you – and no one else.

At the end of the day it’s how satisfied you are with who you are and how much you end up enjoying the journey. The end result is six feet under – if you can’t enjoy the journey what is left?

- AuthorPosts

You must be logged in to reply to this topic.

921526

921524

919244

916783

915526

915524

915354

915129

914037

909862

908811

908810

908500

908465

908464

908300

907963

907895

907477

902002

901301

901106

901105

901104

901024

901017

900393

900392

900391

900390

899038

898980

896844

896798

896797

895983

895850

895848

893740

893036

891671

891670

891336

891017

890865

889894

889741

889058

888157

887960

887768

886321

886306

885519

884948

883951

881340

881339

880491

878671

878351

877678