This topic contains 19 replies, has 13 voices, and was last updated by ![]() IceBankMiceElf 1 year, 4 months ago.

IceBankMiceElf 1 year, 4 months ago.

- AuthorPosts

I only recently came across the FIRE movement (financial independence, retire early) but I find it intriguing and it fits quite a bit with my own approach: basically the idea is to reduce your outgoings as much as possible, and save/invest to the point that you have 25x your annual outgoings, at which point you retire and live off 4% each year while keeping the capital invested in a low-cost tracker fund or similar. Mr Money Mustache is one of the more popular blogs/websites advocating it.

Just wondering if anyone here follows FIRE or has any thoughts on the people in it?

There aren't holes in your pockets. It's called marriage.

I’m a trucker so that I don’t have a house or car bill, and I save the majority of my money as a result. I definitely won’t have to work until 60+ years old.

Murph ~ There is nothing brave or manly about entering into a contract with somebody which allows them to take your money, assets, children, and decades of your future income on a mere whim.

It’s not for everybody. There are so many people who feel that they are entitled to a comfortable life. IMO, not too many would be willing to make the necessary sacrifices for it to work…

There are so many people who feel that they are entitled to a comfortable life.

That is the very foundation to the “pursuit of happiness”.

IMO, not too many would be willing to make the necessary sacrifices for it to work…

Most taxes, costs, bills, busy work, etc are created as a way to steal wealth and time from the people and send that wealth into the hands of the globalists.

If all these bills did not exist, each person would only have to work one or two “eight hour work” days a week to live comfortably.

Most taxes, costs, bills, busy work, etc are created as a way to steal wealth and time from the people and send that wealth into the hands of the globalists.

True.

It’s not that they want the money per se (they simply print whatever they require), it’s that they don’t want you to have it in case you do something dangerous with it.

Most taxes, costs, bills, busy work, etc are created as a way to steal wealth and time from the people and send that wealth into the hands of the globalists.

True.

It’s not that they want the money per se (they simply print whatever they require), it’s that they don’t want you to have it in case you do something dangerous with it.A combination of MGTOW and Minimalism frees oneself from a lot of problems.

The globalists created this situation with the plan being that men would break and become obedient servants to bitchy women and their foreign masters. They did not plan for the possibility that men would walk away, leaving everyone else to pay the bills the globalists created.

The collapse is going to happen. The only question is when.

I don’t want to retire, I love what I do.

I’m definitely interested! I’ll check it out for sure! F~~~ society!

#ICETHEMOUT

#MANOUT

#HIDEYOURWEALTH#ICETHEMOUT!!! #MANOUT!!! #HIDEYOURWEALTH #VAGINAISWORTHLESS

It’s not for everybody. There are so many people who feel that they are entitled to a comfortable life. IMO, not too many would be willing to make the necessary sacrifices for it to work…

From what I understand, I don’t think the idea is generally that they feel “entitled”. I think in general they work very hard and try to cut out all the unnecessary expenditure which consumerist society makes them think they can’t live without. But you’re right, a lot of people might not have the guts to make those kinds of cuts to their lives.

In my experience, men are much more able to live minimally. I know a lot of men who could live minimally, but I know a lot of women who would struggle with it. Women nowadays seem to rely more on having stuff to give their lives meaning.

I don’t want to retire, I love what I do.

That’s great! Me too. I think a lot of FIRE people continue to work once they reach financial independence, but they do it because they love it rather than because they’re going to get kicked out of their house if they’re out of work.

There aren't holes in your pockets. It's called marriage.

I once watched an episode of undercover boss where the CEO seemed legitimately moved by seeing the struggles of the less fortunate. At the end he said to his wife and kids that their extravagant lifestyle wasnt something he was comfortable with anymore and there would be some cut backs. Iirc his wife’s exact words were, ” oh no there won’t ”

Indeed most people absolutely must have the newest car which devalues at thousands of dollars a year, a house that costs 20% more than they really can afford, and the latest fashion and other toys to show their status. It’s funny to me, that I have family members with double my income, but I’m at least double their net worth.

I don’t like having useless things really. Money isn’t useless though, just keep that instead.

Murph ~ There is nothing brave or manly about entering into a contract with somebody which allows them to take your money, assets, children, and decades of your future income on a mere whim.

I’ve been shooting for FIRE before I knew it had a fancy acronym lol. When I was a little kid with my first savings account the thought occurred to me, “Hey…if I had enough money in here, I’d make a ton off interest!” The idea that if I save hard enough when I’m young that most of my life time earnings will be from passive income and not payroll is just too damn appealing to me to pass up. At this point I’m shooting to RE at 40 +/- a year or two depending how the market treats me.

It’s not for everybody. There are so many people who feel that they are entitled to a comfortable life. IMO, not too many would be willing to make the necessary sacrifices for it to work…

This is one of the interesting things about the FIRE mind set…are you really making sacrifices? Just for example a coworker of mine just bought some Mercedes recently he probably paid like 80k for. In his mind I’m making sacrifices because I could afford a much nicer car, but I chose to drive something more modest. In my mind I could care less about having an expensive car and he’s making a sacrifice by choosing to spend more of his life punching a clock to pay for that nice car. So…who’s actually making the sacrifice?

I think I live a comfortable life. I live in a nice 1BR condo, I’ve got a decent car that is paid off, I have money to go out to eat or do something fun with friends whenever I want, etc. My coworker who lives alone in a 4BR house, has a big truck and a new car, a boat, dirt bikes, a quad, motorcycles, and a trailer to haul his s~~~ around, routinely spends 100+ a night on the weekend going out eating/drinking, and he thinks I’m living in poverty. Really I don’t even want all that stuff because he has to spend a hell of a lot of time maintaining it all. We’re both comfortable in our own minds, its just the amount of material possessions to achieve comfort varies by person.

For him, setting out to FIRE in 10 years would be a torturous path full of sacrifice and discomfort. For me, I’m comfortable and don’t really feel like I’m making any major sacrifices. We all have different perspectives.

That’s great! Me too. I think a lot of FIRE people continue to work once they reach financial independence, but they do it because they love it rather than because they’re going to get kicked out of their house if they’re out of work.

Exactly…I’ve been active on FIRE forums for a while now…and for a lot of people its about options. Maybe you like your job right now…but what happens if your company goes under, you get laid off due to budget cuts, or you get a new boss that is a total prick? Now suddenly you don’t have a job or hate your job, and either of those situations are a lot easier to rebound from if you have a pile of money in the bank, and there isn’t any amount of money you could have in the bank that prevents you from working if you really like what you do.

There is a reason why “What would you do if you had a million dollars” is probably a conversation you’ve been part of many times throughout your life, where as nobody really gives a s~~~ what you would do if you had $4.37 until next payday. One of those isn’t going to leave you with much to talk about because you have s~~~ for options.

I don’t like having useless things really. Money isn’t useless though, just keep that instead.

Having money in some sort of investment that earns you passive income is like having a slave work for you and hand all his wages over.

Having debt and paying lots of interest is like you voluntarily being the slave.

Yes.

"Once you’ve taken care of the basics, there’s very little in this world for which your life is worth deferring." -David Hansson. "It’s not when women are mean or nasty that anything is out of the ordinary. It’s when they are NICE to you that you have to be on high alert..." -Jackinov.

It’s a great topic that you’re bringing up, Lion on the loose. Unless you’ve got an additional source of income (and Social Security at least in this country is by no means a sure thing anymore), it’s not going to be enough because it a 4% investment rate that’s only bringing you back to what you were earning before, which will not take into account the effects of inflation, especially if you retire early. I’d suggest a higher rate, but understand that’s kind of difficult to achieve and may mean that we’ve got to work longer. At least we’re not wasting our resources on cupcakes anymore!

We just don't realize life's most significant events while they're happening. Back then, I thought, "Well, there'll be other days". I didn't realize that that was the only day. - "Moonlight" Graham

I want to retire so that I CAN do what I love to do…

(For me, doing something as a job — even if it’s something I generally enjoy — eventually destroys the enjoyment of it).I don’t want to retire, I love what I do.

I want to retire so that I CAN do what I love to do…

(For me, doing something as a job — even if it’s something I generally enjoy — eventually destroys the enjoyment of it).Indeed. I have a hard time really believing people who claim that they “love their job” unless of course they mean that they will do it without being paid. I mean I do work for people for free because it’s actually stuff that I ‘love’ doing…

Hey Beer, good to hear your thoughts. Which forums do you follow bro? I might check them out.

I think you’re bang on about the fact that living minimally isn’t necessarily a sacrifice. When I was married, I was working in a job I hated which paid very well but my ex wife was spending it faster than I could earn it and I was miserable as f~~~ even though we had bought all this s~~~. I really think it’s good for the soul not to have too much stuff. I love my minimalist life now and I feel way more wealthy even though I earn less, just because I’m spending so little. I still treat myself to nice things occasionally but only when I know I’ll really get some value out of them.

I don’t like having useless things really. Money isn’t useless though, just keep that instead.

Having money in some sort of investment that earns you passive income is like having a slave work for you and hand all his wages over.

Having debt and paying lots of interest is like you voluntarily being the slave.That’s a really nice way of putting it.

It’s a great topic that you’re bringing up, Lion on the loose. Unless you’ve got an additional source of income (and Social Security at least in this country is by no means a sure thing anymore), it’s not going to be enough because it a 4% investment rate that’s only bringing you back to what you were earning before, which will not take into account the effects of inflation, especially if you retire early. I’d suggest a higher rate, but understand that’s kind of difficult to achieve and may mean that we’ve got to work longer. At least we’re not wasting our resources on cupcakes anymore!

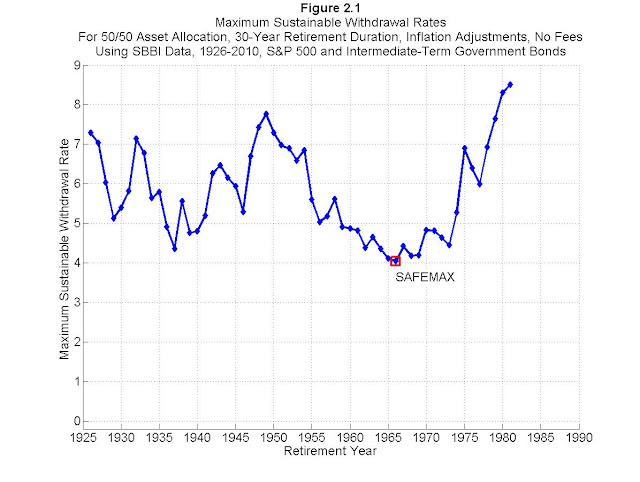

Thanks man. The 4% idea isn’t necessarily that you’ll get a 4% ROR on your investment (hopefully you’ll get more), it’s more the idea that withdrawing 4% of your capital every year is the safe “minimum rate of withdrawal”, i.e. the amount of capital you can withdraw if you’re in the market and never run out of money. Obviously depending on how the market performs, you could take out more than that sometimes, but there’s been quite a lot of research about what can reliably be withdrawn each year, and the conclusion is that 4% is safe even for worst points in the last hundred years:

That said, of course the market could get more f~~~ed than it ever has before. Anyway, this article explains it quite well:

The 4% Rule: The Easy Answer to “How Much Do I Need for Retirement?”

There aren't holes in your pockets. It's called marriage.

Anonymous38I don’t want to retire, I love what I do.

Props to you. I’m. learning to love the game. I think it’s something to do with playing it well.

Hey Beer, good to hear your thoughts. Which forums do you follow bro? I might check them out.

I dabble on FIRE reddit now. I used to dabble a bit on Mr. Money Mustache but I p~~~ed off a bunch of people in some thread when I said women shouldn’t be allowed to get abortions if the father wants the baby, they should have to have the baby, give it to him, and pay child support, so I got the ban hammer lol. Financial Samurai occasionally has some interesting posts, but that is more of a blog.

It’s a great topic that you’re bringing up, Lion on the loose. Unless you’ve got an additional source of income (and Social Security at least in this country is by no means a sure thing anymore), it’s not going to be enough because it a 4% investment rate that’s only bringing you back to what you were earning before, which will not take into account the effects of inflation, especially if you retire early. I’d suggest a higher rate, but understand that’s kind of difficult to achieve and may mean that we’ve got to work longer. At least we’re not wasting our resources on cupcakes anymore!

Its based off long term market gains of 7%. If you withdraw 4% and we have 3% inflation, in theory you can go on forever and have the same buying power year after year. I don’t think its uncommon for people who go early to shoot for a lower withdrawal rate to increase their odds of success…and I don’t think its uncommon for people who retire a few years out from social security and/or a pension to go out on a higher withdrawal rate knowing when their other income stream(s) kick in it will drop their withdrawal rate significantly.

Its not a one size fits all rule…everyone is going to have a unique situation. Its more just a guideline to give you and idea of where you stand.

This is a good topic. Retirement and doing what I want to do sounds exhilarating. As as been mentioned here, 4% annually on $1 million is $40,000. Taking $40,000 out of the account to live on every year and never touching the principle is the key. If you can’t get to $1 million then get as close as you can. They key is starting early. If you can get to $1 million from saving and investing then you have options. I’ve learned that I don’t need a lot to live on and not much space. For me, investing the money is the way to go and having the option to walk away when I get tired of working.

- AuthorPosts

You must be logged in to reply to this topic.

921526

921524

919244

916783

915526

915524

915354

915129

914037

909862

908811

908810

908500

908465

908464

908300

907963

907895

907477

902002

901301

901106

901105

901104

901024

901017

900393

900392

900391

900390

899038

898980

896844

896798

896797

895983

895850

895848

893740

893036

891671

891670

891336

891017

890865

889894

889741

889058

888157

887960

887768

886321

886306

885519

884948

883951

881340

881339

880491

878671

878351

877678