This topic contains 10 replies, has 4 voices, and was last updated by ![]() Beer 2 years, 11 months ago.

Beer 2 years, 11 months ago.

- AuthorPosts

I wanted to share some financial insights I’ve learned recently. It’s my goal to see as many wealthy MGTOW as possible!

EFFICIENT MARKETS HYPOTHESIS is the most important piece of financial information you will ever read.

While I don’t agree that markets are 100% efficient- I find that it’s a great FRAMEWORK to view the world and capitalism in general.

What it states is that Markets Are EFFICIENT. Which is a fancy way of saying there is no free money in the universe!

And thats a GOOD thing!

What that means is that people are not stupid (or at least there are enough smart people out there), that if any hole in the universe opens up, where $$$ is made very easily, this HOLE IN THE UNIVERSE will close rapidly.

If there were a JOB or BUSINESS that was extremely profitable, smart people would notice, and many of them would enter this sector of the economy- UNTIL it was no longer insanely profitable…

This is also known as THE INVISIBLE HAND OF THE MARKET. Everyone wants to make EASY MONEY so people naturally pursue it.

If you do manage to make “easy money”, IT WILL NOT LAST. It never does and never will.

In general, if you want to make MORE MONEY, you will have to do one of 3 things:

1- WORK HARDER, OR WORK LONGER HOURS, OR WORK S~~~TY HOURS.

2- TAKE RISKS- this is why people that work on power lines make more than bartenders- and always will. Or why some drug dealers make good money.

3- BE HIGHLY SPECIALIZED LABOR- Go to school for 10 years to become a dentist, or surgeon, or some crazy IT s~~~- and you will make more than average.

The world is much more FAIR than you think. As you can see there are opportunity costs to everything. There is no such thing as a free lunch.

If any business begins to make obscene profits, enterprising individuals will quickly move in until those out-sized returns shrink to “average” or below-average…

HOW DOES THIS APPLY TO INVESTING?

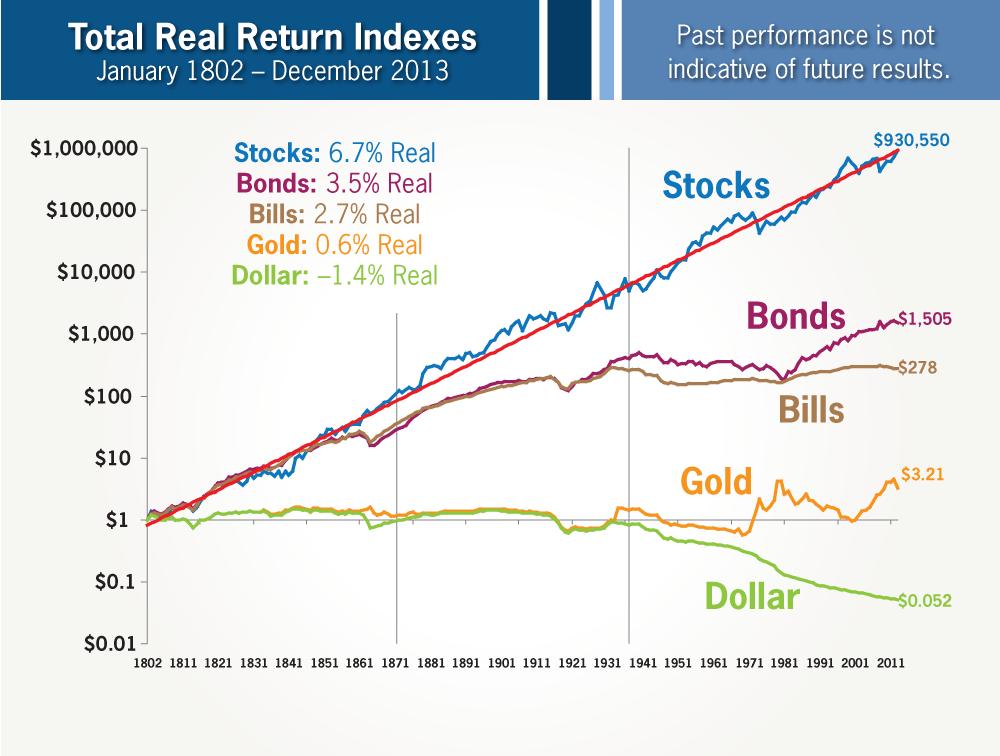

It is well known that STOCKS AND RENTAL PROPERTY are the BEST investment vehicles for the long term!!!

In fact, the MARKET AVERAGE for these investments is 9.2%

Where did I get this crazy 9.2% number you ask?

The S+P 500! The S+P 500 is what is called an “index fund” It’s the best way to invest in stocks. It consists of the top 500 companies in America and is diverse across ALL INDUSTRIES.

As soon as a company loses market share to a better company, it quickly gets replaced and is no longer in the fund.

Because it is DIVERSE across ALL SECTORS of the ECONOMY EQUALLY, you are guaranteed to capture the MAXIMUM amount of VALUE in each sector of the ECONOMY.

It’s also has the LEAST RISK because it’s equally diverse across all sectors. Someone is always making money, even during recessions.

Most people never figure this out. Everyone tries to “beat the market”, but it’s a well known fact that only 20% of active money managers BEAT THE MARKET.

Many manage to “beat the market” in the short term over a few years, but almost NONE beat the market over the long-term (30 years).

Keep in mind that you have to account for all those trading fees and money manger fees. And the time you spend researching stocks. Unless your time is worthless…

Financial advisers actually convince people to pay them 1%- and almost NONE of them beat the market.

Think about that. You pay a financial advisor 1% to under-perform the market- it’s idiotic! Every percentage you lose out on is potentially MILLIONS OF DOLLARS you are throwing away.

Keep in mind the actual returns are closer to 7% after you factor in inflation. And yes stocks will always beat inflation.

EXXONMOBILE doesn’t give a f~~~ if the dollar goes to s~~~, it will just raise prices accordingly. It doesn’t matter if we are using dollars, gold, bitcoin or seashells as currency.

Business will carry on one way or another. There is no universe where Apple or ExxonMobile dont make money over the long term.

In fact they have a FIDUCIARY DUTY to maximize PROFITS for their shareholders- and they will go to jail if they so much as leave a penny on the table…

Stop listening to the libertarian conspiracy theories!

These crazy gold-f~~~s have been saying the dollar will collapse and the world will go to s~~~ for the last 40 years. Seriously.

Look up some old peter schiff or doug casey interviews. These guys have been saying that s~~~ since the 70s.

It will never happen. If it does it’s not a big deal- we will just swap out the currency for another one.

Real Estate tends to do a bit better, but once you factor in all the maintenance and lost time it’s actually very difficult to beat the stock market over time.

Personally, I love rental property for diversification if nothing else. Can’t beat the steady cash flow but it does cost more, and it is immobile. Closing costs are expensive, and there is more liability.

But THE MARKET FACTORS ALL THAT IN!!! Because markets are efficient…

If you are not getting 9.2% over the long run you are scamming yourself. Do not throw all your money in gold based on some IDEALOGY.

Yes fiat currency is a scam. No you will not get rich buying gold.

Throw all your money in gold if you want to throw away millions of dollars in compound interest over the course of your life. I do own some PM and physical currency but not a substantial amount.

If you want to try “beating the market”, go ahead and pick stocks. Have fun competing against Warren Buffett and hedge funds that employ 30+ investment analysts each.

They sit at computers ALL DAY, reading and crunching numbers. You will not beat them. Most professionals don’t beat the market, neither will you (over the long run). Good luck trying.

Now I’m not saying don’t take easy money if you stumble across it! If you happen to spot a $100 bill lying in the street, by all means pick it up and put it in your pocket.

Just don’t waste your life looking for “easy money”. The opportunity costs will eat you alive.

If anyone tells you you can make OUTSIZED RETURNS (above 9.2%), you are likely being scammed by a bernie madoff.

Typically if you beat the market you are probably taking excessive risk (and could easily lose big too). Or you are involved in something that requires a MASSIVE amount of specialized knowledge like Bitcoin. Or a mixture of both. Or you got lucky.

The stock market is not a scam. Just don’t invest in crazy derivative nonsense or s~~~ you don’t understand- like Collateralized Debt Obligations or Mortgage-Backed Securities- and you will be just fine.

It’s a fact that pretty much everyone older than 16 buys stocks. The smart ones invest in the S/P 500.

Now I’m not saying the market is or isn’t overvalued right now. Many investors certainly think so.

What I’m saying is I have no f~~~ing clue if it is or not. I’m humble enough to admit I’m just an idiot on the Internet and I’m PROBABLY NOT SMARTER THAN THE MARKET.

I’m simply confident that over the long term I’ll be fine.

You should also know that Stocks are volatile and you will likely encounter 3 or 4 market “crashes” during your lifetime.

It’s not a big deal- s~~~ will rebound in 2-3 years. It always does.

If you are 5-10 years away from retirement, its time to switch some or all of your portfolio to BONDS, which return less but are more stable, less risk.

Now how can I be so sure that the stock market will rise and rise forever (with recessions along the way)????

Progress! Automation, computers, knowledge, etc etc. The economy is constantly getting more efficient. Take a look at the last 5000 years if ya don’t believe me.

The government will not rob your brokerage account. They would be shooting themselves in the foot in a big way. The incentives are aligned in your favor.

If they don’t let you make money the government will collapse along with their tax revenues. Their financial survival is tied to their citizens. There is no conspiracy.

Side Note: I’ve also learned over the years that most businesses are run by retards that don’t understand this s~~~. 80% do not beat the market and are therefore wasting their energy because they want to “be the boss” AKA poor…

Typically 80% of “businesspeople” think that there is free money in the universe and they are the guys to go get it. Good luck I say!

Take the average business. Add up the hours and the capital invested. Put that in the SP500 and you will find the average business underperforms. Often by ALOT.

Many retard business owners think they are getting rich but it’s usually because they forget to factor in their labor or they cherrypick the data.

That being said- I’m probably going to start a business later in life- once I’m retired in 5-10 years. I have a few ideas in mind.

Will I beat the market? Probably not although I’ll certainly try. I’m cool with making 5% if it means I can be my own boss and do more relaxing work then I’m doing now.

I will likely be giving up superior returns (opportunity costs) in order to relax and be my own boss. I don’t see a problem with that.

I’m simply going to wait until I have 3-4k a month coming in from stocks and rental property first. I will only play with what I can lose.

Hope you enjoyed!

Enjoy your 9.2% returns my MGTOW Brothers.

Not my property... Not my problem

Also I recommend VANGUARDS ETF. It has the lowest fee- .5%

Look for Stock Symbol VOO

Also do some research into ROTH IRAs. The tax benefits are considerable, but keep in mind you will be penalized if you withdrawl before you turn 59.5 years old.

Since you are MGTOW, and you understand EMH, you will likely be retiring earlier than 59.5.

The ROTH IRA only allows you to contribute $5,500 per year, so Jan-Feb I contribute and once I hit the limit, I switch to rental property or just a regular old brokerage account.

That way when I retire at 40 I can tap the dividends from the regular brokerage account, and I will just ignore the ROTH IRA until I’m 60.

Here is a link to a COMPOUND INTEREST CALCULATOR:

http://moneychimp.com/calculator/compound_interest_calculator.htm

Enjoy playing around with that- Be conservative. Assume the world WILL go to s~~~ and we will lose Reserve Currency Status and all that.

Even in worst case scenario, s/p500 will just return slightly less. Maybe 7 or 8%

Also keep in mind that 9.2% is the average over ANY 30 year period in the past 200 years. You will likely get some years that return 30%+, and some years you will go -30%.

In the long term you will be fine…

Not my property... Not my problem

Haha good call Stealthy. I’m cheap but not that cheap. My job isn’t that bad and I’m set to retire around 40 either way, so I can afford to enjoy life a bit.

Thanks to your lessons I didn’t fall for the disney dream vacation debt trap lol. I live good as f~~~ on $1200 per month and save the other 2/3rds lol!

Gotta spend a little and enjoy life. I’m going to Iceland in a couple days. $1500 for a single man. Would have been 3x that if I had a whore to bring.

Outside of a yearly vacation I don’t spend splurge on anything else. It’s nice seeing the world and eat a steak once in a while.

Not my property... Not my problem

By the way I was considering a garden… but markets are efficient.

No f~~~ing way I’m going to produce a cheaper tomato then a guy who SPECIALIZES.

Some guy out there spent his whole life mastering the art of growing tomatos… and his farm is probably huge with economies of scale.

I’m better off picking up extra hours at my job because I have a specialization there— no way tomato man going to do my job better than me and I cant do his job better than him.

Add up the hours you spend growing that food and the opportunity costs wont be worth it. Unless it’s a hobby and ya got time on your hands. hahah EMH is great.

Life is so fair. I look around at how smooth everything runs and thank god I’m in America.

Everyone has something to complain about- but life has never been more prosperous. Life expectancy at all time highs, crazy technology everywhere, driverless taxis almost here…

Specialized labor makes us all wealthier. Every see that story of the guy who made a chicken sandwich from scratch?

Cost him $1500 and 6 months- and he said it tasted like s~~~ anyways. LOL EMH for the win!

Not my property... Not my problem

Enjoyable read. Nice post! My only regret is I probably wasted 5 years with the mindset of developing my own business. If I had my time again I would have worked for someone the whole time and invested it. Anyone in their 20s who works hard, stays single and invests can easily be set by the time they are 40-45.

Ya live ya learn Chris. In fact you probably learned alot. More than if you wasted 5 years at college I’m sure.

Anyways I take my hat off to anyone that has the b~~~~ to enter the shark-infested waters that is entrepreneurship. If no one did that we wouldnt have all the crazy technology and efficient markets and good stuff we have today!

I have a feeling entrepreneurship was probably a hell of a lot easier even 50 years ago. Nowadays big companies come in and dominate most major markets. Which is probably a net benefit to society as it means cheaper goods and more efficient services for us all.

Now we can just buy stock in those big companies, relax after 5PM and turn the brain off. I dont envy business owners at all lol.

Not my property... Not my problem

Good post!

I find it somewhat funny that all my friends around my age (31) are all super scared of the stock market

One has even gone so far to say: I don’t gambleI show him my returns and he says “Won’t last forever”

…Ummm, it’s lasting now, sure, I will diversify when I feel the time is right, but for now I’m riding the waveI think it’s done intentionally to keep younger people more broke than ever.

I do however think a “correction” may come October 2017 or Oct 2018…They will blame Trump, of course.

I find it somewhat funny that all my friends around my age (31) are all super scared of the stock market

One has even gone so far to say: I don’t gambleI show him my returns and he says “Won’t last forever”

Yeah I’m the same way. I’m 33 and most the people I know around my age laugh at me that I put money in the market like I’m making some stupid choice…as they spend all their money on cars, vacations, and cell phones, and put the minimum into their 401k to get their match and don’t even know what they are investing it in. I’m just like wtf morons…that is your future…why not educate yourself about it a bit, and they’re just like OMG did you see what Kim Kardashian wore last weekend?

I think for a lot of them though its just an excuse…like a fat person shaming a fit person. They aren’t smart with their money for whatever reason…so its easier to just act like those who are smart with their money are the dumb ones.

I also think a lot of them just fail to see the big picture…like if you put away 5,000 this year and make 10%…you make 500 bucks. In the long run that 500 bucks isn’t a ton of money, a lot of people would rather just have a vacation and a new cell phone right now rather than nothing right now but a free 500 dollars in a year…but next year if you have that 5500 and stash away another 5,000 and make your 10%…you just made 1,050 bucks. Do it again a third year…you made 1655. Basically if you look at it long term its not going to take long for your 5k a year investments to start yielding more in returns each year than the 5,000 you invest. The way I see it…why not get that passive income working for you soon as you can? You’ll have more money over the course of your life time by making a few sacrifices while you are young as compared to blowing all your money young and playing catch up later in life…yet almost nobody wants to do it that way.

Now we can just buy stock in those big companies, relax after 5PM and turn the brain off. I dont envy business owners at all lol.

Yeah lol…nothing better than getting those periodic auto-emails from my online brokerage account notifying me I have upcoming dividend payments. It requires no effort, no stress, or no time investment…just sit back and watch it roll in.

I do however think a “correction” may come October 2017 or Oct 2018…They will blame Trump, of course.

Yes I suspect this is true. Trying to time the market is a fools game though.

Look at the market index for THE LAST 200 YEARS. You can literally pick out any 30 year period since 1800 and you will find the market averages 9.2%

You don’t even need to “pick stocks”. Efficient Market Hypothesis states that as soon as new information hits the market, it will be reflected in the price almost instantly.

Why bother even researching individual stocks? You might as well just buy the index fund and relax… The market WILL crash 3 or 4 more times in my life. You only lose money if you sell during the crash.

Just ride it out and 2-4 years later you are back up. 75% of the years are up. 25% are down. Think LONG TERM and you’ll be fine.

Not my property... Not my problem

Yeah lol…nothing better than getting those periodic auto-emails from my online brokerage account notifying me I have upcoming dividend payments. It requires no effort, no stress, or no time investment…just sit back and watch it roll in.

I f~~~ing love capitalism!

I gave up explaining this to average blue-pill retards. They ask “when are you going to cash out?”

As if the point of getting rich is so you can get poor. Everyone is looking for the big payout. I just want 3-4k per month lol.

I will never sell a good asset. Only spend the dividends, the interest income, or the rent checks. Never spend the principle!

Not my property... Not my problem

The market WILL crash 3 or 4 more times in my life. You only lose money if you sell during the crash.

Just ride it out and 2-4 years later you are back up. 75% of the years are up. 25% are down. Think LONG TERM and you’ll be fine.

Yup…people focus on brief periods where it crashes…like the mortgage meltdown for example. They don’t want to look at the 10 years before the crash, or the 10 years after the crash that did well…its just f~~~ the market…its going to crash! They just don’t grasp the concept that having a year where you lose 25% isn’t a big deal when you are up 80% from the 5 years prior. Yeah it sucks seeing your balance go down…but had you been sitting in a 1% savings account the whole time you be even further behind than that guy in the market for the long haul.

The way I look at it…when it eventually takes a dip again its just like a stock sale…great time to buy in. Money I throw in the market isn’t money I’m going to need short term…I can afford to ride out the dips while I’m still working. When I get closer to pulling the plug on work, I’m just going to ladder a bit of money into CDs so if the market takes a big hit I have easy access to some money to live on for a year or so to allow me to ride out the rough spot without having to touch my investments.

I f~~~ing love capitalism!

I gave up explaining this to average blue-pill retards. They ask “when are you going to cash out?”

As if the point of getting rich is so you can get poor. Everyone is looking for the big payout. I just want 3-4k per month lol.

I will never sell a good asset. Only spend the dividends, the interest income, or the rent checks. Never spend the principle!

Yeah lol. Most people don’t get it. If I got handed 100k tomorrow I’d be thinking f~~~ yeah…I can turn this into 4k a year worth of dividend income for life, complete with long term dividend increases and share appreciation. Most people though would go out and spend it on s~~~ they don’t really need, and if they spent any of it paying off debt they would think that was being smart with their money. The sad part would be that a lot of debt is run on buying stuff you don’t need…and many of those people would get themselves back into debt in the future.

- AuthorPosts

You must be logged in to reply to this topic.

921526

921524

919244

916783

915526

915524

915354

915129

914037

909862

908811

908810

908500

908465

908464

908300

907963

907895

907477

902002

901301

901106

901105

901104

901024

901017

900393

900392

900391

900390

899038

898980

896844

896798

896797

895983

895850

895848

893740

893036

891671

891670

891336

891017

890865

889894

889741

889058

888157

887960

887768

886321

886306

885519

884948

883951

881340

881339

880491

878671

878351

877678